Summary

This report covers the market landscape and supply-chain for wet chemicals used in semiconductor device fabrication. It includes information about key suppliers, issues/trends in the material supply chain, estimates on supplier market share, and forecast for the material segments.

-

Covers the wet chemicals market and supply-chain issues for such used in semiconductor device fabrication.

-

Contains data and analysis from TECHCET’s database and Sr. Analyst experience, as well as that developed from primary and secondary market research.

-

Provides focused information for electronics supply-chain managers, process integration and R&D directors, as well as business and financial analysts.

-

Covers information about key semiconductor wet chemical suppliers, issues/trends in the wet chemicals material supply chain, estimates on supplier market share, and forecast for the wet chemicals material segments.

-

Includes 3 Quarterly Updates, with updates on market trends and forecasts from the analyst.

ページTOPに戻る

Table of Contents

1 EXECUTIVE SUMMARY 10

1.1 WET CHEMICALS AND SPECIALTY CLEANS BUSINESS :MARKET OVERVIEW 11

1.2 MARKET TRENDS IMPACTING 2025 OUTLOOK 12

1.3 WET CHEMICALS AND SPECIALTY CLEANS 5-YEAR UNIT SHIPMENT FORECAST BY SEGMENT 13

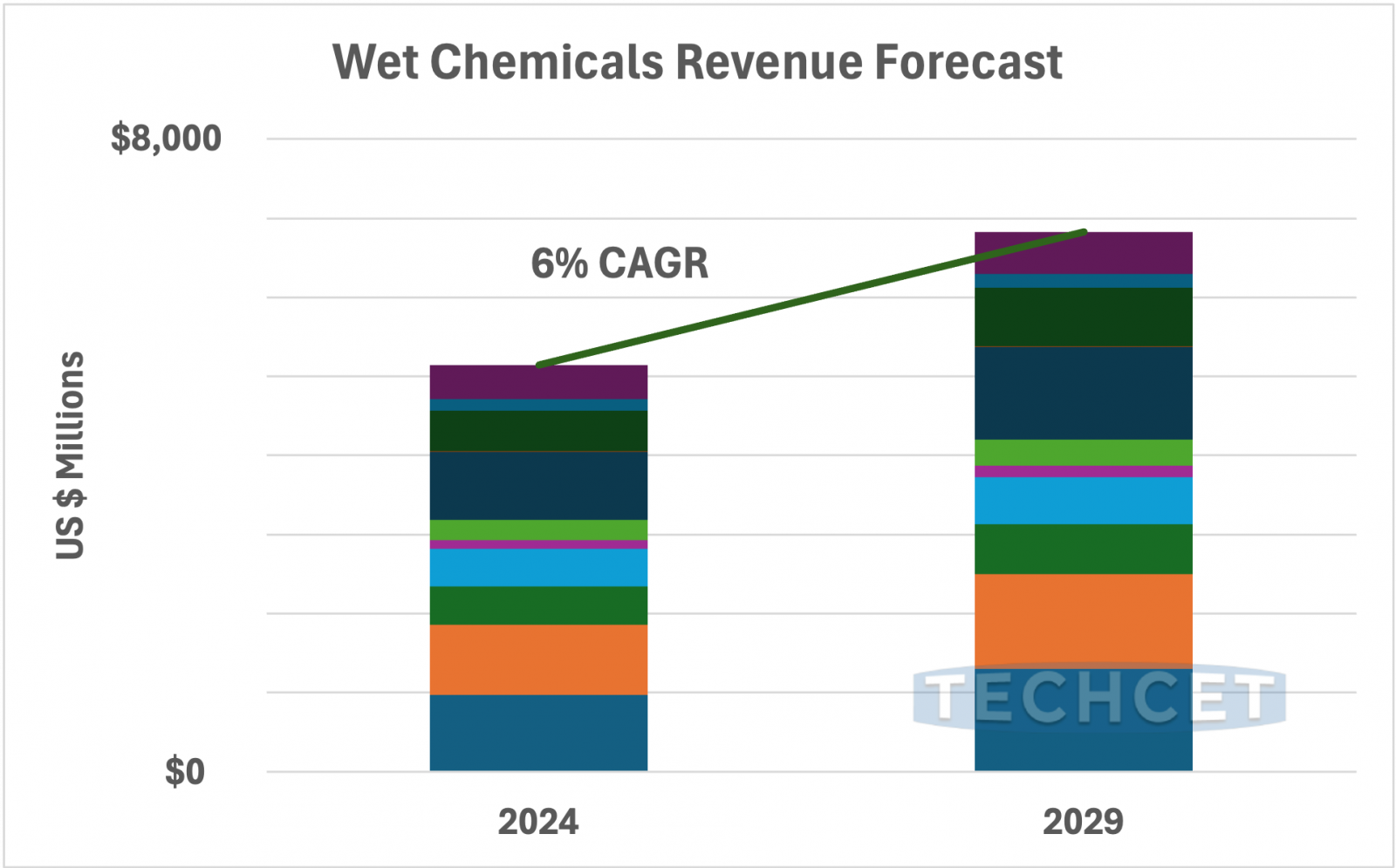

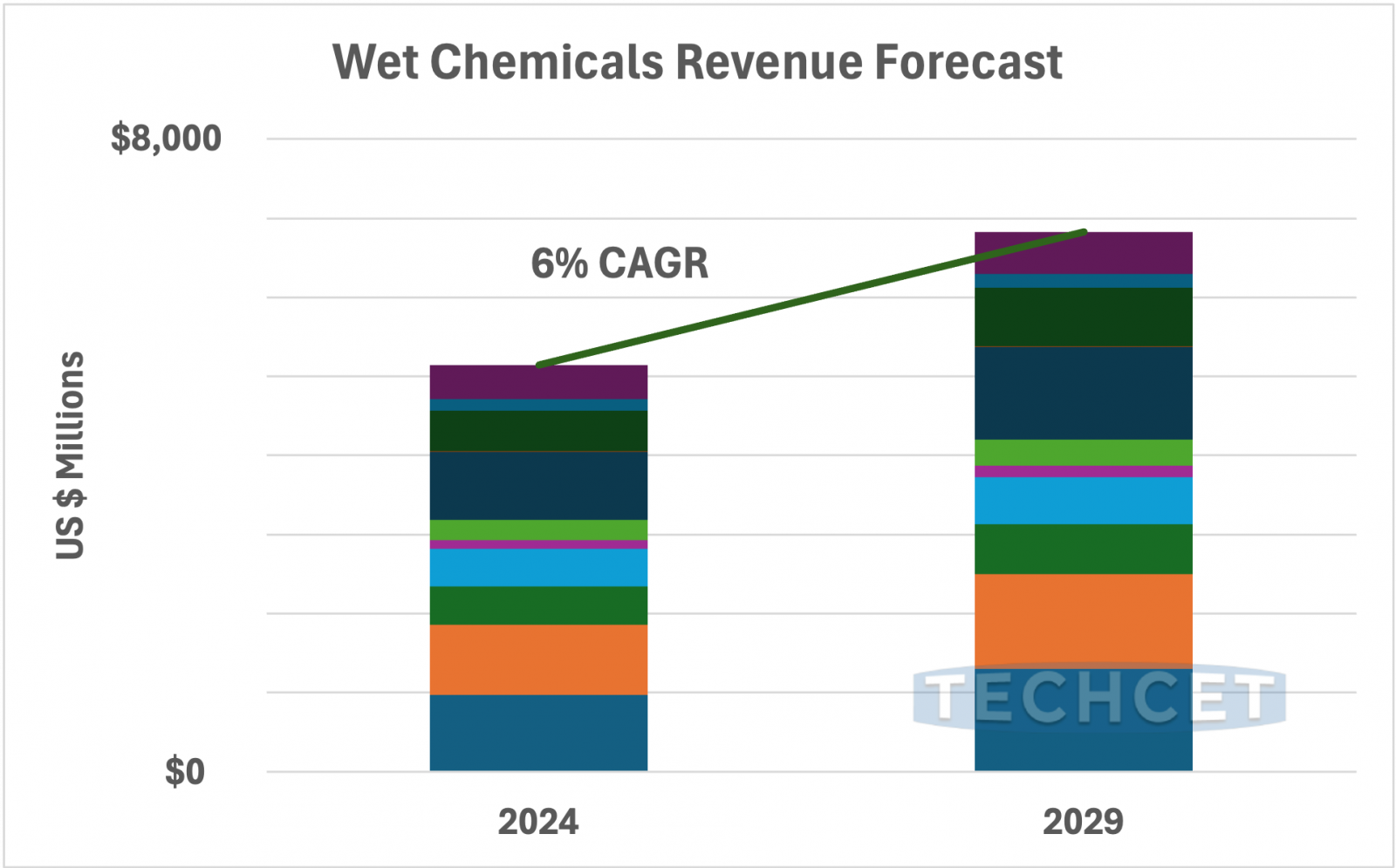

1.4 WET CHEMICALS AND SPECIALTY CLEANS 5-YEAR REVENUE FORECAST BY SEGMENT 14

1.5 WET CHEMICALS AND SPECIALTY CLEANS SEGMENT TRENDS 15

1.6 TECHNOLOGY TRENDS 16

1.7 REGIONAL TRENDS 17

1.8 FIRST QUARTER 2025 FINANCIALS OF TOP 10 18

1.9 EHS, TRADE, AND/OR LOGISTICS ISSUES/CONCERNS 19

