金属付加製造(積層造形)サービスの市場 2023-2031年

The Market for Metal Additive Manufacturing Services 2023-2031

米国調査会社スマーテックマーケッツパブリッシング(SmarTech Markets Publishing)の調査レポート「金属付加製造(積層造形)サービスの市場 2023-2031年」は、金属添加剤製造サービスの分野の最... もっと見る

|

|

サマリー

金属積層造形サービス市場 2023-2031

発行日:2023年06月05日 SKU SMP-AM-MAMS-0623

ページTOPに戻る

目次

目次

エグゼクティブサマリー

E.1 サービスビューローとメタルAM

E.1.1 金属サービス市場のセグメント化

E.1.2 金属サービスビューローの台頭を促進するその他の要因

E.2 3D金属サービスビューローにおける競争優位としての品質

E.3 金属サービスビューローが提供する付加価値サービスは成長を続ける

E.3.1 ネットワーキングに関するメモ

E.3.2 購入前にプリンターを試す機会をエンドユーザーに提供するサービスビューロー

E.4 金属サービス業者の10年予測のまとめ

E.4.1 エンドユーザーのタイプ別サービス収入予測

E.4.2 非AMサービス別の金属サービス局収益の予測

E.4.3 金属サービスビューローによる材料とプリンターの使用予測

第1章 メタルサービスビューローのビジネスモデルと促進要因 1.1 本レポートの背景

1.2 金属向けサービス事業者の5つのタイプ

1.2.1 汎用AMサービスビューロー

1.2.2 統合サービスビューロー:1.2.3 統合サービスビューロー:金属粉末企業

1.2.4 受託製造業者および金属工場

1.2.5 専門局

1.3 本レポートの方法論

1.4 本レポートの計画

1.5 市場促進要因、収益性、マーケティング

1.6 本章の要点まとめ

第2章 金属サービスプロバイダーの新サービス

2.1 新種の金属サービスプロバイダーが提供するサービス

2.1.1 金属サービスプロバイダーの中核サービス

2.1.2 ハイブリッド金属製造:積層造形と伝統的手法

2.2 金属サービスビューローにおける設計・エンジニアリングサービスの役割

2.3 クラウドベースとハブベースのサービス:ITプレーとしてのサービス・ビューロー

2.3.1 サービス・プロバイダー・ネットワークのマーケティング

2.3.2 サービスビューローにおける卓上金属印刷の役割

2.4 本章の要点のまとめ

第3章需要パターンと10年間の市場予測

3.1 メタルAMサービスプロバイダー需要構造

3.1.1 予測方法の詳細

3.2 航空宇宙分野における金属サービス局

3.2.1 航空宇宙産業における金属積層造形の利用

3.2.2 航空宇宙産業における積層造形の役割

3.2.3 航空宇宙サービスビューロー部門の構造

3.2.4 航空宇宙産業における金属AMサービスビューローの役割に影響を与える要因

3.2.5 航空宇宙産業における金属AMサービスの成功要因

3.2.6 金属サービス局の収入と支出の10年予測 3.3 自動車分野における金属サービスプロバイダーの需要

3.3.1 自動車産業における金属積層造形の利用

3.3.2 自動車で使用される金属AM材料と機械

3.3.3 自動車サービス産業の構造

3.3.4 自動車セクターにおける金属サービスビューローの収入と支出の10年予測

3.4 医療機器

3.4.1 医療機器分野におけるAM

3.4.2 医療機器分野におけるAMサービスビューローの役割

3.4.3 AMとインプラント

3.4.4 金属補聴器

3.4.5 医療用AM市場におけるサービスプロバイダー

3.4.6 金属サービスビューローの収入と支出の10年予測 3.5 歯科業界におけるAMサービスビューロー

3.5.1 歯科業界の現状とAMの役割

3.5.2 デジタル歯科における加法と減法

3.5.3 AMと義歯

3.5.4 AMと歯科インプラント

3.5.5 国際的な違い

3.5.6 歯科用金属印刷技術に関する考察

3.5.7 金属サービスビューローの収入と支出の10年予測 3.6 宝飾業界におけるAMメタルサービスビューロー

3.6.1 宝飾産業におけるサービスビューロー

3.6.2 使用されるAM技術

3.6.3 宝飾業界におけるAMメタルサービスビューローの予測

3.7 消費財産業におけるAM金属サービス

3.7.1 消費財の構造

3.7.2 消費財のAM金属サービス:予測

3.8 エネルギーにおける金属AMサービス:石油・ガス

3.8.1 石油・ガス産業の現状

3.8.2 石油・ガス産業におけるAMの利用

3.8.3 石油・ガス産業におけるAMサービスビューローの利用

3.8.4 石油・ガス産業におけるAMメタル・サービス・ビューローの活動構造

3.8.5 金属サービス局の収入と支出の10年予測 3.9 その他の産業市場におけるAM金属サービス局

3.10 本章の要点のまとめ

第4章主要3Dプリンティングサービスの戦略分析

4.1 3DEO(米国)

4.2 アドマン(米国)

4.3 アメクシ(スウェーデン)

4.4 BLT(中国)

4.5 Burloak Technologies(カナダ)

4.5.1 Burloakが提供するサービス

4.5.2 Burloakの重要な提携と顧客

4.6 カーペンター・アディティブ(米国)

4.7 デジタルメタル/マークフォージド(スウェーデン)

4.8 ExOne/デスクトップ・メタル(米国)

4.8.1 サンドプリンティング/キャスティング

4.8.2 ExOneの採用センター:オンデマンド金属印刷

4.8.3 サービス対象市場

4.9 FIT(ドイツ)

4.9.1 スペアパーツオンデマンドサービス

4.9.2 製造拠点

4.10 GEアディティブ(米国)

4.10.1 AddWorks

4.10.2 サービスプロバイダーへのマシン供給

4.11 GKN Forecast 3D(米国) 4.12 Hitch3DPrint(シンガポール)

4.13 HP(米国)

4.14 マテリアライズ(ベルギー)

