|

1. |

EXECUTIVE SUMMARY |

|

1.1. |

Marine sectors |

|

1.2. |

Overview |

|

1.3. |

Do diesel-electrics count? |

|

1.4. |

Overview of drivers |

|

1.5. |

Drivers: fuel economy |

|

1.6. |

Emissions reduction study |

|

1.7. |

Why use a battery? |

|

1.8. |

Fuel cost savings and ROI |

|

1.9. |

Roadblocks to maritime electrification |

|

1.10. |

Shipping emissions: the problem |

|

1.11. |

NOx and SOx: a huge problem for the shipping sector |

|

1.12. |

Emission control areas (ECA) |

|

1.13. |

Emission control areas (ECA) before 2020 |

|

1.14. |

Unprecedented global cap on Sulphur |

|

1.15. |

Emissions Control World - Annex VI - Sulphur |

|

1.16. |

What about CO2? |

|

1.17. |

Regulatory Developments |

|

1.18. |

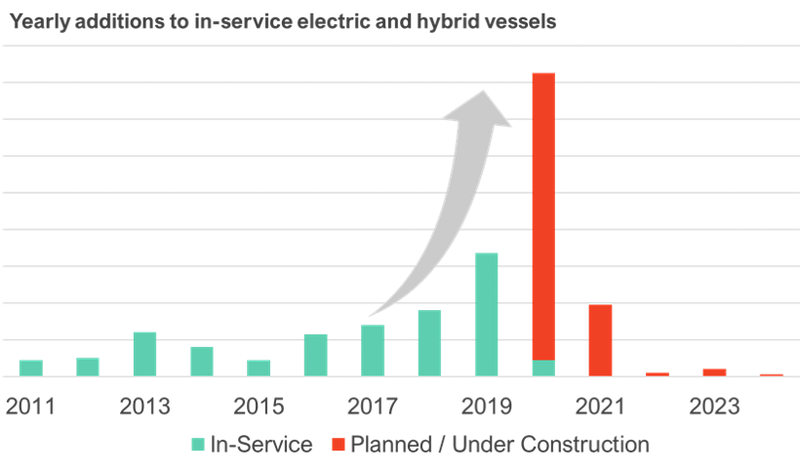

Historic market growth and 2020 - 21 pipeline |

|

1.19. |

Forecast 2021 - 2040 - Cruise, Ferry, Offshore Support, Tugboat, Deep-sea (Vessels) |

|

1.20. |

Forecast 2021 - 2040 - Leisure Boats & Fishing (Vessels) |

|

1.21. |

Forecast 2021 - 2040 - Leisure Boats, Fishing, Cruise, Ferry, Offshore Support, Tugboat, Deepsea (MWh) |