1.10 ANALYST ASSESSMENT OF WET CHEMICALS AND SPECIALTY CLEANS 20

2 SCOPE, PURPOSE AND METHODOLOGY 22

2.1 SCOPE, PURPOSE & METHODOLOGY 23

2.2 OVERVIEW OF TECHCET CMR™ OFFERINGS 24

3 SEMICONDUCTOR INDUSTRY MARKET STATUS & OUTLOOK 25

3.1 WORLDWIDE ECONOMY AND OUTLOOK 26

3.2 WORLDWIDE ECONOMY AND OVERVIEW 27

3.2.1 WORLDWIDE ECONOMY AND SEMICONDUCTOR MARKET OVERVIEW 28

3.2.2 SEMICONDUCTOR INDUSTRIES TIES TO THE GLOBAL ECONOMY 29

3.2.3 SEMICONDUCTOR SALES GROWTH 30

3.2.4 TAIWAN OUTSOURCE MANUFACTURER MONTHLY SALES TRENDS 31

3.3 CHIPS SALES BY ELECTRONIC GOODS SEGMENT 32

3.3.1 FACTORS IMPACTING ELECTRONIC SYSTEMS OUTLOOK 33

3.3.2 PC OUTLOOK 34

3.3.3 SMARTPHONE OUTLOOK 35

3.3.4 AUTOMOTIVE INDUSTRY OUTLOOK 36

3.3.5 SERVERS / IT MARKET 39

3.4 SEMICONDUCTOR FABRICATION GROWTH & EXPANSION 42

3.4.1 IN THE MIDST OF HUGE INVESTMENT IN CHIP EXPANSIONS 43

3.4.2 PUBLIC FUNDS STIMULATING PRIVATE INVESTMENTS IN EXPANSION ACROSS THE GLOBE 44

3.4.3 SEMICONDUCTOR SUPPLY CHAIN ANNOUNCED EXPANSIONS IN THE US 45

3.4.4 EQUIPMENT SPENDING TRENDS 46

3.4.5 TECHNOLOGY ROADMAPS 47

3.5 POLICY & TRADE TRENDS AND IMPACT 48

3.6 SEMICONDUCTOR PRODUCTION (WAFER STARTS*) AND MATERIALS OVERVIEW 50

3.6.1 TECHCET WAFER STARTS FORECAST THROUGH 2029 51

3.6.2 TECHCET ELECTRONIC MATERIALS MARKET FORECAST THROUGH 2028 52

4 WET CHEMICALS AND SPECIALTY CLEANS MARKET TRENDS 53

4.1 WET CHEMICALS AND SPECIALTY CLEANS MARKET TRENDS:OUTLINE 54

4.1.1 2024 WET CHEMICALS AND SPECIALTY CLEANS MARKET LEADING INTO 2025 55

4.1.2 WET CHEMICALS AND SPECIALTY CLEANS MARKET OUTLOOK 56

4.1.3 WET CHEMICALS AND SPECIALTY CLEANS 5-YEAR UNIT SHIPMENT FORECAST BY SEGMENT 57

