Summary

2025-2026 CMR(TM) SPUTTERING TARGETS SUPPLY-CHAIN & MARKET ANALYSIS

A CRITICAL MATERIALS REPORT

This report addresses sputtering, the dominant PVD technique used in semiconductor device fabrication, and specifically covers the market and supply-chain for targets within that segment. The report contains data and analysis from TECHCET’s data base and Sr. Analyst experience, as well as that developed from primary and secondary market research.

Report Details

• Provides a detailed look and analysis of the sputter targets market and supply chain as applied to semiconductor device manufacturing

• Included are raw material supply chain dynamics and companies, target manufacturing cost considerations, pricing trends and more

• Provides focused information for supply-chain managers, process integration and R&D directors, as well as business development and financial analysts

• Covers information about key sputter target suppliers, issues/trends in the electronics material supply chain, estimates on supplier market share, and forecast for the electronic material segments

• Includes 3 Quarterly Updates, with updates on market trends and forecasts from the analyst

ページTOPに戻る

Table of Contents

1 EXECUTIVE SUMMARY 11

1.1 SPUTTERING TARGET BUSINESS - MARKET OVERVIEW 12

1.2 MARKET TRENDS IMPACTING 2025 OUTLOOK 13

1.3 SPUTTERING TARGET 5-YEAR UNIT SHIPMENT FORECAST 14

1.4 SPUTTERING TARGET 5-YEAR REVENUE FORECAST 15

1.5 SPUTTERING TARGET SEGMENT TRENDS 16

1.6 TECHNOLOGY TRENDS 17

1.7 COMPETITIVE LANDSCAPE 18

1.8 SECOND QUARTER 2025 FINANCIALS OF TOP - 5 19

1.9 EHS, TRADE, AND/OR LOGISTICS ISSUES/CONCERNS 20

1.10 ANALYST ASSESSMENT OF SPUTTERING TARGETS 21

2 SCOPE, PURPOSE AND METHODOLOGY 24

2.1 SCOPE, PURPOSE & METHODOLOGY 25

2.2 OVERVIEW OF TECHCET MATERIALS FOCUS AREAS 26

3 SEMICONDUCTOR INDUSTRY MARKET STATUS & OUTLOOK 27

3.1 WORLDWIDE ECONOMY AND OUTLOOK 28

3.2 WORLDWIDE ECONOMY AND OVERVIEW 29

3.2.1 WORLDWIDE ECONOMY AND SEMICONDUCTOR MARKET OVERVIEW 30

3.2.2 SEMICONDUCTOR INDUSTRIES TIES TO THE GLOBAL ECONOMY 31

3.2.3 TECHCET SEMICONDUCTOR SALES GROWTH OUTLOOK THROUGH 2029 32

3.2.4 TAIWAN OUTSOURCE MANUFACTURER MONTHLY SALES TRENDS 33

3.3 CHIPS SALES BY ELECTRONIC GOODS SEGMENT 34

3.3.1 FACTORS IMPACTING ELECTRONIC SYSTEMS OUTLOOK 35

3.3.2 PC OUTLOOK 36

3.3.3 SMARTPHONE OUTLOOK 37

3.3.4 AUTOMOTIVE INDUSTRY OUTLOOK 38

3.3.5 SERVERS / IT MARKET 41

3.4 SEMICONDUCTOR FABRICATION GROWTH & EXPANSION 44

3.4.1 IN THE MIDST OF HUGE INVESTMENT IN CHIP EXPANSIONS 45

3.4.2 PUBLIC FUNDS STIMULATING PRIVATE INVESTMENTS IN EXPANSION ACROSS THE GLOBE 46

