Summary

This report covers the market landscape and supply-chain for silicon wafers used in semiconductor device fabrication. It includes information about key suppliers, issues/trends in the material supply chain, estimates on supplier market share, and forecast for the material segments. Silicon wafers are the fundamental starting point for nearly all semiconductor device fabrication. As such, the criticality of the role that this material plays in the semiconductor supply chain is hard to refute and is treated as such accordingly in this Critical Materials Report.

-

Contains data and analysis from TECHCET’s database and Sr. Analyst experience, as well as that developed from primary and secondary market research

-

Provides focused silicon wafers supply chain information for supply-chain managers, process integration and R&D directors, as well as business development and financial analysts

-

Covers information about key silicon wafer suppliers, issues/trends in the silicon wafer supply chain, estimates on supplier market share, and silicon wafer market forecasting

-

Includes 3 Quarterly Updates, with updates on market trends and forecasts from the analyst

ページTOPに戻る

Table of Contents

1 EXECUTIVE SUMMARY

1.1 SILICON WAFER BUSINESS – MARKET OVERVIEW

1.2 MARKET TRENDS AFFECTING 2025

1.3 SILICON WAFER 5-YEAR UNIT SHIPMENT FORECAST BY SEGMENT

1.4 WAFER 5-YEAR REVENUE FORECAST BY SEGMENT

1.5 SILICON WAFER SEGMENT TRENDS

1.6 TECHNOLOGY TRENDS

1.7 COMPETITIVE LANDSCAPE

1.8 FIRST QUARTER 2025 FINANCIALS OF TOP-5 SUPPLIERS

1.9 EHS, TRADE, AND/OR LOGISTICS ISSUES/CONCERNS

1.10 ANALYST ASSESSMENT OF SILICON WAFERS

2 SCOPE, PURPOSE AND METHODOLOGY

2.1 SCOPE, PURPOSE & METHODOLOGY

2.2 OVERVIEW OF OTHER TECHCET CMR(TM) OFFERINGS

3 SEMICONDUCTOR INDUSTRY MARKET STATUS & OUTLOOK

3.1 WORLDWIDE ECONOMY AND OUTLOOK

3.2 WORLDWIDE ECONOMY AND OVERVIEW

3.2.1 WORLDWIDE ECONOMY AND SEMICONDUCTOR MARKET OVERVIEW

3.2.2 SEMICONDUCTOR INDUSTRIES TIES TO THE GLOBAL ECONOMY

3.2.3 SEMICONDUCTOR SALES GROWTH

3.2.4 TAIWAN OUTSOURCE MANUFACTURER MONTHLY SALES TRENDS

3.3 CHIPS SALES BY ELECTRONIC GOODS SEGMENT

3.3.1 FACTORS IMPACTING ELECTRONIC SYSTEMS OUTLOOK

3.3.2 PC OUTLOOK

3.3.3 SMARTPHONE OUTLOOK

3.3.4 AUTOMOTIVE INDUSTRY OUTLOOK

3.3.5 SERVERS / IT MARKET

3.4 SEMICONDUCTOR FABRICATION GROWTH & EXPANSION

3.4.1 IN THE MIDST OF HUGE INVESTMENT IN CHIP EXPANSIONS

3.4.2 PUBLIC FUNDS STIMULATING PRIVATE INVESTMENTS IN EXPANSION ACROSS THE GLOBE

3.4.3 SEMICONDUCTOR SUPPLY CHAIN ANNOUNCED EXPANSIONS IN THE US