4.1.4 WET CHEMICALS AND SPECIALTY CLEANS 5-YEAR REVENUE FORECAST BY SEGMENT 58

4.1.5 WET CHEMICALS AND SPECIALTY CLEANS 5-YEAR UNIT SHIPMENT FORECAST:H2SO4 59

4.1.6 WET CHEMICALS AND SPECIALTY CLEANS 5-YEAR REVENUE FORECAST:H2SO4 60

4.1.7 WET CHEMICALS AND SPECIALTY CLEANS 5-YEAR UNIT SHIPMENT FORECAST:HF 61

4.1.8 WET CHEMICALS AND SPECIALTY CLEANS 5-YEAR REVENUE

FORECAST:HF 62

4.1.9 WET CHEMICALS AND SPECIALTY CLEANS 5-YEAR UNIT SHIPMENT FORECAST:NH4OH 63

4.1.10 WET CHEMICALS AND SPECIALTY CLEANS 5-YEAR REVENUE FORECAST:NH4OH 64

4.1.11 WET CHEMICALS AND SPECIALTY CLEANS 5-YEAR UNIT SHIPMENT FORECAST:H2O2 65

4.1.12 WET CHEMICALS AND SPECIALTY CLEANS 5-YEAR REVENUE FORECAST:H2O2 66

4.1.13 WET CHEMICALS AND SPECIALTY CLEANS 5-YEAR UNIT SHIPMENT FORECAST:H3PO4 67

4.1.14 WET CHEMICALS AND SPECIALTY CLEANS 5-YEAR REVENUE FORECAST:H3PO4 68

4.1.15 WET CHEMICALS AND SPECIALTY CLEANS 5-YEAR UNIT SHIPMENT FORECAST:HCL 69

4.1.16 WET CHEMICALS AND SPECIALTY CLEANS 5-YEAR REVENUE FORECAST:HCL 70

4.1.17 WET CHEMICALS AND SPECIALTY CLEANS 5-YEAR UNIT SHIPMENT FORECAST:HNO3 71

4.1.18 WET CHEMICALS AND SPECIALTY CLEANS 5-YEAR REVENUE FORECAST:HNO3 72

4.1.19 WET CHEMICALS AND SPECIALTY CLEANS 5-YEAR UNIT SHIPMENT FORECAST:IPA 73

4.1.20 WET CHEMICALS AND SPECIALTY CLEANS 5-YEAR REVENUE FORECAST:IPA 74

4.1.21 WET CHEMICALS AND SPECIALTY CLEANS 5-YEAR UNIT SHIPMENT FORECAST:AL PERR 75

4.1.22 WET CHEMICALS AND SPECIALTY CLEANS 5-YEAR REVENUE FORECAST:AL PERR 76

4.1.23 WET CHEMICALS AND SPECIALTY CLEANS 5-YEAR UNIT SHIPMENT FORECAST:CU PERR 77