4.15 MTI(Metal Technology Incorporated)(米国) 4.16 Oerlikon/citim(スイス)

4.16.1 Oerlikon エンドユーザー・フォーカス

4.16.2 シティム

4.17 プロティーク(ドイツ)

4.18 プロトラブズ(米国)

4.19 クイックパーツ(米国)

4.19.1 3Dシステムズのオンデマンドサービスの販売:Quickparts の起源 4.19.2 Quickparts の現在

4.20 サンドビック/ビームIT(スウェーデン)

4.21 Sculpteo(フランス)

4.22 シェイプウェイズ(フランス)

4.23 Shining3D(中国)について

4.24 セウラット(米国)

4.25 シーメンス/マテリアル・ソリューションズ(ドイツ/イギリス)

4.25.1 シーメンス積層造形ネットワーク

4.25.1 マテリアル・ソリューションズについて

4.26 シンタヴィア(米国)

4.26.1 アライアンスと顧客

4.27 ストラタシス・ダイレクト・マニュファクチャリング(米国/イスラエル)

4.28 ティッセンクルップ(ドイツ)

4.28.1 潜水艦と海洋用途

4.28.2 ロボティクス

4.29 ツールクラフト(ドイツ) 4.30 ヴォスタルピネ(オーストリア) 4.31 ウィプロ3D(インド)

4.31.1 3Dプリンティング活動 4.32 Xometry(米国)

図表一覧

図表 E-1: 金属サービスビューローの推進要因

図表E-2:サービスビューロー事業が提供できる10のサービス2023

図表E-3:サービスビューローが提供できるネットワークの種類

図表 E-4: 金属部品の印刷によるサービス収入:印刷技術別 (百万ドル)

図表 E-5: 金属部品の印刷によるサービス収入:エンドユーザー市場別 ($ Millions)

図表E-6:非AM事業からのサービス収入:図表E-7:金属サービスビューロー向けプリンターの出荷台数

図表E-8: 金属サービスビューロー向け材料の出荷額 ($ Millions) 図表1-1: タイプ別および動機別金属サービスプロバイダー

図表 2-1:サービスビューロー事業者が提供できる7つのサービス図表 2-2: ハブベースのサービスビューローネットワークの特徴/要件

図表3-1:AMサービスプロバイダのチャネルを通じて部品を開発する航空宇宙企業の例

図表3-2:AMサービスプロバイダーを通じて部品を開発する宇宙関連企業の事例

図表 3-3: 航空宇宙産業向け金属部品の印刷によるサービス収益:印刷技術別(百万ドル)

図表 3-4: 航空宇宙産業向け金属部品の印刷によるサービス収入:金属の種類別 ($ Millions)

図表 3-5:航空宇宙部品の3Dプリントによるサービス収入:地域別(百万ドル)

図表 3-6: 航空宇宙産業向けサービスビューローによる金属部品のプリント ($ Millions)

図表3-7:図表3-7:航空宇宙産業向けサービスビューローが販売した付加価値サービス(百万ドル)

図表 3-8: 自動車産業向け金属部品の印刷によるサービス収入:印刷技術別(百万ドル)

図表 3-9: 自動車産業向け金属部品の印刷によるサービス収入:金属タイプ別 ($ Millions)

図表 3-10:図表3-10: 自動車部品の3Dプリントによるサービス収入:地域別 ($ Millions)

図表 3-11: 自動車産業向けサービスビューローによる金属部品のプリント ($ Millions)

図表 3-12: 自動車産業向けサービスビューローが販売する付加価値サービス (百万ドル)

図表 3-13: 医療分野向け金属部品の印刷によるサービス収入:印刷技術別(百万ドル)

図表 3-14:図表 図表 図表 図表3-14: 医療分野向け金属部品の印刷によるサービス収入:金属タイプ別 ($ Millions)

図表 3-15:図表3-15:医療用部品の3Dプリントによるサービス収入:地域別(百万ドル)

図表 3-16:医療分野向けサービスビューローによる金属部品のプリント ($ Millions)

図表 3-17:図表 3-17: サービスビューローが医療業界向けに販売した付加価値サービス ($ Millions)

図表 3-18:図表 3-18: 歯科分野向け金属部品の印刷によるサービス収入:印刷技術別(百万ドル)

図表 3-19:図表 3-19: 歯科分野向け金属部品の印刷によるサービス収入:金属タイプ別 ($ Millions)

図表 3-20:図表 3-20: 歯科用部品の3Dプリントによるサービス収入:地域別 (百万ドル)

図表 3-21:図表 3-21: 歯科分野向けサービスビューローによる金属部品のプリント (百万ドル)

図表 3-22:図表 3-22: サービスビューローが歯科業界向けに販売した付加価値サービス ($ Millions)

図表 3-23:図表 図表 図表3-23: 宝飾業界向け金属部品印刷によるサービス収入:印刷技術別(百万ドル)

図表 3-24:宝飾業界向け金属部品印刷のサービス収入:金属タイプ別 ($ Millions)

図表 3-25:図表3-25: ジュエリーパーツの3Dプリントによるサービス収入:地域別 ($ Millions)

図表 3-26:サービスビューローが宝飾品セクター向けにプリントした金属部品 ($ Millions)

図表 3-27:図表 3-27: ジュエリー産業向けサービス・ビューローが販売した付加価値サービス ($ Millions)

図表 3-28:消費財市場向け金属部品の印刷によるサービス収入:印刷技術別(百万ドル)

図表 3-29:消費財市場向け金属部品の印刷によるサービス収入:金属タイプ別 ($ Millions)