3.4.3 SEMICONDUCTOR SUPPLY CHAIN ANNOUNCED EXPANSIONS IN THE US 47

3.4.4 TECHCET SEMICONDUCTOR EQUIPMENT MARKET FORECAST THROUGH 2029 48

3.4.5 TECHNOLOGY ROADMAPS 49

3.5 POLICY & TRADE TRENDS AND IMPACT 50

3.6 SEMICONDUCTOR PRODUCTION (WAFER STARTS*) AND MATERIALS OVERVIEW 52

3.6.1 TECHCET WAFER STARTS FORECAST THROUGH 2029 53

3.6.2 TECHCET ELECTRONIC MATERIALS MARKET FORECAST THROUGH 2029 54

4 SPUTTERING TARGETS MARKET TRENDS 55

4.1 SPUTTERING TARGETS MARKET TRENDS - OUTLINE 56

4.1.1 SPUTTERING TARGETS OVERVIEW OF APPLICATIONS LANDSCAPE 57

4.1.2 2024 SPUTTERING TARGETS MARKET LEADING INTO 2025 59

4.1.3 SPUTTERING TARGET MARKET OUTLOOK 60

4.1.4 SPUTTER TARGETS 5-YEAR UNIT SHIPMENT FORECAST BY SEGMENT 61

4.2 SPUTTERING TARGET SUPPLY / DEMAND, INVESTMENTS - OUTLINE 63

4.2.1 SPUTTERING TARGETS PRODUCTION BY REGION 64

4.2.2 SPUTTERING TARGET SUPPLY VS. DEMAND BALANCE - OVERVIEW 65

4.2.3 SPUTTERING TARGET PRODUCTION CAPACITY EXPANSIONS/INVESTMENT ANNOUNCEMENTS 66

4.3 PRICING TRENDS 67

4.4 TECHNOLOGY TRENDS/TECHNICAL DRIVERS - OUTLINE 68

4.4.1 SPUTTERING TARGET KEY FUNCTIONAL REQUIREMENTS 69

4.4.2 SPUTTERING TARGET GENERAL TECHNOLOGY OVERVIEW 70

4.4.3 SPUTTERING TARGET TECHNOLOGY DRIVERS AND TRENDS 73

4.4.4 SPECIALTY/EMERGING SPUTTERING TARGET AND APPLICATIONS 77

4.5 REGIONAL CONSIDERATIONS 80

4.5.1 REGIONAL ASPECTS AND DRIVERS 81

4.6 EHS AND TRADE/LOGISTIC ISSUES 82

4.6.1 EHS ISSUES 83

4.6.2 TRADE/LOGISTICS ISSUES 85

4.7 ANALYST ASSESSMENT OF SPUTTERING TARGET MARKET TRENDS 87

5 SUPPLY-SIDE MARKET LANDSCAPE 89

5.1 SPUTTERING TARGET MARKET SHARE 90

5.2 SPUTTERING TARGET SUPPLIER EARNINGS REPORTS 91

5.2.1 CURRENT QUARTER ACTIVITY - JX ADVANCED MATERIALS 92

5.2.2 CURRENT QUARTER ACTIVITY - HONEYWELL 93

5.2.3 CURRENT QUARTER ACTIVITY - KFMI 94

5.2.4 CURRENT QUARTER ACTIVITY - LINDE 95

5.2.6 CURRENT QUARTER ACTIVITY - TOSOH 96

5.3 M&A ACTIVITY AND PARTNERSHIPS 97

5.4 PLANT CLOSURES 98

5.5 NEW ENTRANTS - COMMENTARY 99

5.6 SUPPLIERS OR PARTS/PRODUCT LINES THAT ARE AT RISK OF DISCONTINUATIONS 100

5.7 OTHER NOTABLE ACTIONS 101

5.8 TECHCET ANALYST ASSESSMENT OF SPUTTERING TARGET SUPPLIERS 102

6 SUB-TIER SUPPLY-CHAIN, METALS 103

6.1 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW 104

6.1.1 SUB-TIER METAL MARKET BACKGROUND 106

6.1.2 SUB-TIER METALS MARKET TRENDS 107

6.1.3 SUB-TIER METALS ECOSYSTEM NOTABLE PLAYERS 108

6.1.4 SUB-TIER METALS MARKET STATISTICS 109

6.1.4.1 SUB-TIER METALS - CU PRODUCTION AND USAGE OVERVIEW 110

6.1.4.2 SUB-TIER METALS - CU PRICING HISTORY 111

6.1.4.3 SUB-TIER METALS - AL PRODUCTION AND USAGE OVERVIEW 112

