プライベートワイヤレス:先行研究レポートAdvanced Research Reports on Private Wireless プライベート無線RANは、不況が続くRAN市場において際立った存在である。予備調査によると、RAN(パブリックとプライベートを合わせた)の総収益は2023年に減少し、RAN市場の状況は依然として厳しい状況にあり... もっと見る

※当レポートは1-3月と7-9月に更新予定です。

サマリー

プライベート無線RANは、不況が続くRAN市場において際立った存在である。予備調査によると、RAN(パブリックとプライベートを合わせた)の総収益は2023年に減少し、RAN市場の状況は依然として厳しい状況にあり、RAN市場全体の低迷により、固定無線アクセス(FWA)やプライベート無線といった潜在的な成長機会への期待が高まっている。規模は小さいものの成熟度が高いFWAとは対照的に、プライベート無線は巨大な市場機会を秘めている。

レポートに含まれる5年間予測:

レポートに含まれる四半期情報:

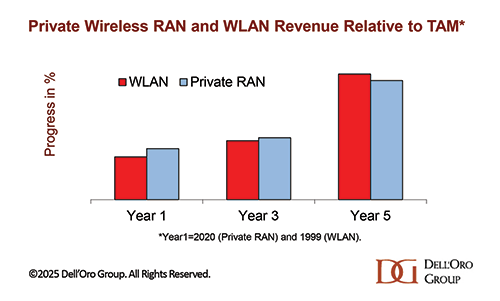

プレスリリースプライベートワイヤレスは、広範なRANの中で際立っている。下半期には前年比での比較がより困難になるとはいえ、プライベートワイヤレスは2025年通年で20%前後の成長軌道を維持する見込みだ。これとは対照的に、パブリックセグメントとプライベートセグメントの両方を含むRAN全体の収益は、今年は横ばいになると予想されている。 プライベート5Gの導入はまだ初期段階にあり、RAN市場全体に大きな影響を与えるには時間がかかるものの、プライベートRANは2025年上半期にRAN総収益に占める割合が1桁台半ばとなり、2022年の1桁台前半から上昇したと推定される。 今後を展望すると、プライベートワイヤレスの導入は健全なペースで進み続ける。注目すべきは、対応可能なRAN市場全体に占めるプライベートワイヤレスのシェアが、最初の5年間における企業向けWi-Fi普及の軌跡とほぼ一致していることである。

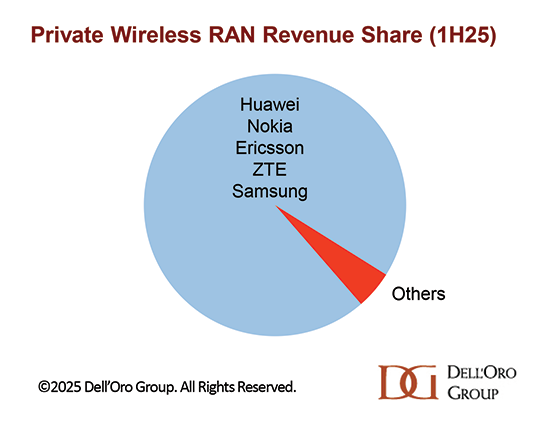

TAM(市場占有率)に対するプライベート無線RANとWLANの収益 プライベート無線の適用範囲の拡大と、プライベート無線RANの機会が未開拓のままであるという事実が相まって、幅広いエコシステム参加者の関心を集めている。RANベンダーの数は5年前と比べて減少しているが、50社を超えるプライベートRANおよび5Gコアサプライヤーとシステムインテグレーターは、継続的な投資が最終的に成果を上げると確信している。 それでも、プライベートワイヤレスRAN市場は依然として高度に集中している。同じ5つの主要なパブリックRANサプライヤーが25年上半期もプライベートRANの状況を支配していた。この重複は、市場が従来のエンタープライズ環境から、規模、パフォーマンス、統合要件において既存ベンダーに有利な産業用アプリケーションへと軸足を移していることを反映している。

プライベートワイヤレスRANの収益シェア(2025年上半期)

その他のハイライト(2025年9月版):