3.4.4 EQUIPMENT SPENDING TRENDS

3.4.5 TECHNOLOGY ROADMAPS

3.5 POLICY & TRADE TRENDS AND IMPACT

3.6 SEMICONDUCTOR PRODUCTION (WAFER STARTS*) AND MATERIALS OVERVIEW

3.6.1 TECHCET WAFER STARTS FORECAST THROUGH 2029

3.6.2 TECHCET ELECTRONIC MATERIALS MARKET FORECAST THROUGH 2028

4 SILICON WAFER MARKET TRENDS

4.1 SILICON WAFER MARKET TRENDS – OUTLINE

4.1.1 SILICON WAFER MARKET TRENDS – INTRODUCTION

4.1.2 2024 SILICON WAFER MARKET LEADING INTO 2025

4.1.3 SILICON WAFER MARKET OUTLOOK

4.1.4 SILICON WAFER 5-YEAR UNIT SHIPMENT FORECAST BY SEGMENT

4.1.5 WAFER 5-YEAR REVENUE FORECAST BY SEGMENT

4.2 SILICON WAFER SUPPLY CAPACITY AND DEMAND, INVESTMENTS - OUTLINE

4.2.1 SILICON WAFER PRODUCTION CAPACITY OF TOP SUPPLIERS

4.2.2 SILICON WAFER PRODUCTION LOCATIONS

4.3 INVESTMENT ANNOUNCEMENTS - OVERVIEW

4.3.1 INVESTMENT ANNOUNCEMENTS & BACKGROUND

4.3.2 INVESTMENT ANNOUNCEMENTS – BACKGROUND OF MARKET LANDSCAPE

4.3.3 INVESTMENT ANNOUNCEMENTS – OTHER CONSIDERATIONS

4.3.4 INVESTMENT ANNOUNCEMENTS – CAPEX TRENDS

4.3.5 SILICON WAFER PRODUCTION CAPACITY EXPANSIONS

4.4 SILICON WAFER SUPPLY VS. DEMAND BALANCE - OVERVIEW

4.4.1 SUPPLY VS. DEMAND BALANCE – 300MM SILICON WAFERS

4.4.2 SUPPLY VS. DEMAND BALANCE – 200MM SILICON WAFERS

4.4.3 SUPPLY VS. DEMAND BALANCE – 300MM SILICON EPI WAFERS

4.5 PRICING TRENDS

4.6 TECHNOLOGY TRENDS/TECHNICAL DRIVERS - OUTLINE

4.6.1 SILICON WAFER GENERAL TECHNOLOGY OVERVIEW

4.6.2 WAFER TECHNOLOGY TRENDS

4.6.3 WAFER TECHNOLOGY TRENDS, SIC

4.6.4 SPECIALTY/EMERGING SILICON WAFER AND APPLICATIONS

4.7 REGIONAL CONSIDERATIONS

4.7.1 REGIONAL ASPECTS AND DRIVERS

4.8 EHS AND TRADE/LOGISTIC ISSUES

4.8.1 EHS ISSUES

4.8.2 TRADE/LOGISTICS ISSUES

4.8.3 TRADE/LOGISTICS ISSUES, SIC

4.9 ANALYST ASSESSMENT OF SILICON WAFER MARKET TRENDS

5 SUPPLY-SIDE MARKET LANDSCAPE

5.1 WAFER MARKET SHARE

5.2 CURRENT QUARTER - SUPPLIERS'ACTIVITIES & REPORTED REVENUES

5.2.1 CURRENT QUARTER TOP-5 SUPPLIERS'ACTIVITIES & REPORTED REVENUES

5.2.2 CURRENT QUARTER ACTIVITY – SHIN-ETSU

5.2.3 CURRENT QUARTER ACTIVITY – SUMCO

5.2.4 CURRENT QUARTER ACTIVITY – GLOBALWAFERS

5.2.5 CURRENT QUARTER ACTIVITY - SILTRONIC

5.2.6 CURRENT QUARTER ACTIVITY – SK SILTRON

5.2.7 CURRENT QUARTER ACTIVITY – OTHER

5.3 M&A ACTIVITY, PARTNERSHIPS, AND COLLABORATIVE AGREEMENTS

5.4 PLANT CLOSURES

5.5 NEW ENTRANTS

5.6 SUPPLIERS OR PARTS/PRODUCT LINES THAT ARE AT RISK OF DISCONTINUATIONS

5.7 TECHCET ANALYST ASSESSMENT OF SILICON WAFER SUPPLIERS

6 SUB-TIER SUPPLY-CHAIN

6.1 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW

6.1.1 SUB-TIER SUPPLY CHAIN: POLYSILICON PROCESS FLOW AND SOURCES

6.1.2 SUB-TIER SUPPLY CHAIN: QUARTZ CRUCIBLES

6.1.3 SUB-TIER SUPPLY CHAIN: CHEMICAL-RELATED WAFER PROCESSING

6.1.4 SUB-TIER SUPPLY CHAIN: GAS-RELATED WAFER PROCESSING

6.2 POLYSILICON MARKET BACKGROUND

6.2.1 POLYSILICON MARKET TRENDS

6.2.2 POLYSILICON INDUSTRIAL(PV) VS. SEMICONDUCTOR-GRADE(EG)

6.2.3 SEMICONDUCTOR-GRADE POLYSILICON DEMAND

6.2.4 SUB-TIER SUPPLY CHAIN: POLYSILICON MARKET SHARE

6.2.5 SEMICONDUCTOR-GRADE POLYSILICON SUPPLIERS

6.3 SUB-TIER SUPPLY-CHAIN PRICING TRENDS

6.4 SEMICONDUCTOR-GRADE POLYSILICON SUPPLIER AND RELATED NEWS

6.5 SUB-TIER SUPPLY-CHAIN: PLANT CLOSURES / DISRUPTIONS

6.6 SUB-TIER SUPPLY-CHAIN M&A OR PARTNERSHIP ACTIVITY

6.7 SUB-TIER SUPPLY-CHAIN “NEW” ENTRANTS

6.8 SUB-TIER SUPPLY-CHAIN PLANT UPDATES

6.9 SUB-TIER SUPPLY-CHAIN EHS AND TRADE/LOGISTICS ISSUES

6.10 SUB-TIER SUPPLY-CHAIN TECHCET ANALYST ASSESSMENT

7 SUPPLIER PROFILES

CENGOL

CETC

CHONGQING AST

CREE/WOLFSPEED

AND MORE …

8 APPENDIX

8.1 SUB-TIER SUPPLY-CHAIN PRICING TRENDS, MAY – JUNE 2025 PV

ページTOPに戻る

List of Tables/Graphs

FIGURES

FIGURE 1.1: SILICON WAFER SHIPMENT FORECAST BY SEGMENT

FIGURE 1.2: WAFER REVENUE FORECAST BY SEGMENT

FIGURE 1.3: 2024 WAFER SUPPLIER MARKET SHARE BY REVENUE

FIGURE 1.4: TOP-5 SILICON WAFER MAKERS'QUARTERLY COMBINED SALES

FIGURE 3.1: HISTORICAL AND FORECASTED GDP GROWTH (2000 – 2029)

FIGURE 3.2: GLOBAL ECONOMY AND THE ELECTRONICS SUPPLY CHAIN (2024)

FIGURE 3.3: WORLDWIDE SEMICONDUCTOR SALES ($B)

FIGURE 3.4: TECHCET’S TAIWAN SEMICONDUCTOR INDUSTRY INDEX (TTSI) MOMENTUM TRACKER

FIGURE 3.5: 2024 SEMICONDUCTOR CHIP APPLICATIONS

FIGURE 3.6: SMARTPHONE SHIPMENTS, WW ESTIMATES

FIGURE 3.7: GLOBAL LIGHT VEHICLE PRODUCTION FORECAST (IN MILLIONS OF UNITS)

FIGURE 3.8: US EV RETAIL SHARE FORECAST

FIGURE 3.9: AUTOMOTIVE SEMICONDUCTOR FORECAST ESTIMATES (2018-2029, B$'S USD)

FIGURE 3.10: AI VALUE FORECAST ($B’S USD)

FIGURE 3.11: SCALE OF TODAY’S AI-CENTRIC DATA CENTERS

FIGURE 3.12: TSMC PHOENIX FAB INVESTMENT TO EXCEED US $65B

FIGURE 3.13: ESTIMATED GLOBAL FAB INVESTMENT 2024-2029 ($858.6B)

FIGURE 3.14: ANNOUNCED PUBLIC STIMULUS AND RESPECTIVE SEMICONDUCTOR CHIP MANUFACTURING REGIONS

FIGURE 3.15: SEMICONDUCTOR SUPPLY CHAIN EXPANSIONS WITHIN THE US

FIGURE 3.16: GLOBAL TOTAL EQUIPMENT SPENDING (US$ M)

FIGURE 3:17: TSMC LOGIC ROADMAP BY NODE

FIGURE 3.18: TECHCET WAFER START FORECAST BY NODE SEGMENTS MILLIONS OF 200MM EQUIVALENTS PER YEAR

FIGURE 3.19: TECHCET WORLDWIDE ELECTRONIC MATERIALS FORECAST ($M USD)