6.1.4.4 SUB-TIER METALS - AL PRICING HISTORY 113

6.1.4.5 SUB-TIER METALS - TI PRODUCTION, USAGE, AND PRICE HISTORY OVERVIEW 114

6.1.4.6 SUB-TIER METALS - TA PRODUCTION, USAGE, AND PRICE HISTORY OVERVIEW 115

6.1.4.7 SUB-TIER METALS - W PRODUCTION, USAGE, AND PRICE HISTORY OVERVIEW 116

6.1.4.8 SUB-TIER METALS - NI PRODUCTION, USAGE, AND PRICE HISTORY OVERVIEW 117

6.1.4.9 SUB-TIER METALS - CO PRODUCTION, USAGE, AND PRICE HISTORY OVERVIEW 118

6.1.4.10 SUB-TIER METALS - MO PRODUCTION, USAGE, AND PRICE HISTORY OVERVIEW 119

6.1.4.11 SUB-TIER METALS - CR PRODUCTION, USAGE, AND PRICE HISTORY OVERVIEW 120

6.1.4.12 SUB-TIER METALS - IN PRODUCTION, USAGE, AND PRICE HISTORY OVERVIEW 121

6.1.4.13 SUB-TIER METALS - RU PRODUCTION, USAGE, AND PRICE HISTORY OVERVIEW 122

6.1.4.14 SUB-TIER METALS - AU PRODUCTION, USAGE, AND PRICE HISTORY OVERVIEW 123

6.1.4.15 SUB-TIER METALS - AG PRODUCTION, USAGE, AND PRICE HISTORY OVERVIEW 124

6.1.4.16 SUB-TIER METALS - PT PRODUCTION, USAGE, AND PRICE HISTORY OVERVIEW 125

6.1.4.17 SUB-TIER METALS - PD PRODUCTION, USAGE, AND PRICE HISTORY OVERVIEW 126

6.1.4.18 SUB-TIER METALS - PT PRODUCTION, USAGE, AND PRICE HISTORY OVERVIEW 127

6.1.5 SEMICONDUCTOR-GRADE SUB-TIER METAL SUPPLIER NEWS 128

6.2 SUB-TIER SUPPLY-CHAIN: DISRUPTIONS 129

6.3 SUB-TIER SUPPLY-CHAIN M&A OR PARTNERSHIP ACTIVITY 131

6.4 SUB-TIER SUPPLY-CHAIN EHS AND LOGISTICS / TRADE ISSUES 132

6.5 SUB-TIER SUPPLY-CHAIN “NEW” ENTRANTS 137

6.6 SUB-TIER SUPPLY-CHAIN PLANT UPDATES 140

6.7 SUB-TIER SUPPLY-CHAIN PLANT CLOSURES 141

6.8 SUB-TIER SUPPLY-CHAIN TECHCET ANALYST ASSESSMENT 143

7 SUPPLIER PROFILES 145

ADVANCED TARGETS MATERIALS CO., LTD.

AMERICAN ELEMENTS

FURUYA METAL CO

8 APPENDIX 276

8.1 SPUTTERING TARGET MARKET BARRIERS TO ENTRY 277

8.2 SUB-TIER METALS SUPPLY CHAIN MANAGEMENT CONSIDERATIONS 278

8.2.1 COINCIDENT METALS UNDER IEA CLEANTECH TRANSITION SCENARIOS 279

8.2.2 SELECT SUB-TIER METALS SUPPLY VERSUS DEMAND 280

8.2.3 SELECT SUB-TIER METALS REGIONALITY OF SOURCE DEPENDENCIES 281

8.2.4 SELECT SUB-TIER METALS RISK ASSESSMENT 282

8.3 SUB-TIER METALS SUPPLY CHAIN SUPPLY SIDE OVERVIEW 283

8.3.1 SUB-TIER SUPPLY CHAIN: KEY COMPANIES ALONG THE VALUE CHAIN 284

8.3.2 SUB-TIER METALS SUPPLIER LOCATIONS AND CUMULATIVE CAPEX SINCE 2013 285

8.3.3 SUB-TIER METALS CAPITAL EXPENDITURES ON PRODUCTION 286

8.3.4 SUB-TIER METALS EXPLORATION SPENDING 288

8.3.5 VENTURE CAPITAL INVESTMENTS IN CRITICAL MINERALS SECTOR 289

8.3.6 SUB-TIER METALS RELATED ETFS 290

8.4 SUB-TIER METAL EFFECTS ON SPUTTERING TARGET PRICING 291

GO ELEMENT

GRIKIN

And more...