図表 3-30:図表 3-30: 消費財セクターの3Dプリントによるサービス収入:地域別 ($ Millions)

図表 3-31:消費財セクターのサービス事業所が印刷した金属部品 ($ Millions)

図表 3-32:図表 3-32: 消費財産業向けサービスビューローが販売した付加価値サービス ($ Millions)

図表 3-33:エネルギー市場向け金属部品の印刷によるサービス収入:印刷技術別(百万ドル)

図表 3-34:エネルギー市場向け金属部品印刷のサービス収入:金属タイプ別 ($ Millions)

図表 3-35:エネルギー市場向け3Dプリントのサービス収入:地域別(百万ドル)

図表 3-36:エネルギー市場向けサービス事業所がプリントした金属部品(百万ドル)

図表 3-37:エネルギー市場向けサービスビューローが販売した付加価値サービス(百万ドル)

図表 3-38:図表 図表 図表3-38: エネルギー市場向けサービス事業所が販売する付加価値サービス エネルギー市場向けサービス事業所が販売する付加価値サービス エネルギー市場向けサービス事業所が販売する付加価値サービス エネルギー市場向けサービス事業所が販売する付加価値サービス印刷技術別(百万ドル)

図表 3-39: 特定されない市場/その他の産業向け金属部品の印刷によるサービス収入:金属タイプ別 ($ Millions)

図表 3-40:図表 3-40: 他に特定されない市場/その他の産業向け3Dプリントのサービス収入:地域別(百万ドル)

図表 3-41:図表 3-41: サービスビューローがプリントした市場/特定されていないその他の産業の金属部品 ($ Millions)