4.1.24 WET CHEMICALS AND SPECIALTY CLEANS 5-YEAR REVENUE FORECAST:CU PERR 78

4.1.25 WET CHEMICALS AND SPECIALTY CLEANS 5-YEAR REVENUE FORECAST:PCMP 79

4.1.26 WET CHEMICALS AND SPECIALTY CLEANS 5-YEAR FORECAST:PCMP CLEANS BY TYPE 80

4.1.27 WET CHEMICALS AND SPECIALTY CLEANS 5-YEAR FORECAST:PCMP CLEANS BY DEVICE 81

4.2 WET CHEMICALS AND SPECIALTY CLEANS SUPPLY CAPACITY AND DEMAND, INVESTMENTS - OUTLINE 82

4.2.1 WET CHEMICALS AND SPECIALTY CLEANS PRODUCTION BY REGION 83

4.2.2 WET CHEMICALS AND SPECIALTY CLEANS PRODUCTION CAPACITY EXPANSIONS 84

4.2.3 INVESTMENT ANNOUNCEMENTS OVERVIEW 85

4.2.4 INVESTMENT ACTIVITY ADDITIONAL COMMENTS 86

4.2.5 WET CHEMICALS AND SPECIALTY CLEANS SUPPLY VS. DEMAND BALANCE:OVERVIEW 87

4.3 PRICING TRENDS 88

4.4 TECHNOLOGY TRENDS/TECHNICAL DRIVERS - OUTLINE 89

4.4.1 WET CHEMICALS AND SPECIALTY CLEANS GENERAL TECHNOLOGY OVERVIEW 90

4.4.2 WET CHEMICALS AND SPECIALTY CLEANS TECHNOLOGY TRENDS 91

4.5 REGIONAL CONSIDERATIONS 92

4.5.1 REGIONAL ASPECTS AND DRIVERS 93

4.6 EHS AND TRADE/LOGISTIC ISSUES 95

4.6.1 EHS ISSUES 96

4.6.2 TRADE/LOGISTICS ISSUES 97

4.7 ANALYST ASSESSMENT OF WET CHEMICALS AND SPECIALTY 98

5 SUPPLY-SIDE MARKET LANDSCAPE 99

5.1 WET CHEMICALS MARKET SHARE 100

5.2 SPECIALTY CLEANS MARKET SHARE 101

5.2.1 CURRENT QUARTER - SUPPLIER ACTIVITIES & REPORTED REVENUES 102

5.2.2 CURRENT QUARTER TOP 10 SUPPLIER ACTIVITIES & REPORTED REVENUES 103

5.2.3 CURRENT QUARTER ACTIVITY:DUPONT ELECTRONICS & INDUSTRIAL 104

5.2.4 CURRENT QUARTER ACTIVITY:FUJIFILM ELECTRONIC MATERIALS 105

5.2.5 CURRENT QUARTER ACTIVITY:MERCK KGAA/EMD ELECTRONICS 106

5.2.6 CURRENT QUARTER ACTIVITY:BASF SE 107

