Thermal Management for Electric Vehicles 2025-2035: Materials, Markets, and Technologies電気自動車2025-2035年の熱管理:材料、市場、技術 この調査レポートは、EV市場とOEMとそのサプライヤーが採用している熱管理戦略を分析し、将来を見据えて、主要なEV技術動向が電気自動車のバッテリー、モーター、パワーエレクトロニクス、車室内の熱管理手法... もっと見る

※ 調査会社の事情により、予告なしに価格が変更になる場合がございます。

Summary

この調査レポートは、EV市場とOEMとそのサプライヤーが採用している熱管理戦略を分析し、将来を見据えて、主要なEV技術動向が電気自動車のバッテリー、モーター、パワーエレクトロニクス、車室内の熱管理手法にどのような影響を与えるかについて詳細に調査・分析しています。

主な掲載内容(目次より抜粋)

Report Summary

Early trends in the market largely revolved around the adoption of active cooling for the battery pack, now this is the industry standard. However, batteries, motors, and power electronics in EVs continue to evolve with developments of cell-to-pack designs, directly oil-cooled motors, and silicon carbide power electronics being just a few of the key trends that will impact thermal management strategies. How this all interacts with the cabin thermal management is equally important with thermal architectures becoming more integrated and impending regulations impacting future refrigerant choices.