AND MORE …

ページTOPに戻る

List of Tables/Graphs

2025-2026 CMR(TM) SPUTTERING TARGETS

SUPPLY-CHAIN & MARKET ANALYSIS

A CRITICAL MATERIALS REPORT

FIGURES

FIGURE 1.1: SPUTTERING TARGET SHIPMENT FORECAST BY SEGMENT 14

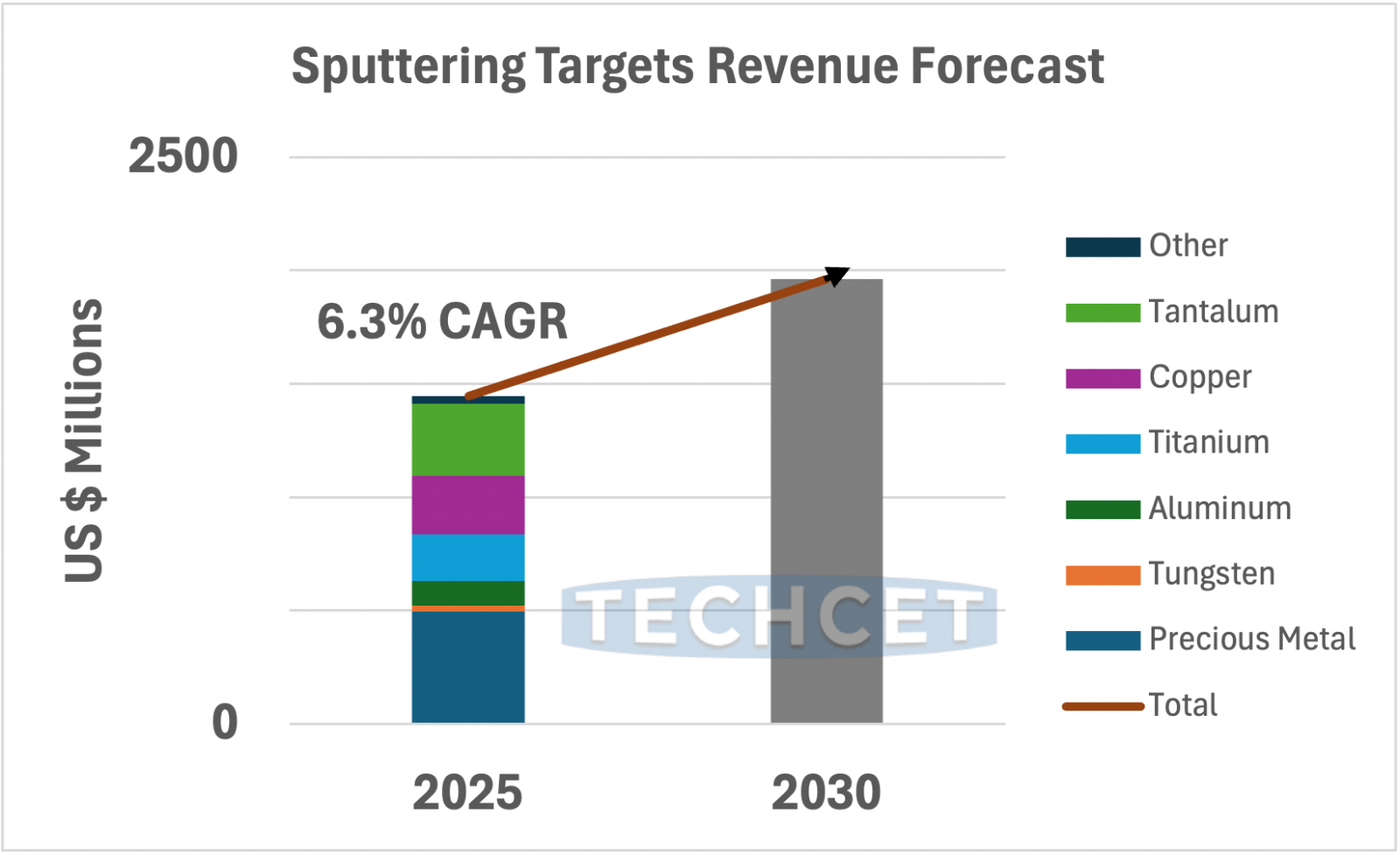

FIGURE 1.2: SPUTTERING TARGET REVENUE FORECAST BY SEGMENT 15

FIGURE 1.3: CHANGING MATERIALS IN SEMICONDUCTOR PROCESSES 16

FIGURE 1.4: 2024 SPUTTERING TARGET SUPPLIER MARKET SHARE ESTIMATES BY REVENUE 18

FIGURE 3.1: HISTORICAL AND FORECASTED GDP GROWTH (2000 – 2029) 30

FIGURE 3.2: GLOBAL ECONOMY AND THE ELECTRONICS SUPPLY CHAIN 31

FIGURE 3.3: WORLDWIDE SEMICONDUCTOR SALES ($B) 32

FIGURE 3.4: TECHCET’S TAIWAN SEMICONDUCTOR INDUSTRY INDEX (TTSI) MOMENTUM TRACKER 33

FIGURE 3.5: 2024 SEMICONDUCTOR CHIP APPLICATIONS 34

FIGURE 3.6: SMARTPHONE SHIPMENTS, WW ESTIMATES 37

FIGURE 3.7: GLOBAL LIGHT VEHICLE PRODUCTION FORECAST 38

FIGURE 3.8: US EV RETAIL SHARE FORECAST 39

FIGURE 3.9: AUTOMOTIVE SEMICONDUCTOR FORECAST ESTIMATES 40

FIGURE 3.10: AI VALUE FORECAST ($B’S USD) 42

FIGURE 3.11: SCALE OF TODAY’S AI-CENTRIC DATA CENTERS 43

FIGURE 3.12: TSMC PHOENIX FAB INVESTMENT TO EXCEED US $65B 44

FIGURE 3.13: ESTIMATED GLOBAL FAB INVESTMENT 2024-2029 ($858.6B) 45

FIGURE 3.14: ANNOUNCED PUBLIC STIMULUS AND RESPECTIVE SEMICONDUCTOR CHIP MANUFACTURING REGIONS 46

FIGURE 3.15: SEMICONDUCTOR SUPPLY CHAIN EXPANSIONS WITHIN THE US 47

FIGURE 3.16: TECHCET WORLDWIDE SEMICONDUCTOR EQUIPMENT FORECAST 48

FIGURE 3:17: TSMC LOGIC ROADMAP BY NODE 49

FIGURE 3.18: TECHCET WAFER START FORECAST BY NODE SEGMENTS 53

FIGURE 3.19: TECHCET WORLDWIDE ELECTRONIC MATERIALS FORECAST 54

FIGURE 4.1: KEY SPUTTERING TARGET SEGMENTS AND PRIMARY APPLICATIONS 57

FIGURE 4.2: ESTIMATED MARKET COMPOSITION 57

FIGURE 4.3: PVD THIN FILM USE EXAMPLES IN SEMICONDUCTOR DEVICE FABRICATION 58

FIGURE 4.4: SPUTTERING TARGET SHIPMENT FORECAST BY SEGMENT 61

FIGURE 4.5: SPUTTERING TARGET REVENUE FORECAST BY SEGMENT 62