5.2.7 CURRENT QUARTER ACTIVITY:HONEYWELL ADVANCED MATERIALS 108

5.3 M&A ACTIVITY AND PARTNERSHIPS 109

5.4 PLANT CLOSURES 110

5.5 NEW ENTRANTS 111

5.6 SUPPLIERS OR PARTS/PRODUCT LINES THAT ARE AT RISK OF DISCONTINUATIONS 112

5.7 TECHCET ANALYST ASSESSMENT OF WET CHEMICALS AND SPECIALTY CLEANS SUPPLIERS 113

6 SUB-TIER SUPPLY-CHAIN 115

6.1 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW 116

6.1.1 SUB-TIER MATERIAL SUPPLIER MARKET BACKGROUND 117

6.1.2 SUB-TIER MATERIAL SUPPLIER MARKET TRENDS 118

6.1.3 SUB-TIER MATERIAL SUPPLIER INDUSTRIAL VS. SEMICONDUCTOR-GRADE 119

6.1.4 SUB-TIER SUPPLY CHAIN: SUB-TIER MATERIAL SUPPLIERS 120

6.1.5 SEMICONDUCTOR-GRADE SUB-TIER MATERIAL SUPPLIER NEWS 123

6.2 SUB-TIER SUPPLY-CHAIN: DISRUPTIONS 125

6.3 SUB-TIER SUPPLY-CHAIN M&A OR PARTNERSHIP ACTIVITY 126

6.4 SUB-TIER SUPPLY-CHAIN EHS AND LOGISTICS ISSUES 127

6.5 SUB-TIER SUPPLY-CHAIN “NEW” ENTRANTS 128

6.6 SUB-TIER SUPPLY-CHAIN RECENT PLANT UPDATES 129

6.7 SUB-TIER SUPPLY-CHAIN PLANT CLOSURES 130

6.8 SUB-TIER SUPPLY-CHAIN TECHCET ANALYST ASSESSMENT 131

7 SUPPLIER PROFILES

ARKEMA

ATOTECH

AUECC

AVANTOR

133

LYONDELLBASELL INDUSTRIES HOLDINGS B.V.

MARATHON PETROLEUM CORP

MERCK/EMD GROUP

and more...

ページTOPに戻る

List of Tables/Graphs

FIGURES

FIGURE 1.1: WET CHEMICALS AND SPECIALTY CLEANS SHIPMENT FORECAST BY SEGMENT 13

FIGURE 1.2: WET CHEMICALS AND SPECIALTY CLEANS REVENUE FORECAST BY SEGMENT 14

FIGURE 1.3: 2025 WET CHEMICALS VOLUME SHARE FORECAST BY REGION 17

FIGURE 1.4: TOP 10 SUPPLIERS QUARTERLY COMBINED SALES (INCLUDES BASF, EVONIK, HONEYWELL, MERCK, MGC, SOLVAY, FFEM, ENTEGRIS, DONGJIN, TOKUYAMA) 18