図表 3-42:図表 3-42: サービスビューローが販売する付加価値サービス(百万ドル):特定されない市場/その他の産業向け(百万ドル

ページTOPに戻る

プレスリリース

SmarTech Analysisの新レポートによると、金属サービスビューローの収益は2025年までに69億5000万ドルに達する。

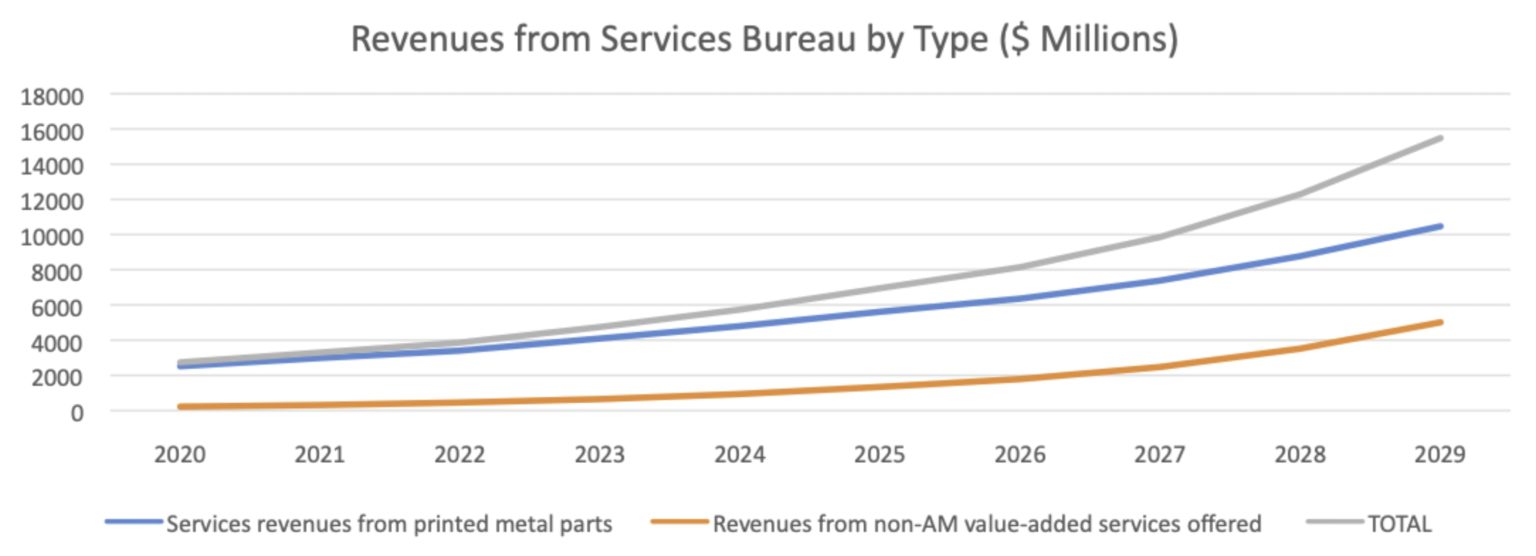

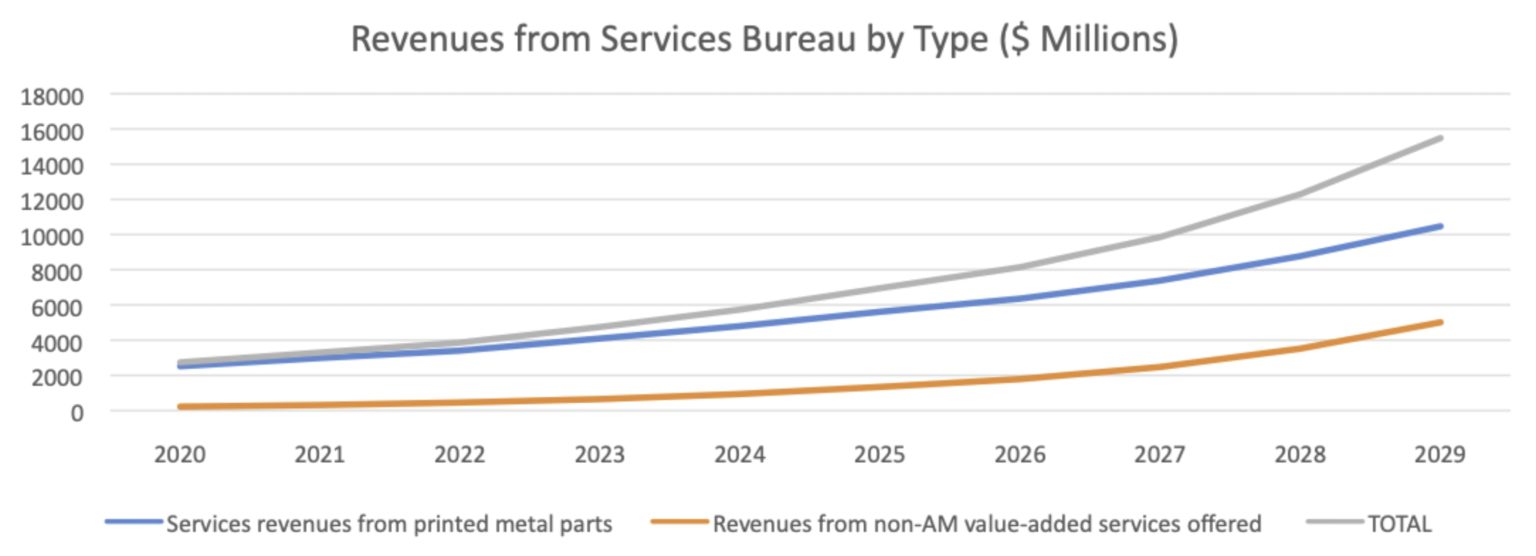

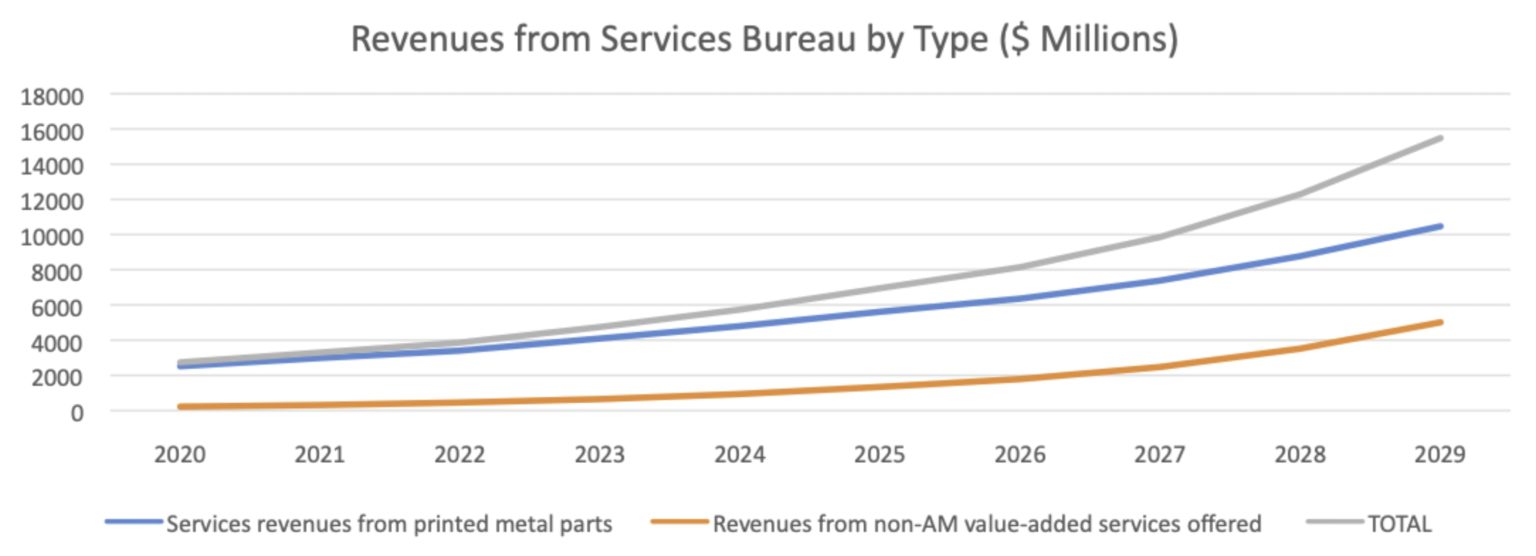

2020年11月04日

ニューヨーク、ニューヨークSmarTech Analysisは、金属積層造形サービスビューローの収益を分析・予測する最新レポート「金属積層造形サービスビューローの収益」を発表した、「金属積層造形サービス市場:2021-2029". この新しいレポートの中で、SmarTech Analysisは金属AMサービスの売上高を2025年までに69億5,000万ドル、2029年までに155億ドルに増加すると予測している。

この予測には、中核的な製造サービスやプロトタイピングサービスのほか、設計サービス、トレーニング、非AM製造などの新しい付加価値サービスによる収益も含まれている。

本レポートにおけるSmarTechの収益予測は、主にCOVID-19パンデミックのため、2019年に発表されたサービスセクターの同等の数値よりも低くなっている。

レポートについて

本報告書は4章とエグゼクティブ・サマリーで構成されている。 第1章では、金属サービスビューロー事業とそのプレーヤーについて詳細な事業分析を行っている。第二章では、3D金属プリントサービスの需要がどこから来ているのか、どのようなサービスが求められているのかを分析している。第3章では、その需要の詳細な10年予測を行っている。最後に第4章では、金属分野で大きな割合を占める主要サービスビューローの戦略的プロフィールを提供する。