|

1.22. |

Forecast 2021 - 2040 - Pure Electric v Hybrids (MWh) |

|

1.23. |

Forecast 2021 - 2040 ($ billion) |

|

1.24. |

Assumptions and analysis |

|

1.25. |

Impact of coronavirus on forecasts |

|

1.26. |

Maritime battery pack suppliers |

|

1.27. |

Maritime battery maker market share (2019) |

|

1.28. |

Corvus Energy: battery deployment by vessel type |

|

1.29. |

Marine battery pack price forecast |

|

2. |

MARITIME POLICY, REGULATIONS AND TARGETS |

|

2.1. |

Introduction to marine emissions regulation |

|

2.2. |

Emissions Regulation: Annex VI |

|

2.3. |

SOx reductions more important than NOx |

|

2.4. |

Annex VI - Sulphur |

|

2.5. |

US seeks late change to sulphur-cap fuel rules |

|

2.6. |

Annex VI - NOx |

|

2.7. |

CO2 target for shipping |

|

2.8. |

CO2 in shipping forecast |

|

2.9. |

Timeline of regulatory developments |

|

2.10. |

Local regulations: U.S. |

|

2.11. |

Local regulations: Asia |

|

2.12. |

Local regulations: Amsterdam zero emission canals |

|

2.13. |

Bell Marine: Major Supplier to Amsterdam Canals! |

|

2.14. |

Solutions to emissions targets |

|

2.14.1. |

What cards do vessel operators have to play? |

|

2.14.2. |

Slow-steaming: the first port of call |

|

2.14.3. |

Scrubbers |

|

2.14.4. |

More expensive fuels |

|

2.14.5. |

Batteries and electrification |

|

3. |

LEISURE BOATING |

|

3.1. |

What is a leisure watercraft? |

|

3.2. |

Leisure boating market |

|

3.3. |

Overview of boating motor types |

|

3.4. |

Powerful Outboards Undermining Inboards |

|

3.5. |

Regional outboard sales |

|

3.6. |

Outboard emissions |

|

3.7. |

Outboard pollution: an increasing problem, ignored |

|

3.8. |

Trolling motors |

|

3.9. |

Electric propeller |

|

3.10. |

Torqeedo motor range |

|

3.11. |

Shaft power versus propulsive power |

|

3.12. |

Torqeedo |

|

3.13. |

Torqeedo: Moving Up to 100kW! |

|

3.14. |

Torqeedo: Low Voltage Sales Dominate |

|

3.15. |

Torqeedo storage systems |

|

3.16. |

Torqeedo uses BMW i battery systems |

|

3.17. |

Conventional outboard companies |

|

3.18. |

Electric outboard price |

|

3.19. |

Outboard-powered ferry |

|

3.20. |

Oceanvolt |

|

3.21. |

OceanVolt motors |

|

3.22. |

Hull efficiency zones |

|

3.23. |

Aquawatt |

|

3.24. |

Selected examples |

|

3.24.1. |

Aquawatt 550 Elliniko |

|

3.24.2. |

Duffy - 16 Sport Cat Lake Series |

|

3.24.3. |

Savannah - superyacht |

|

3.24.4. |

006 Yacht |

|

3.24.5. |

Hybrid-electric Tag 60 yacht |

|

4. |

COMMERCIAL (SHORT-SEA) |

|

4.1. |

Navigating shipping terms |

|

4.2. |

Industry Jargon |

|

4.3. |

Electric and hybrid vessel configurations |

|

4.4. |

Hybrid battery propulsion |

|

4.5. |

Efficient hybrid battery propulsion |

|

4.6. |

Battery propulsion |

|

4.7. |

Low load is inefficient |

|

4.8. |

Fuel efficiency calculation |

|

4.9. |

Wartsila: hybrid engine profile |

|

4.10. |

Offshore support vessels |

|

4.10.1. |

Types of offshore support vessels |

|

4.10.2. |

The uses of offshore support vessels |

|

4.10.3. |

OSV: the global fleet |

|

4.10.4. |

Offshore support vessel oversupply |

|

4.10.5. |

Negative oil price? |