FIGURE 3.1: HISTORICAL AND FORECASTED GDP GROWTH (2000:2029) 28

FIGURE 3.2: GLOBAL ECONOMY AND THE ELECTRONICS SUPPLY CHAIN (2024) 29

FIGURE 3.3: WORLDWIDE SEMICONDUCTOR SALES ($B) 30

FIGURE 3.4: TECHCET’S TAIWAN SEMICONDUCTOR INDUSTRY INDEX (TTSI) MOMENTUM TRACKER 31

FIGURE 3.5: 2024 SEMICONDUCTOR CHIP APPLICATIONS 32

FIGURE 3.6: SMARTPHONE SHIPMENTS, WW ESTIMATES 35

FIGURE 3.7: GLOBAL LIGHT VEHICLE PRODUCTION FORECAST (IN MILLIONS OF UNITS) 36

FIGURE 3.8: US EV RETAIL SHARE FORECAST 37

FIGURE 3.9: AUTOMOTIVE SEMICONDUCTOR REVENUES HISTORY AND FORECAST (ESTIMATED, B$’S USD) 38

FIGURE 3.10: AI VALUE FORECAST ($B’S USD) 40

FIGURE 3.11: SCALE OF TODAY’S AI-CENTRIC DATA CENTERS 41

FIGURE 3.12: TSMC PHOENIX FAB INVESTMENT TO EXCEED US $65B 42

FIGURE 3.13: ESTIMATED GLOBAL FAB INVESTMENT 2024-2029 ($858.6B) 43

FIGURE 3.14: ANNOUNCED PUBLIC STIMULUS AND RESPECTIVE SEMICONDUCTOR CHIP MANUFACTURING REGIONS 44

FIGURE 3.15: SEMICONDUCTOR SUPPLY CHAIN EXPANSIONS WITHIN THE US 45

FIGURE 3.16: GLOBAL TOTAL EQUIPMENT SPENDING (US$ M) 46

FIGURE 3.17: TSMC LOGIC ROADMAP BY NODE 47

FIGURE 3.18: TECHCET WAFER START FORECAST BY NODE SEGMENTS (MILLIONS OF 200MM EQUIVALENTS PER YEAR) 51

FIGURE 3.19: TECHCET WORLDWIDE ELECTRONIC MATERIALS FORECAST ($M USD) 52

FIGURE 4.1: WET CHEMICALS AND SPECIALTY CLEANS SHIPMENT FORECAST BY SEGMENT 57

FIGURE 4.2: WET CHEMICALS AND SPECIALTY CLEANS REVENUE FORECAST BY SEGMENT 58

FIGURE 4.3: H2SO4 VOLUME FORECAST 59

FIGURE 4.4: H2SO4 REVENUE FORECAST 60

FIGURE 4.5: HF VOLUME FORECAST 61

FIGURE 4.6: HF REVENUE FORECAST 62

FIGURE 4.7: NH4OH VOLUME FORECAST 63

FIGURE 4.8: NH4OH REVENUE FORECAST 64

FIGURE 4.9: H2O2 VOLUME FORECAST 65

FIGURE 4.10: H2O2 REVENUE FORECAST 66

FIGURE 4.11: H3PO4 VOLUME FORECAST 67

FIGURE 4.12: H3PO4 REVENUE FORECAST 68

FIGURE 4.13: HCL VOLUME FORECAST 69

FIGURE 4.14: HCL REVENUE FORECAST 70

FIGURE 4.15: HNO3 VOLUME FORECAST 71

FIGURE 4.16: HNO3 REVENUE FORECAST 72

FIGURE 4.17: IPA VOLUME FORECAST 73

FIGURE 4.18: IPA REVENUE FORECAST 74

FIGURE 4.19: AL PERR VOLUME FORECAST 75

FIGURE 4.20: AL PERR REVENUE FORECAST 76

FIGURE 4.21: CU PERR VOLUME FORECAST 77

FIGURE 4.22: CU PERR REVENUE FORECAST 78

FIGURE 4.23: PCMP REVENUE FORECAST 79

FIGURE 4.24: PCMP CLEANS BY SLURRY TYPE 80

FIGURE 4.25: PCMP CLEANS BY DEVICE 81

FIGURE 4.26: MO ETCHING CHALLENGES 91

FIGURE 4.27: SIGE ETCHING CHALLENGES 91

FIGURE 4.28: 2025 WET CHEMICALS VOLUME SHARE FORECAST BY REGION 92

FIGURE 5.1: 2024 SPECIALTY CLEANS SUPPLIER MARKET SHARE BY REVENUE 101

FIGURE 5.2: TOP 10 SUPPLIERS QUARTERLY COMBINED SALES (INCLUDES BASF, EVONIK, HONEYWELL, MERCK, MGC, SOLVAY, FFEM, ENTEGRIS, DONGJIN, TOKUYAMA) 103