本レポートでカバーする金属印刷サービス市場には、航空宇宙、自動車、医療・ヘルスケア、歯科、宝飾品、消費財、石油・ガスなどの産業が含まれる。 また、3Dプリンティングサービスに加え、AMサービスビューローが販売するデザインサービス、トレーニング、非AM製造サービスも予測している。 内訳は、材料の種類別および地域別の売上高である。 また、AMサービスビューローに販売されたプリンターの予測を、使用された印刷技術別に掲載した。

本レポートに掲載されている企業は以下の通り:3D Systems, BeamIT, Burloak Technologies, Carpenter, DM3D, ExOne, Falcontech, FIT, GE Additive, GKN, Henkel, Hoganas, HP, i3DMFG, Jabil, Metal Point Advanced Manufacturing, Materialise、MTI、Oerlikon、Protolabs、Renishaw、Sculpteo、Shining3D、Sintavia、Siemens、Solid Concepts、Stratasys、Thyssenkrupp、voestalpine、Wipro 3D3D Hubs、Hitch3DPrint、Xometry。

レポートより

-

COVID-19は金属サービスビューロー事業の収益見通しに打撃を与えたが、同時にビジネスチャンスも生み出したと考える。企業は今、サプライチェーンの危機に対する不測の事態への備えを戦略上の最優先事項としている。金属AM技術を通じて供給されるサプライチェーンの安定性と多様化は、こうしたニーズに応えるのに役立つだろう。さらに、中国からのリショアリングの影響も、AMサービスの利用を後押しするだろう。

-

金属プリントサービスの収益の40%以上は、ヘルスケア(医療と歯科を合わせたもの)からもたらされる。医師や病院はしばしば3Dプリントの利点を実感するが、医療用3Dプリントを自社で行う知識を持ち合わせていない。そのため、これらのエンドユーザーは、必要な3Dプリント製品を製造するためにビューローを利用する。場合によっては、医療ビューローはこの分野で非常に付加価値の高い部品に集中することができる。例えば、骨置換用に設計されたEBMを使用して、生体適合性のあるチタン合金(グレード2とグレード5)から作られた医療用インプラントのプリントを得意としているFITを考えてみよう。一方、3Dプリンティングはすでに歯科分野で広く受け入れられており、今後も成長し続けるだろう。

-

社内にかなりの専門知識を持つサービスビューローは、その専門知識をトレーニングサービスやコンサルティングの形で販売することもでき、実践的な積層造形に日常的に携わっていることを強みとして押し出すことができる。成功する可能性のあるトレーニング・サービスやコンサルティング・サービスは、部品の品質や一貫性の向上、認証取得、環境教育などを志向したものになるだろう。また、エンドユーザーがAMをよりよく導入できるよう支援することを目的とした、各局が提供するコンサルタント・サービスの増加も予想される。

ソーススマーテック分析

スマーテック分析について

2013年以来、SmarTech Analysisは、3Dプリンティング/付加製造分野のすべての重要な収益機会に関するレポートを発行しており、この分野のカバレッジを提供する業界をリードするアナリスト会社と見なされています。当社には、3DP/AM分野の最大手3Dプリンター企業、材料企業、投資家を含む顧客名簿があります。

ページTOPに戻る

Summary

The Market for Metal Additive Manufacturing Services 2023-2031

Published on Jun 05, 2023 SKU SMP-AM-MAMS-0623

This report is the follow-up on our 2021 report on AM metal services. The 2023 report focuses on how the rush by AM services to provide value-added offerings is working out for them — it has been something of a mixed bag. The report also discusses the ongoing consolidation in the metal services business and the acceleration of the trend towards networks.

Our forecasts in this report have been adjusted to reflect the realities of the post- COVID-19 era. In addition the section covering the strategies of leading players in this sector and the number of service providers in this section has been increased.

ページTOPに戻る

Table of Contents

Table of Contents

Executive Summary

E.1 Service Bureaus and Metals AM

E.1.1 Segmenting the Metal Services Market

E.1.2 Other Factors Driving the Rise of Metals Service Bureaus

E.2 Quality as Competitive Advantage in the 3D Metals Service Bureau

E.3 Value-added Services Offered by Metals Service Bureaus Continue to Grow

E.3.1 A Note on Networking

E.3.2 Service Bureaus Give End Users the Opportunity to Try Out Printers Before Buying

E.4 Summary of Ten-year Forecasts of Metal Service Providers

E.4.1 Forecasts of Service Revenue by Type of End User

E.4.2 Forecast of Metal Service Bureau Revenue by Non-AM Services

E.4.3 Forecast of Material and Printer Use by Metal Service Bureaus

Chapter One: Business Models and Drivers for Metal Service Bureaus 1.1 Background to this Report

1.2 Five Types of Metal-Oriented Service Providers

1.2.1 General-purpose AM Service Bureaus

1.2.2 Integrated Service Bureaus: Additive Manufacturing Equipment Firms 1.2.3 Integrated Service Bureaus: Metal Powder Firms

1.2.4 Contract Manufacturers and Metals Shops

1.2.5 Specialist Bureaus

1.3 Methodology of this Report

1.4 Plan of this Report

1.5 Market Drivers, Profitability and Marketing

1.6 Summary of Key Points from This Chapter

Chapter Two: Emerging Services for Metal Service Providers

2.1 Services Offered by the New Breed of Metal Service Providers

2.1.1 Core Services at Metal Service Providers

2.1.2 Hybrid Metals Manufacturing: Additive Manufacturing plus Traditional Methods

2.2 Design and Engineering Service Plays for Metal Service Bureaus

2.3 Cloud- and Hub-based Services: Service Bureaus as an IT play

2.3.1 Marketing of Service Provider Networks

2.3.2 Role of Desktop Metal Printing at Service Bureaus

2.4 Summary of Key Points in this Chapter

Chapter Three: Demand Patterns and Ten-year Market Forecasts

3.1 Metal AM Service Providers: Demand Structure

3.1.1 More on Forecasting Methodology

3.2 Metal Service Bureaus in the Aerospace Sector

3.2.1 Use of Metal Additive Manufacturing in the Aerospace Industry

3.2.2 Role of Additive Metals in the Aerospace Industry

3.2.3 Structure of the Aerospace Service Bureau Sector

3.2.4 Factors Influencing the Role of Metal AM Service Bureaus in the Aerospace Industry

3.2.5 Success Factors for AM Metal Services in the Aerospace Industry

3.2.6 Ten-year Forecast of Metals Service Bureau Revenues and Expenditures 3.3 Demand for Metal Service Providers in the Automotive Sector