|

4.10.6. |

The spike for hybrid OSVs |

|

4.11. |

Tugboats |

|

4.11.1. |

Tugboat definition and market size |

|

4.11.2. |

Electric tugboat projects tracked by IDTechEx |

|

4.11.3. |

Kotug and Corvus Energy |

|

4.11.4. |

Tugboat operational profile |

|

4.11.5. |

Ports of Auckland buy electric tug |

|

4.12. |

Fishing |

|

4.12.1. |

Global fishing fleet by region |

|

4.12.2. |

Global fishing fleet by vessel length |

|

4.12.3. |

Fishing in Europe |

|

4.12.4. |

Fishing relies on subsidies |

|

4.12.5. |

Leo Greentier Marines: electric fishing boats in Asia |

|

4.12.6. |

Leo Greetier Marines |

|

4.12.7. |

Cutting Norway's Emissions with Electric Fishing Boats |

|

4.13. |

Ferries |

|

4.13.1. |

Ferries, the addressable market |

|

4.13.2. |

Electric and hybrid ferries: regional market share |

|

4.13.3. |

Short routes |

|

4.13.4. |

Ferries in Norway |

|

4.13.5. |

Electric ferry forecast 2021 - 2040 - Norway, EU, RoW |

|

4.13.6. |

Fuel economy for electric ferries |

|

4.13.7. |

Scandlines |

|

4.13.8. |

Scandlines timeline for electrification |

|

4.14. |

Selected examples of e-ferry projects |

|

4.14.1. |

Leclanché e-ferry |

|

4.14.2. |

50MWh Ferry? |

|

4.14.3. |

Supercapacitor ferry |

|

4.14.4. |

The Prius of the Sea - battery hybrid ferry |

|

4.14.5. |

Ampere |

|

4.14.6. |

Green City Ferries: Innovation on Swedish waterways |

|

4.14.7. |

Ferry Conversion: M/S Prinsesse Benedikte |

|

4.14.8. |

Energy Absolute |

|

4.14.9. |

HH Ferries Group conversion |

|

4.14.10. |

Scandlines battery price |

|

4.14.11. |

Scandlines Hybrid Ferry Inverter |

|

5. |

COMMERCIAL (DEEP-SEA) |

|

5.1. |

Seaborne trade and the global economy |

|

5.2. |

Global economy and demand for shipping |

|

5.3. |

More expensive fuels |

|

5.4. |

Shipbuilding is cycle |

|

5.5. |

Deep-sea vessel fleet |

|

5.6. |

Shipbuilding by country 2017 |

|

5.7. |

Hyundai Heavy Industries |

|

5.8. |

Hyundai Heavy partners with Magna E-Car |

|

5.9. |

Ship pricing |

|

5.10. |

Electric and hybrid trading vessels |

|

5.11. |

Selected examples |

|

5.11.1. |

First electric tanker - moving beyond ferries |

|

5.11.2. |

First pure electric container ship |

|

5.11.3. |

6.7MWh pure electric barges? |

|

5.11.4. |

Asahi Tanker: Japan's First Pure Electric Tanker |

|

6. |

PROPULSION TECHNOLOGY |

|

6.1. |

Which technologies are adopted? |

|

6.2. |

Benchmarking electric traction motors |

|

6.3. |

Motor efficiency comparison |

|

6.4. |

Electric Propulsion: Danfoss Motor |

|

6.5. |

Electric Propulsion: Vebrat |

|

6.6. |

Diesel |

|

6.7. |

Diesel-electric |

|

6.8. |

Gas turbine |

|

6.9. |

Water-jet propulsion |

|

6.10. |

Gas fuel or tri-fuel propulsion |

|

6.11. |

Steam turbine |

|

6.12. |

Biofuel |

|

6.13. |

Wind |

|

6.14. |

Norsepower Rotor Sail Specification |

|

6.15. |

Solar Propulsion |

|

7. |

OVERVIEW OF BATTERY TECHNOLOGIES |

|

7.1. |

Why are marine batteries different? |

|

7.2. |

DNG.VL Type approval |

|

7.3. |

Safety - pause for thought? |

|

7.4. |

Thermal runaway |

|

7.5. |

Battery types: lead-acid and leapfrogging NiMH |