FIGURE 4.6: COUNTERVAILING SPUTTERING TARGET DEMAND TRENDS 65

FIGURE 4.7: MARKET METAL PRICE TRENDS 67

FIGURE 4.8: KEY DESIGN CONSIDERATIONS AND ASSOCIATED FUNCTIONALITY 69

FIGURE 4.9: PHYSICAL LIMITATIONS OF PVD IN ADVANCED DEVICE ARCHITECTURES 71

FIGURE 4.10: ENDURING ADVANTAGES OF PVD 72

FIGURE 4.11: CHANGING MATERIALS IN SEMICONDUCTOR PROCESSES 73

FIGURE 4.12: EXAMPLE OF MATERIAL INNOVATIONS FOR ADVANCED TECHNOLOGIES 74

FIGURE 4.13: SCALE OF EQUIPMENT AND EFFECTS OF HIP 75

FIGURE 4.14: EXAMPLE OF A BIMETALLIC TARGET 76

FIGURE 4.15: CONVERGING OBSTACLES FOR ADVANCED TECHNOLOGY 77

FIGURE 4.16: BURIED POWER RAIL / BACKSIDE INTERCONNECT SCHEME 78

FIGURE 4.17 ESTIMATED 2024 SPUTTERING TARGET REVENUE SHARE BY REGION 80

FIGURE 4.18: IMPACT OF PLASMA ON SPUTTERING PROFILE IMPACTING EFFICIENCY / END OF USE 84

FIGURE 4.19: END-OF-LIFE SKETCH 84

FIGURE 4.20: SUPPLY CHAIN SEGMENTS IMPACTED BY CHINA + 1 AND THE COUNTRIES BENEFITING 86

FIGURE 5.1: 2024 SPUTTERING TARGET SUPPLIER MARKET SHARE ESTIMATES BY REVENUE 90

FIGURE 5.2: JX ADVANCED METALS’ MOST RECENT QUARTER FINANCIALS 92

FIGURE 5.3: HONEYWELL’S MOST RECENT QUARTER FINANCIALS 93

FIGURE 5.4: KFMI’S MOST RECENT QUARTER FINANCIALS 94

FIGURE 5.5: LINDE’S MOST RECENT QUARTER FINANCIALS 95

FIGURE 5.6: MATERION COMPLETES KONASOL ACQUISITION 97

FIGURE 5.7: ULVAC DIVESTITURES AND PRODUCTION SITE RESTRUCTURING PLAN 100

FIGURE 5.8: PLANSEE ANNOUNCES LONG-TERM OFFTAKE AGREEMENT FOR TUNGSTEN CONCENTRATES 101

FIGURE 5.9: OVERVIEW OF SANGDONG MINE IN SOUTH KOREA 101

FIGURE 6.1: KEY PLAYERS IN THE SUB-TIER METAL SUPPLY CHAIN 108

FIGURE 6.2: CU PRODUCTION AND APPLICATION HIGHLIGHTS QUADRANT CHART 110

FIGURE 6.3: CU 5-YEAR PRICE HISTORY 111

FIGURE 6.4: AL PRODUCTION AND APPLICATION HIGHLIGHTS QUADRANT CHART 112

FIGURE 6.5: AL 5-YEAR PRICE HISTORY 113

FIGURE 6.6: TI PRODUCTION, APPLICATION HIGHLIGHTS, AND 5-YEAR PRICE HISTORY QUADRANT CHART 114