FIGURE 4.1: INDUSTRY STANDARD WAFER DIAMETER PROGRESSION

FIGURE 4.2: WAFER DIAMETER IMPACT ON DIE COUNT

FIGURE 4.3: SILICON WAFER SHIPMENT FORECAST BY SEGMENT

FIGURE 4.4: WAFER REVENUE FORECAST BY SEGMENT

FIGURE 4.5: SILICON WAFER SUPPLIER MARKET SHARE OF 300MM CAPACITY (AS A % OF TOTAL UNITS)

FIGURE 4.6: ILLUSTRATIVE PRODUCTION IMPACT VERSUS COST FOR INVESTMENT CATEGORIES

FIGURE 4.7: HEIGHTENED EXPANSION INVESTMENT CHALLENGE – THE ENVIRONMENT FACED BY SILICON WAFER MANUFACTURERS

FIGURE 4.8: STRATEGIES TO IMPROVE ROIC OUTLOOKS

FIGURE 4.9: INDEXED CAPITAL EXPENDITURE TRENDS, 2020 = 100

FIGURE 4.10: FROM GROUNDBREAKING TO CERTIFICATION

FIGURE 4.11: 300MM WAFER SUPPLY / DEMAND FORECAST

FIGURE 4.12: 200MM WAFER SUPPLY / DEMAND FORECAST

FIGURE 4.13: 300MM EPI WAFER SUPPLY / DEMAND FORECAST

FIGURE 4.14: WORLDWIDE SILICON WAFER ASP TREND (INCLUDES SOI)

FIGURE 4.15: WAFER FIDUCIAL FEATURES DENOTING DOPANT TYPE AND SURFACE ORIENTATION

FIGURE 4.16: THE EVOLUTION OF WAFER SLICING

FIGURE 4.17: CONTROLLING THE WAFER SHAPE AT ITS PERIPHERY

FIGURE 4.18: QUANTUM COMPUTING, BITS VERSUS QUBITS

FIGURE 4.19: FABRICATION STRUCTURES REQUIRING MORE THAN ONE WAFER

FIGURE 4.20: 2024 SILICON AND SOI REVENUE SHARE BY COMPANY HQ REGION

FIGURE 4.21: ENVIRONMENTAL FOOTPRINT OF SILICON WAFER PRODUCTION

FIGURE 4.22: INCREASING WEIGHT OF A BATCH1 OF SILICON WAFERS

FIGURE 4.23: OVERHEAD 300MM WAFER TRANSPORTATION SYSTEM

FIGURE 5.1: 2024 WAFER SUPPLIER MARKET SHARE BY REVENUE

FIGURE 5.2: TOP-5 SILICON WAFER MAKERS'QUARTERLY COMBINED SALES

FIGURE 5.3: SHIN-ETSU CURRENT QUARTER FINANCIAL DISCLOSURE

FIGURE 5.4: SUMCO CURRENT QUARTER FINANCIAL REPORT AND OUTLOOK

FIGURE 5.5: GLOBALWAFERS CURRENT QUARTER FINANCIAL REPORT

FIGURE 5.6: SILTRONIC CURRENT QUARTER FINANCIAL REPORT

FIGURE 5.7: SK SILTRON CURRENT QUARTER FINANCIALS

FIGURE 5.8: NSIG PERFORMANCE HAS SHIFTED NEGATIVELY

FIGURE 6.1: PRIMARY INPUTS OF SILICON WAFER MANUFACTURING AND NOTABLE SUPPLIERS (HQ COUNTRY)

FIGURE 6.2: HIGH-LEVEL SUPPLY CHAIN AND KEY SOURCE REGIONS

FIGURE 6.3: SPECIALIZED SUBMERGED ARC FURNACE FOR MG-SI PRODUCTION

FIGURE 6.4: PROCESS OVERVIEW OF ELECTRONIC-GRADE (EG) POLYSILICON1 PRODUCTION

FIGURE 6.5: FORMED POLYSILICON RODS IN CVD REACTOR AND CLOSEUP OF CHUNK POLYSILICON

FIGURE 6.6: QUARTZ CRUCIBLE SIZES HAVE EVOLVED WITH WAFER DIAMETER

FIGURE 6.7: QUARTZ CRUCIBLE APPLICATION AND PURITY

FIGURE 6.8: PRIMARY USES OF CHEMICALS IN PRODUCTION OF SILICON WAFERS

FIGURE 6.9: PRIMARY USES OF GASES IN PRODUCTION OF SILICON WAFERS

FIGURE 6.10: POLYSILICON NAMING CONVENTION

FIGURE 6.11: HSC CHIPS ACT FUNDING

FIGURE 6.12: TRIGGERING THE SUPPLY EXPANSION OF CHINA EG POLYSILICON

FIGURE 6.13: POLYSILICON DEMAND - SEMICONDUCTOR (EG) VS.INDUSTRIAL (PV)