レポートについて

SummaryPrivate Wireless RAN is standing out in the otherwise gloomy RAN market. Preliminary findings show total RAN (public plus private) revenues declined in 2023 and RAN market conditions remain challenging. The downturn in the broader RAN market is raising the expectations of potential growth opportunities such as Fixed Wireless Access (FWA) and private wireless. In contrast to FWA, which is a smaller but more mature segment, private wireless is a massive market opportunity. One of the challenges with measuring the private wireless market is that it is not a specific technology but rather a broader term encompassing a wide range of technologies, segments, business models, and architectures. More importantly, the narrative and scope are evolving as the understanding of how enterprises can tap into the various private wireless options changes. Our ambitions remain unchanged – we aim to capture the progress of enterprise cellular, intending to understand its impact on the broader RAN market ultimately. The “enterprise” term is, by default, ambiguous. In this report, we consider private wireless to be nearly synonymous with 3GPP’s vision for Non-Public Networks (NPNs). According to 3GPP, NPNs are intended for the sole use of a private entity, such as an enterprise. NPNs can be deployed in various configurations, utilizing both virtual and physical elements located close or far away from the site. NPNs might be offered as a network slice of a Public Land Mobile Network (PLMN), hosted by a PLMN, or deployed as a completely standalone network. Although the industry scope of private wireless is evolving and moving towards a broader definition that includes a variety of on-premise and virtual 3GPP and non-3GPP solutions, private wireless is in this report confined to 3GPP-based technologies (Wi-Fi, LoRa, TETRA, and P25 are excluded). In this report, it is our objective to dig deeper about the private wireless RAN opportunity and assess if this time is any different—is there enough momentum and progress with private wireless to ensure this opportunity will play a significant role in future 4G and 5G rollouts? The report addresses such questions as:

The report includes a 5-year forecast for the following areas:

The report includes quarterly updates for the following areas:

Press ReleaseThe trajectory of private wireless stands out within the broader RAN landscape. Even though year-over-year comparisons will become more challenging in the second half, private wireless remains on track to grow around 20% for the full year 2025. In contrast, total RAN revenues—including both public and private segments—are expected to remain flat this year. Although private 5G adoption is still in its early stages and will take time to materially impact the overall RAN market, we estimate that private RAN accounted for a mid-single-digit share of total RAN revenues in 1H25, up from a low single-digit share in 2022. Looking ahead, private wireless adoption continues to progress at a healthy pace. Notably, private wireless as a share of the total addressable RAN market is tracking closely with the trajectory of enterprise Wi-Fi adoption during its first five years.

Private Wireless RAN and WLAN Revenue Relative to TAM The expanding scope of private wireless, combined with the fact that the private wireless RAN opportunity remains largely untapped, is fueling interest from a wide range of ecosystem participants. Although the number of RAN vendors is smaller today than it was five years ago, more than 50 private RAN and 5G core suppliers and system integrators are betting that ongoing investments will eventually pay off. Still, the Private Wireless RAN market remains highly concentrated. The same five leading public RAN suppliers continued to dominate the private RAN landscape in 1H25. This overlap reflects the market’s pivot away from traditional enterprise environments toward industrial applications, where scale, performance, and integration requirements favor established vendors.

Private Wireless RAN Revenue Share(1H25) Additional highlights from the September 2025 Private Wireless Report:

About the Report

ご注文は、お電話またはWEBから承ります。お見積もりの作成もお気軽にご相談ください。本レポートと同分野(無線・モバイル・ワイヤレス)の最新刊レポート

Dell'Oro Group社の 先行研究レポート Advanced Research Reports分野 での最新刊レポート本レポートと同じKEY WORD(advanced research)の最新刊レポート

よくあるご質問Dell'Oro Group社はどのような調査会社ですか?シリコンバレーの中心部に本社を置くデローログループ(Dell’Oro Group)は 通信、エンタープライズネットワーク、データセンタ、セキュリテ... もっと見る 調査レポートの納品までの日数はどの程度ですか?在庫のあるものは速納となりますが、平均的には 3-4日と見て下さい。

注文の手続きはどのようになっていますか?1)お客様からの御問い合わせをいただきます。

お支払方法の方法はどのようになっていますか?納品と同時にデータリソース社よりお客様へ請求書(必要に応じて納品書も)を発送いたします。

データリソース社はどのような会社ですか?当社は、世界各国の主要調査会社・レポート出版社と提携し、世界各国の市場調査レポートや技術動向レポートなどを日本国内の企業・公官庁及び教育研究機関に提供しております。

|

|