FIGURE 6.7: TA PRODUCTION, APPLICATION HIGHLIGHTS, AND 5-YEAR PRICE HISTORY QUADRANT CHART 115

FIGURE 6.8: W PRODUCTION, APPLICATION HIGHLIGHTS, AND 5-YEAR PRICE HISTORY QUADRANT CHART 116

FIGURE 6.9: NI PRODUCTION, APPLICATION HIGHLIGHTS, AND 5-YEAR PRICE HISTORY QUADRANT CHART 117

FIGURE 6.10: CO PRODUCTION, APPLICATION HIGHLIGHTS, AND 5-YEAR PRICE HISTORY QUADRANT CHART 118

FIGURE 6.11: MO PRODUCTION, APPLICATION HIGHLIGHTS, AND 5-YEAR PRICE HISTORY QUADRANT CHART 119

FIGURE 6.12: CR PRODUCTION, APPLICATION HIGHLIGHTS, AND 5-YEAR PRICE HISTORY QUADRANT CHART 120

FIGURE 6.13: IN PRODUCTION, APPLICATION HIGHLIGHTS, AND 5-YEAR PRICE HISTORY QUADRANT CHART 121

FIGURE 6.14: RU PRODUCTION, APPLICATION HIGHLIGHTS, AND 5-YEAR PRICE HISTORY QUADRANT CHART 122

FIGURE 6.15: AU PRODUCTION, APPLICATION HIGHLIGHTS, AND 5-YEAR PRICE HISTORY QUADRANT CHART 123

FIGURE 6.16: AG PRODUCTION, APPLICATION HIGHLIGHTS, AND 5-YEAR PRICE HISTORY QUADRANT CHART 124

FIGURE 6.17: PT PRODUCTION, APPLICATION HIGHLIGHTS, AND 5-YEAR PRICE HISTORY QUADRANT CHART 125

FIGURE 6.18: PD PRODUCTION, APPLICATION HIGHLIGHTS, AND 5-YEAR PRICE HISTORY QUADRANT CHART 126

FIGURE 6.19: PT PRODUCTION, APPLICATION HIGHLIGHTS, AND 5-YEAR PRICE HISTORY QUADRANT CHART 127

FIGURE 6.20: PARTIAL LIST OF MATERIALS IMPACTED BY CHINA’S EXPORT CONTROLS 129

FIGURE 6.21: TUNGSTEN OXIDE PRICE APPRECIATION 129

FIGURE 6.22: SOME WESTERN SMELTERS ARE INCREASINGLY TEETERING ON INSOLVENCY 130

FIGURE 6.23: MINING FLOW OVERVIEW 132

FIGURE 6.24: COMPARISON OF ENERGY INTENSITY PER TON OF VARIOUS METALS / MINERALS 132

FIGURE 6.25: TYPICAL SOURCE YIELDS 133

FIGURE 6.26: OPEN PIT MINE AERIAL VIEW 133

FIGURE 6.27: AERIAL VIEW SHOWING SCALE OF ENVIRONMENTAL IMPACT 134

FIGURE 6.28: SUB-TIER LOGISTICS & TRADE CHALLENGES 135

FIGURE 6.29: CHINA’S EXPORT CONTROL FALLOUT 136

FIGURE 6.30: SUB-TIER MARKET BARRIERS TO NEW ENTRANTS 137

TABLE 6.31: MINING PROJECT LIFETIME VALUATION CURVE AND METHODOLOGY 139

FIGURE 6.32: A KEY REVENUE STREAM FOR SMELTERS INVERTS 141