FIGURE 6.14: EG POLYSILICON DEMAND TREND FOR SILICON WAFER PRODUCTION

FIGURE 6.15: 5-YEAR PRICE TREND OF SOLAR POLYSILICON – A TWO-TIERED STRUCTURE

FIGURE 6.16: DAILY CLOSING SPOT PRICE TREND OF EG POLYSILICON MAY 9 – JUNE 9, 2025

FIGURE 6.17: KEY POLYSILICON INPUT COST TRENDS

FIGURE 6.18: US CONGRESSIONAL APPEAL TO DOC REGARDING CHINESE PRACTICES

FIGURE 6.19: SPRUCE PINE, NC FLOODING AS A RESULT OF HURRICANE HELENE

FIGURE 8.1: DAILY CLOSING SPOT PRICE TREND OF SOLAR POLYSILICON – MAY 9 THRU JUNE 9, 2025

TABLES

TABLE 1.1: WAFER GROWTH OVERVIEW

TABLE 3.1: GLOBAL GDP AND SEMICONDUCTOR REVENUES

TABLE 3.2: INITIALLY ANNOUNCED* US RECIPROCAL TARIFF SCHEDULE

TABLE 3.3: WORLDWIDE PC FORECAST BY SEGMENT

TABLE 3.4: IT MARKET SPENDING FORECAST, 2025

TABLE 4.1: OVERVIEW OF WAFER CATEGORIES

TABLE 4.2: ESTIMATED 300MM SHARE OF CAPACITY BY SUPPLIER

TABLE 4.3: NOTABLE SILICON WAFER SUPPLIER MANUFACTURING LOCATIONS

TABLE 4.4: OVERVIEW OF SILICON WAFER SUPPLIER INVESTMENT ANNOUNCEMENTS

TABLE 4.5: REGIONAL WAFER MARKETS

TABLE 4.6: TRADE INVESTIGATION COMPARISON

TABLE 5.1: MOST RECENT TOP-5 QUARTERLY SILICON WAFER SUPPLIER SALES (IN LOCAL CURRENCY, AS REPORTED)

TABLE 5.2: DETAILS OF SUMCO SMALL DIAMETER WAFER CONSOLIDATION

TABLE 6.1: ESTIMATED 2024 POLYSILICON TOP-7 SUPPLIER RANKING

TABLE 6.2: SEMICONDUCTOR–GRADE POLYSILICON SUPPLIERS QUALIFIED OUTSIDE OF CHINA

TABLE 6.3: SEMICONDUCTOR–GRADE POLYSILICON SUPPLIER STATUS IN CHINA

Press Release

December 18, 2025 | Press Release

Silicon Wafers: Navigating Diameter Shifts and Demand Drivers

San Diego, CA, :