3.3.1 Use of Metal Additive Manufacturing in the Automotive Industry

3.3.2 Metal AM Materials and Machines Used in Automotive

3.3.3 Structure of the Automotive Service Bureau Sector

3.3.4 Ten-year Forecast of Metals Service Bureau Revenues and Expenditures in the Automotive Sector

3.4 Medical Devices

3.4.1 AM in the Medical Device Sector

3.4.2 The Role of AM Service Bureaus in the Medical Device Sector

3.4.3 AM and Implants

3.4.4 Metal Hearing Aids

3.4.5 Service Providers in the Medical AM Market

3.4.6 Ten-year Forecast of Metals Service Bureau Revenues and Expenditures 3.5 AM Service Bureaus in the Dental Industry

3.5.1 State of the Dental Industry and the Role of AM

3.5.2 Additive vs. Subtractive in Digital Dentistry

3.5.3 AM and Dentures

3.5.4 AM and Dental Implants

3.5.5 International Differences

3.5.6 Dental Metal Printing Technology Considerations

3.5.7 Ten-year Forecast of Metals Service Bureau Revenues and Expenditures 3.6 AM Metal Service Bureaus in the Jewelry Industry

3.6.1 Service Bureaus in the Jewelry Industry

3.6.2 AM Technologies Used

3.6.3 Forecasts of AM Metal Service Bureaus in the Jewelry Industry

3.7 AM Metal Services in the Consumer Goods Industry

3.7.1 Structure of Consumer Goods

3.7.2 AM Metal Services for Consumer Goods: Forecasts

3.8 Metal AM Services in Energy: Oil and Gas

3.8.1 Current State of the Oil and Gas Industry

3.8.2 Use of AM in the Oil and Gas Industry

3.8.3 Use of AM Service Bureaus in the Oil and Gas Industry

3.8.4 Structure of AM Metal Service Bureau Activity in Oil and Gas

3.8.5 Ten-year Forecast of Metals Service Bureau Revenues and Expenditures 3.9 AM Metal Service Bureaus in Other Industrial Markets

3.10 Summary of Key Points from this Chapter

Chapter Four: Strategic Analysis of Leading 3D Printing Services

4.1 3DEO (United States)

4.2 Addman (United States)

4.3 AMEXCI (Sweden)

4.4 BLT (China)

4.5 Burloak Technologies (Canada)

4.5.1 Services Offered by Burloak

4.5.2 Important Burloak’s Alliances and Customers

4.6 Carpenter Additive (United States)

4.7 Digital Metal/Markforged (Sweden)

4.8 ExOne/Desktop Metal (United States)

4.8.1 Sand Printing/Casting

4.8.2 ExOne Adoption Centers: Metal Printing on Demand

4.8.3 Markets Served

4.9 FIT (Germany)

4.9.1 Spare Parts on Demand Service

4.9.2 Manufacturing Sites

4.10 GE Additive (United States)

4.10.1 AddWorks

4.10.2 Supply of Machines to Service Providers

4.11 GKN Forecast 3D (United States) 4.12 Hitch3DPrint (Singapore)

4.13 HP (United States)

4.14 Materialise (Belgium)

4.15 MTI (Metal Technology Incorporated) (United States) 4.16 Oerlikon/citim (Switzerland)

4.16.1 Oerlikon End-user Focus

4.16.2 citim

4.17 Protiq (Germany)

4.18 Protolabs (United States)

4.19 Quickparts (United States)

4.19.1 Sale of 3D Systems On-demand Services: The Origins of Quickparts 4.19.2 Quickparts Today

4.20 Sandvik/BeamIT (Sweden)

4.21 Sculpteo (France)

4.22 Shapeways (France)

4.23 A Note on Shining3D (China)

4.24 Seurat (United States)

4.25 Siemens/Materials Solutions (Germany/U.K.)

4.25.1 Siemens Additive Manufacturing Network

4.25.1 A Note on Materials Solutions

4.26 Sintavia (United States)

4.26.1 Alliances and Customers

4.27 Stratasys Direct Manufacturing (United States/Israel)

4.28 Thyssenkrupp (Germany)

4.28.1 Submarines and Marine Applications

4.28.2 Robotics

4.29 Toolcraft (Germany) 4.30 voestalpine (Austria) 4.31 Wipro 3D (India)

4.31.1 3D Printing Activities 4.32 Xometry (United States)

List of Exhibits

Exhibit E-1: Drivers for Metal Service Bureaus

Exhibit E-2: Ten Services that Service Bureau Business Can Offer: 2023

Exhibit E-3: Types of Networks that Service Bureau Business Can Offer

Exhibit E-4: Service Revenues from Printing Metal Parts: By Print Technology ($ Millions)

Exhibit E-5: Service Revenues from Printing Metal Parts: By End-user Market ($ Millions)

Exhibit E-6: Service Bureau Revenues from non-AM Activities: By Process Type Exhibit E-7: Shipments of Printers for Metal Service Bureaus

Exhibit E-8: Shipments of Materials for Metal Service Bureaus ($ Millions) Exhibit 1-1: Metal Service Providers by Type and Motivation