FIGURE 6.33: TAILWINDS CURRENTLY AVAILABLE TO SMELTERs 142

FIGURE 8.1: METALS MAKEUP IN CLEANTECH, BY MASS 279

FIGURE 8.2: METAL USAGE INDICES IN CLEANTECH BY SCENARIO 279

FIGURE 8.3: SUPPLY / DEMAND BALANCE AND CLEANTECH’S IMPACT 280

FIGURE 8.4: RELATED CHINA MINING AND REFINING PRODUCTION 281

FIGURE 8.5: RISK ASSESSMENT OF METALS 282

FIGURE 8.6: KEY PLAYERS IN THE SPUTTERING TARGET SUPPLY CHAIN 284

FIGURE 8.7: CAPITAL EXPENDITURE ($B) FROM EACH MINING GROUP 286

FIGURE 8.8: CAPITAL SPENDING CONTRIBUTION FROM EACH MINING GROUP 287

FIGURE 8.9: RECENT EXPLORATION SPENDING, IN $B 288

FIGURE 8.10: VENTURE CAPITAL INVESTMENT IN CRITICAL MINERALS OPERATIONS 289

FIGURE 8.11: A COMPARISON OF METAL TO MINING ETFS 290

FIGURE 8.12: TARGET EROSION PROFILE 291

FIGURE 8.13: DIAMETER AND THICKNESS IMPACT ON VOLUME 291

FIGURE 8.14: AL TARGET SAMPLE PRICING OFFERED BY A DISTRIBUTOR 291

TABLES

TABLE 1.1: SPUTTERING TARGETS GROWTH OVERVIEW 12

TABLE 1.2: PUBLICLY REPORTED REVENUES OF SEMICONDUCTOR MATERIAL RELATED SEGMENTS 19

TABLE 3.1: GLOBAL GDP AND SEMICONDUCTOR REVENUES 28

TABLE 3.2: INITIALLY ANNOUNCED* US RECIPROCAL TARIFF SCHEDULE 29

TABLE 3.3: WORLDWIDE PC FORECAST BY SEGMENT 36

TABLE 3.4: IT MARKET SPENDING FORECAST, 2025 41

TABLE 4.1: SPUTTERING TARGETS SUPPLIER MANUFACTURING LOCATIONS 64

TABLE 4.2: REGIONAL SPUTTERING TARGET MARKETS 81

TABLE 5.1 MOST RECENT QUARTERLY SUPPLIER SALES – CY 2Q 2025 91

TABLE 5.2: TOSOH’S MOST RECENT QUARTER FINANCIALS 96

TABLE 6.1: COMPANIES TO WATCH IN THE SUB-TIER SUPPLY CHAIN 138

TABLE 6.2: PLANT CLOSURES, SUSPENSIONS 141

TABLE 6.3: PLANT CLOSURES, THREATENED / UNDER REVIEW 142

TABLE 8.1: ENTRY BARRIERS TO THE SPUTTERING TARGET MARKET AND MITIGATION APPROACHES 277

TABLE 8.2: HEIGHTENED RISK SUMMARIZATION 282

TABLE 8.3: KEY OPERATIONS OF SUB-TIER METALS SUPPLIERS AND THEIR COMPANY-WIDE INVESTMENTS 285

TABLE 8.4: SUMMARY OF CAPEX GROWTH FROM EACH MINING GROUP 286