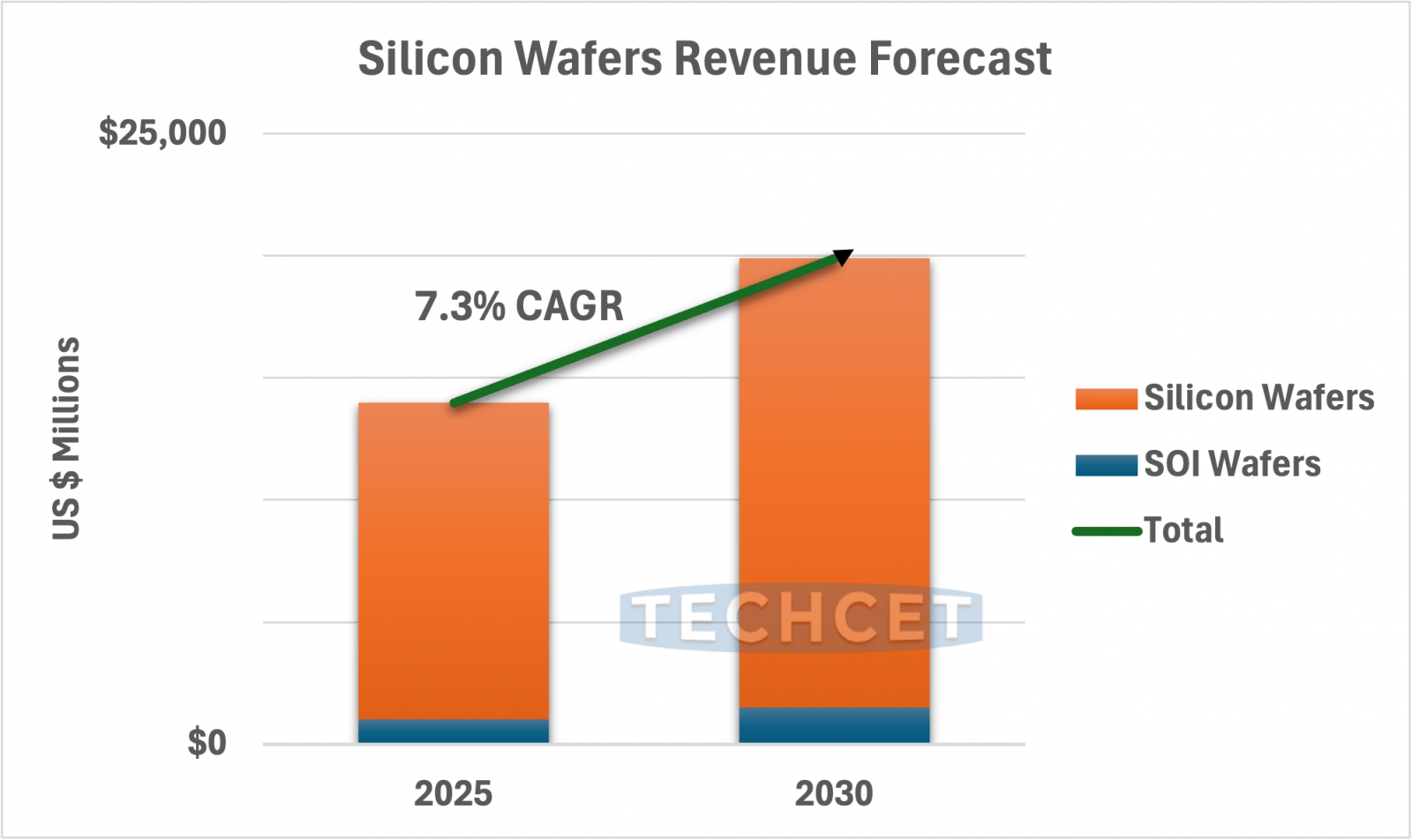

TECHCET, reports after challenging years, the wafer industry is forecasted to see stronger growth for the remainder of 2025. Shipment volumes are expected to have risen +5%, driven largely by increasing demand for 300mm wafers in 2025. Revenue is projected to increase nearly 4% to USD $14.0B, with both silicon and SOI wafers contributing to the gain. Looking ahead, shipment 5-year CAGRs is +7% according to TECHCET’s 2025-2026 Critical Materials Report on Silicon Wafers.

Silicon Wafers Revenue Forecast 2025-2030

Market conditions continue to reflect both recovery and disruption as inventories slowly normalize, and new orders resume. Some order activity has been influenced by tariff uncertainty rather than pure market demand, particularly in smaller-diameter segments. The ongoing migration away from smaller sizes to more 300mm has intensified competitive pressure on 200mm and below, prompting capacity-management considerations among major suppliers. This trend has benefited China wafer makers, that are gaining share in the 200mm segment. Meanwhile, industry headlines from Shin-Etsu’s GaN performance milestone to GlobalWafers’ expansions (300mm) and SK siltron’s ownership restructuring highlight accelerating technical and strategic shifts across the supply base.

The wafer market remains on a trajectory shaped by advanced applications in HPC, AI, and leading-edge semiconductor logic. Smaller-diameter wafers are expected to gradually phase out over time, with diameters ≤125mm facing the highest sunset risk. Trade-related challenges, including potential tariff outcomes tied to the ongoing Section 232 Investigation of Polysilicon and Derivatives, may increase input costs and reshape supply strategies. As the market transitions, wafer suppliers will need to balance technology leadership, capacity investment, and geopolitical risk to maintain long-term competitiveness.