Exhibit 2-1: Seven Services that Service Bureau Business Can Offer: 2023 Exhibit 2-2: Hub-based Service Bureau Network Feature/Requirements

Exhibit 3-1: Selected Examples of Aerospace Firms Developing Parts Through AM Service Provider Channels

Exhibit 3-2: Selected Examples of Space Firms Developing Parts Through AM Service Provider Channels

Exhibit 3-3: Service Revenues from Printing Metal Parts for the Aerospace Industry: By Print Technology ($ Millions)

Exhibit 3-4: Service Revenues from Printing Metal Parts for the Aerospace Industry: By Type of Metal ($ Millions)

Exhibit 3-5: Service Revenues from 3D Printing of Aerospace Parts by Geography ($ Millions)

Exhibit 3-6: Metal Parts Printed by Service Bureaus for the Aerospace Industry ($ Millions)

Exhibit 3-7: Value-added Services Sold by Service Bureaus for the Aerospace Industry ($ Millions)

Exhibit 3-8: Service Revenues from Printing Metal Parts for the Automotive Industry: By Print Technology ($ Millions)

Exhibit 3-9: Service Revenues from Printing Metal Parts for the Automotive Industry: By Metal Type ($ Millions)

Exhibit 3-10: Service Revenues from 3D Printing of Automotive Parts by Geography ($ Millions)

Exhibit 3-11: Metal Parts Printed by Service Bureaus for the Automotive Industry ($ Millions)

Exhibit 3-12: Value-added Services Sold by Service Bureaus for the Automotive Industry ($Millions)

Exhibit 3-13: Service Revenues from Printing Metal Parts for the Medical Sector: By Print Technology ($ Millions)

Exhibit 3-14: Service Revenues from Printing Metal Parts for the Medical Sector: By Metal Type ($ Millions)

Exhibit 3-15: Service Revenues from 3D Printing of Medical Parts by Geography ($ Millions)

Exhibit 3-16: Metal Parts Printed by Service Bureaus for the Medical Sector ($ Millions)

Exhibit 3-17: Value-added Services Sold by Service Bureaus for the Medical Industry ($ Millions)

Exhibit 3-18: Service Revenues from Printing Metal Parts for the Dental Sector: By Print Technology ($ Millions)

Exhibit 3-19: Service Revenues from Printing Metal Parts for the Dental Sector: By Metal Type ($ Millions)

Exhibit 3-20: Service Revenues from 3D Printing of Dental Parts by Geography ($ Millions)

Exhibit 3-21: Metal Parts Printed by Service Bureaus for the Dental Sector ($ Millions)

Exhibit 3-22: Value-added Services Sold by Service Bureaus for the Dental Industry ($ Millions)

Exhibit 3-23: Service Revenues from Printing Metal Parts for the Jewelry Sector: By Print Technology ($ Millions)

Exhibit 3-24: Service Revenues from Printing Metal Parts for the Jewelry Sector: By Metal Type ($ Millions)

Exhibit 3-25: Service Revenues from 3D Printing of Jewelry Parts by Geography ($ Millions)

Exhibit 3-26: Metal Parts Printed by Service Bureaus for the Jewelry Sector ($ Millions)

Exhibit 3-27: Value-added Services Sold by Service Bureaus for the Jewelry Industry ($ Millions)

Exhibit 3-28: Service Revenues from Printing Metal Parts for Consumer Goods Market: By Print Technology ($ Millions)

Exhibit 3-29: Service Revenues from Printing Metal Parts for the Consumer Goods Sector: By Metal Type ($ Millions)

Exhibit 3-30: Service Revenues from 3D Printing of Consumer Goods Sector by Geography ($ Millions)

Exhibit 3-31: Metal Parts Printed by Service Bureaus for the Consumer Goods Sector ($ Millions)

Exhibit 3-32: Value-added Services Sold by Service Bureaus for the Consumer Goods Industry ($ Millions)

Exhibit 3-33: Service Revenues from Printing Metal Parts for Energy Market: By Print Technology ($ Millions)

Exhibit 3-34: Service Revenues from Printing Metal Parts for the Energy Market: By Metal Type ($ Millions)

Exhibit 3-35: Service Revenues from 3D Printing for the Energy Market by Geography ($ Millions)

Exhibit 3-36: Metal Parts Printed by Service Bureaus for the Energy Market Sector ($ Millions)

Exhibit 3-37: Value-added Services Sold by Service Bureaus for the Energy Market Sector ($ Millions)

Exhibit 3-38: Service Revenues from Printing Metal Parts for Markets/Other Industries Not Elsewhere Specified: By Print Technology ($ Millions)

Exhibit 3-39: Service Revenues from Printing Metal Parts for Markets/Other Industries Not Elsewhere Specified: By Metal Type ($ Millions)

Exhibit 3-40: Service Revenues from 3D Printing for Markets/Other Industries Not Elsewhere Specified by Geography ($ Millions)

Exhibit 3-41: Metal Parts Printed by Service Bureaus for Markets/Other Industries Not Elsewhere Specified ($ Millions)

Exhibit 3-42: Value-added Services Sold by Service Bureaus for Markets/Other Industries Not Elsewhere Specified ($ Millions)

ページTOPに戻る

Press Release

Revenues from Metal Service Bureaus to Reach $6.95 Billion by 2025 According to New Report from SmarTech Analysis

November 04, 2020

NEW YORK, NY: SmarTech Analysis has just issued its latest report that analyzes and forecasts metal additive manufacturing service bureau revenues titled, “The Market for Metal Additive Manufacturing Services: 2021-2029”. In this new report, SmarTech Analysis has pegged revenues for Metal AM Services at $6.95 Billion by the year 2025, rising to 15.5 Billion by 2029.

These projections include revenues from core manufacturing and prototyping services as well newer value-added services such as design services, training and non-AM manufacturing.