FIGURE 5.3: DUPONT CURRENT QUARTER FINANCIALS 104

FIGURE 5.4: FUJIFILM ELECTRONICS CURRENT QUARTER FINANCIALS 105

FIGURE 5.5: MERCK KGAA CURRENT QUARTER FINANCIALS 106

FIGURE 5.6: BASF CURRENT QUARTER FINANCIALS 107

FIGURE 5.7: HONEYWELL CURRENT QUARTER FINANCIALS 108

FIGURE 6.1: SUB-TIER MATERIAL SUPPLIER DEMAND SEMICONDUCTOR VS. INDUSTRIAL 119

FIGURE 6.2: FLUORSPAR PRICING 123

FIGURE 6.3: PHOSPHATE ROCK PRICING 123

FIGURE 6.4: ENERGY COST TRENDS (REPORTED BY ST. LOUIS FED 5/2025) 124

TABLES

TABLE 1.1: WET CHEMICALS AND SPECIALTY CLEANS GROWTH OVERVIEW 11

TABLE 3.1: GLOBAL GDP AND SEMICONDUCTOR REVENUES 26

TABLE 3.2: INITIALLY ANNOUNCED* US RECIPROCAL TARIFF SCHEDULE 27

TABLE 3.3: WORLDWIDE PC FORECAST BY SEGMENT 34

TABLE 3.4: IT MARKET SPENDING FORECAST, 2025 39

TABLE 4.1: PCMP CLEANS BY SLURRY TYPE CAGR 80

TABLE 4.2: PCMP CLEANS BY DEVICE TYPE CAGR 81

TABLE 4.3: WET CHEMICALS SUPPLIER MANUFACTURING LOCATIONS 83

TABLE 4.4: SPECIALTY CLEANS SUPPLIER MANUFACTURING LOCATIONS 83

TABLE 4.5: OVERVIEW OF ANNOUNCED 2024/2025 WET CHEMICALS AND SPECIALTY CLEANS SUPPLIER INVESTMENTS 85

TABLE 4.6: REGIONAL WET CHEMICALS AND SPECIALTY CLEANS MARKETS 93

TABLE 5.1: TIER 1 WET CHEMICALS SUPPLIERS 100

TABLE 5.2: MOST RECENT QUARTERLY WET CHEMICAL AND SPECIALTY CLEANS SUPPLIER SALES (IN LOCAL REPORTING CURRENCY) 102

TABLE 6.1: SEMICONDUCTOR–GRADE SUB-TIER MATERIAL SUPPLIERS 120

Press Release

Wet Chemicals & Specialty Cleans Set for 6% Growth in 2025

San Diego, CA,

September 15, 2025|Press Release

TECHCET, the electronic materials advisory firm providing semiconductor materials supply chain information, reported an update on the Wet Chemicals and Specialty Cleans markets showing shipments growth at +5% for 2025 to total 2,706 M Kg, with revenues up +6% to US $5,440M. This rebound follows a sluggish 2024, when shipments rose only +1% and revenues +5%. Long-term growth is steady, with 2024–2029 CAGRs of +6% for shipments and +6% for revenues according to TECHCET’s 2025-2026 Critical Materials Report(TM) on Wet Chemicals. “The market is starting to normalize on a global basis, although varies from region to region,” stated Lita Shon-Roy, TECHCET’s President / CEO.

*Each color represents a different segment, which can be uncovered in the Wet Chemicals Report

Growth is fueled by wafer start expansion, stronger fab utilization in Asia, and rising demand for ultra-high purity (UHP) products. Cu Post-Etch Residue Removal (PERR) is the fastest-growing segment (+8% CAGR), while nitric acid (HNO3) lags at +3%. Advanced device structures (GAA, CFET) and new conductors like molybdenum are also driving demand for more selective etchants and cleans.

Global supply remains balanced with demand, though most UHP production is concentrated in Asia. Localized capacity in the US and Europe is slowly emerging, but many planned expansions are on hold due to fab delays and trade tensions. Overall, 2025 is shaping up to be a good year for Wet Chemicals and Specialty Cleans, aligned with strong semiconductor market growth of -15%.