|

7.6. |

The Li-ion advantage |

|

7.7. |

Comparison of specific energy and energy density of various battery systems |

|

7.8. |

What is a Li-ion battery (LIB)? |

|

7.9. |

A family tree of batteries - lithium-based |

|

7.10. |

Standard cathode materials |

|

7.11. |

Conventional versus advanced Li-ion? |

|

7.12. |

Li-ion battery cathodes |

|

7.13. |

Cathode alternatives - NCA |

|

7.14. |

Li-ion battery cathode recap |

|

7.15. |

LTO anode -- Toshiba |

|

7.16. |

Battery cell geometries |

|

7.17. |

Short-sea battery packaging technologies |

|

7.18. |

Battery packaging technologies |

|

7.19. |

Differences between cell, module, and pack |

|

7.20. |

Strings |

|

7.21. |

ESS in shipping containers |

|

7.22. |

Cooling systems for LIB |

|

7.23. |

Current challenges facing Li-ion batteries |

|

7.24. |

Key marine battery suppliers |

|

7.25. |

Maritime battery vendor market share (based on MWh) |

|

7.26. |

Battery Chemistry Market Share |

|

7.27. |

Marine battery pack price forecast |

|

7.28. |

Corvus Energy: History |

|

7.29. |

Corvus Energy (2019 Update) |

|

7.30. |

Applications of Corvus' New ESS |

|

7.31. |

The Head-start Advantage |

|

7.32. |

Corvus Energy Orca ESS |

|

7.33. |

Corvus Energy: battery deployment by vessel type |

|

7.34. |

Second life marine batteries? |

|

7.35. |

Spear Power Systems (SPS): Up and Coming! |

|

7.36. |

Spear Power Systems |

|

7.37. |

Spear Power Systems: Trident ESS |

|

7.38. |

Spear Power Systems: choosing the right battery |

|

7.39. |

Valence (LithiumWerks) |

|

7.40. |

Valence Technology (LithiumWerks) |

|

7.41. |

LithiumWerks: The Road to $400 per kWh |

|

7.42. |

LithiumWerks' New Marine Stack |

|

7.43. |

LithiumWerks |

|

7.44. |

Bell Marine |

|

7.45. |

Akasol |

|

7.46. |

Leclanché |

|

7.47. |

Leclanché: LTO Rack |

|

7.48. |

Leclanché: NMC Rack |

|

7.49. |

Xalt Energy - marine storage systems |

|

7.50. |

Case study: XALT's ESS for a Platform Supply Vessel (PSV) |

|

7.51. |

Saft: Seanergy |

|

7.52. |

Saft projects in France |

|

7.53. |

Prime Energy Systems: Diversifying into Marine |

|

7.54. |

Anko |

|

7.55. |

ページTOPに戻る

本レポートと同じKEY WORD()の最新刊レポート

- 本レポートと同じKEY WORDの最新刊レポートはありません。

よくあるご質問

IDTechEx社はどのような調査会社ですか?

IDTechExはセンサ技術や3D印刷、電気自動車などの先端技術・材料市場を対象に広範かつ詳細な調査を行っています。データリソースはIDTechExの調査レポートおよび委託調査(個別調査)を取り扱う日... もっと見る

調査レポートの納品までの日数はどの程度ですか?

在庫のあるものは速納となりますが、平均的には 3-4日と見て下さい。

但し、一部の調査レポートでは、発注を受けた段階で内容更新をして納品をする場合もあります。

発注をする前のお問合せをお願いします。

注文の手続きはどのようになっていますか?

1)お客様からの御問い合わせをいただきます。

2)見積書やサンプルの提示をいたします。

3)お客様指定、もしくは弊社の発注書をメール添付にて発送してください。

4)データリソース社からレポート発行元の調査会社へ納品手配します。

5) 調査会社からお客様へ納品されます。最近は、pdfにてのメール納品が大半です。

お支払方法の方法はどのようになっていますか?

納品と同時にデータリソース社よりお客様へ請求書(必要に応じて納品書も)を発送いたします。

お客様よりデータリソース社へ(通常は円払い)の御振り込みをお願いします。

請求書は、納品日の日付で発行しますので、翌月最終営業日までの当社指定口座への振込みをお願いします。振込み手数料は御社負担にてお願いします。

お客様の御支払い条件が60日以上の場合は御相談ください。

尚、初めてのお取引先や個人の場合、前払いをお願いすることもあります。ご了承のほど、お願いします。

データリソース社はどのような会社ですか?

当社は、世界各国の主要調査会社・レポート出版社と提携し、世界各国の市場調査レポートや技術動向レポートなどを日本国内の企業・公官庁及び教育研究機関に提供しております。

世界各国の「市場・技術・法規制などの」実情を調査・収集される時には、データリソース社にご相談ください。

お客様の御要望にあったデータや情報を抽出する為のレポート紹介や調査のアドバイスも致します。

|

|