SmarTech’s revenues projections in this report are lower than our equivalent numbers for the services sector published in 2019, primarily because of the COVID-19 pandemic.

About the Report

This report consists of four chapters and an Executive Summary. Chapter One provides a detailed business analysis of the metals service bureaus business and its players. Chapter Two is an analysis of where the demand for 3D metal printing services is coming from and what type of services are being demanded. Chapter Three provides detailed ten-year forecasts of that demand. Finally, in Chapter Four we provide strategic profiles of leading service bureaus that have a significant proportion of their business in the metals space.

The metal printing services markets that are covered in this report include those targeted to the following industries aerospace, automotive, medical/healthcare, dental, jewelry, consumer goods, and oil& gas. In addition, to 3D printing services, the report also forecasts design services, training and non-AM manufacturing services sold by AM service bureaus. Breakouts include revenues by type of material and by geography. We also include forecasts of printers sold to AM service bureaus, with a breakout by printing technology used.

Companies profiled in the report include: 3D Systems, BeamIT, Burloak Technologies, Carpenter, DM3D, ExOne, Falcontech, FIT, GE Additive, GKN, Henkel, Hoganas, HP, i3DMFG, Jabil, Metal Point Advanced Manufacturing, Materialise, MTI, Oerlikon, Protolabs, Renishaw, Sculpteo, Shining3D, Sintavia, Siemens, Solid Concepts, Stratasys, Thyssenkrupp, voestalpine, Wipro 3D3D Hubs, Hitch3DPrint and Xometry.

From the Report

-

Although COVID-19 has hurt revenue prospects for the metal service bureaus business, we believe it has also created opportunities. Corporations will now make contingency planning for supply chain crises a top strategic priority. Supply chain stability and diversification supplied through metal AM technologies will help meet their needs. In addition, the impact of reshoring from China will also boost the use of AM services.

-

More than 40 percent of metal printing services revenues will come from the healthcare (medical and dental combined). Doctors and hospitals often see the benefits in 3D printing, but do not have the knowledge to do medical 3D printing in house. Hence these end users turn to bureaus to build the 3D printed items that they need. In some cases, medical bureaus are able to focus on very high value-added parts in this space. Thus, consider FIT which has made a specialty in printing medical implants made from biocompatible titanium alloys (Grade 2 and Grade 5) using EBM designed for bone replacement. Meanwhile, 3D printing is already a widely accepted approach used in the dental sector which can only continue to grow.

-

Service bureaus with considerable in-house expertise can also sell that expertise in the form of training services and consulting, pushing their daily involvement with practical additive manufacturing as an advantage. Successful training and consulting services that may emerge will be oriented towards improving part quality and part consistency, certification and environmental education. We also expect an increase in consultancy services offered by the bureaus designed to help end-users better implement AM.

Source: SmarTech Analysis

About SmarTech Analysis

Since 2013 SmarTech Analysis has published reports on all the important revenue opportunities in the 3D printing/additive manufacturing sector and is considered the leading industry analyst firm providing coverage of this sector. Our company has a client roster that includes the largest 3D printer firms, materials firms and investors in the 3DP/AM sector.

ページTOPに戻る

Additive Manufacturing Research(旧SmarTech Analysis)社の 金属付加製造分野 での最新刊レポート

よくあるご質問

Additive Manufacturing Research(旧SmarTech Analysis)社はどのような調査会社ですか?

※2023年12月に旧社名スマーテックアナリシスよりアディティブマニファクチャリングリサーチへ変更しました。

米国調査会社Aditive Manufacturing Researchの調査レポートは... もっと見る

調査レポートの納品までの日数はどの程度ですか?

在庫のあるものは速納となりますが、平均的には 3-4日と見て下さい。

但し、一部の調査レポートでは、発注を受けた段階で内容更新をして納品をする場合もあります。

発注をする前のお問合せをお願いします。

注文の手続きはどのようになっていますか?

1)お客様からの御問い合わせをいただきます。

2)見積書やサンプルの提示をいたします。

3)お客様指定、もしくは弊社の発注書をメール添付にて発送してください。

4)データリソース社からレポート発行元の調査会社へ納品手配します。

5) 調査会社からお客様へ納品されます。最近は、pdfにてのメール納品が大半です。

お支払方法の方法はどのようになっていますか?

納品と同時にデータリソース社よりお客様へ請求書(必要に応じて納品書も)を発送いたします。

お客様よりデータリソース社へ(通常は円払い)の御振り込みをお願いします。

請求書は、納品日の日付で発行しますので、翌月最終営業日までの当社指定口座への振込みをお願いします。振込み手数料は御社負担にてお願いします。

お客様の御支払い条件が60日以上の場合は御相談ください。

尚、初めてのお取引先や個人の場合、前払いをお願いすることもあります。ご了承のほど、お願いします。

データリソース社はどのような会社ですか?

当社は、世界各国の主要調査会社・レポート出版社と提携し、世界各国の市場調査レポートや技術動向レポートなどを日本国内の企業・公官庁及び教育研究機関に提供しております。

世界各国の「市場・技術・法規制などの」実情を調査・収集される時には、データリソース社にご相談ください。

お客様の御要望にあったデータや情報を抽出する為のレポート紹介や調査のアドバイスも致します。

|

|

米国調査会社スマーテックマーケッツパブリッシング(SmarTech Markets Publishing)の調査レポート「金属付加製造(積層造形)サービスの市場 2023-2031年」は、金属添加剤製造サービスの分野の最新の評価と市場予測である。

米国調査会社スマーテックマーケッツパブリッシング(SmarTech Markets Publishing)の調査レポート「金属付加製造(積層造形)サービスの市場 2023-2031年」は、金属添加剤製造サービスの分野の最新の評価と市場予測である。