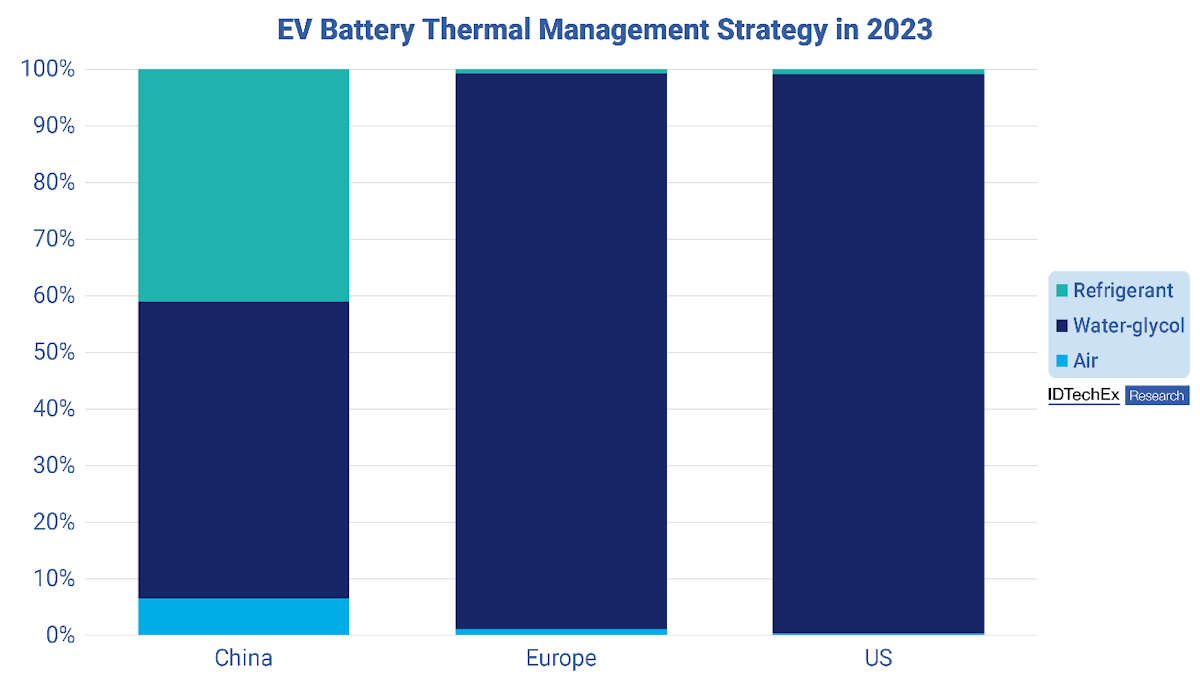

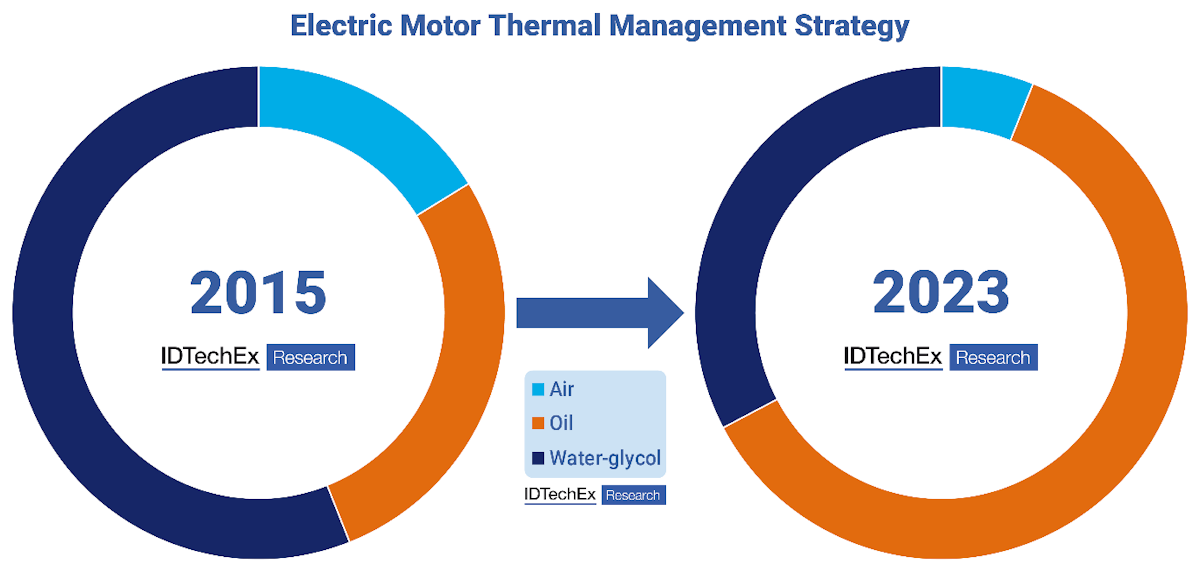

This report from IDTechEx analyses the EV market and the thermal management strategies adopted by OEMs and their suppliers, with a look to the future and how key EV technology trends will impact these methods for electric vehicle batteries, motors, power electronics, and cabin thermal management. This information is obtained from primary and secondary sources across the EV industry. The research also utilizes IDTechEx's extensive electric car database that consists of over 650 model variants with their sales figures for 2015-2023 plus technical specifications such as battery capacity, battery thermal strategy, motor power, motor cooling strategy, and many others. Market shares are given for existing thermal management strategies (air, oil, water, immersion) and fluids used (water-glycol, oil, immersion), for the battery, motor, and inverter in EVs along with market forecasts to 2035.

Evolving Thermal Architecture and Coolants

How the thermal management of the drivetrain components and cabin all interact is critical. The market is moving to greater levels of integration, with heat pumps and integrated thermal management modules. Some OEMs are taking thermal management and components development in-house to improve overall system efficiency and shorten the supply chain. This report takes a look at examples of EV thermal architectures and some key market announcements for key thermal management components (high voltage coolant heaters, condensers, pumps, integrated modules, etc.). The report also gives an overview of the key tier 1 thermal system suppliers and their size.

A host of fluids including refrigerants, oils, and water-glycol are required for the operation of an EV. These fluids are evolving to meet new requirements in EVs such as lower electrical conductivity, copper corrosion performance, and other properties. Regulatory factors will impact refrigerants and the choice between R134a, R1234yf, R744, and R290. This report provides an analysis of the coolant and refrigerant capacities in EVs with forecasts to 2035 for water-glycol, refrigerant, oils, and immersion fluids.

Active cooling with coolants is the industry standard for EV battery thermal management. Source: IDTechEx

Battery: cell-to-pack, thermal interface materials, fire protection, and immersion

The move towards increasing energy density and reducing costs has led to cell-to-pack or cell-to-body/chassis designs. Cell-to-pack eliminates module housings, stacking the cells directly together. Designs from BYD, Tesla, CATL, and others have made it onto the road, with more expected. In this report, IDTechEx considers how this trend will impact thermal management.

One major change is the application of thermal interface materials (TIMs), pushing in favor of thermally conductive adhesives to make a structural connection rather than the typical gap filler seen in many existing designs. This report forecasts TIM demand for EV batteries to 2035 in terms of mass and revenue, segmented by gap pad, gap filler, and thermally conductive adhesive.

Many material suppliers are tailoring their materials to provide multiple functions, including fire protection. This enables fire protection to be included without severely impacting the energy density of the pack. These include inter-cell materials that provide compression, thermal insulation, and fire protection. This report gives an overview of the material options with a total forecast to 2035. For a segmented material forecast and a deeper dive into fire protection, please see the Fire Protection Materials for EVs report by IDTechEx.

Immersion cooling is a topic that retains interest in the EV market with greater thermal homogeneity proposing benefits such as faster charging and increased safety. The technology is still at an early stage in terms of automotive commercialization but has seen greater traction in off-road markets. This report takes a deep dive into immersion cooling technology, with benchmarking of fluids and suppliers, market announcements and partnerships, and fluid volume forecasts for EVs in automotive, construction, agriculture, and mining markets.

Motors

For electric motors, the magnets used in the rotor and the windings used in the stator must be kept in an optimal operating temperature window to avoid damage or inefficient operation. Water-glycol used in a jacket around the motor has been the standard thermal management strategy for electric motors in EVs. However, recent years have seen much greater adoption of directly oil cooling the motor to provide better thermal performance, and in some cases, eliminate the cooling jacket, reducing the overall motor size. Oil cooling became the dominant form of cooling for EV motors in the first half of 2022, but that's not to say that water-jackets are going away, they are often used in conjunction with oil cooling, and water-glycol coolant is typically used to remove heat from the oil and can be used to integrate with the vehicles thermal management strategy as a whole. IDTechEx provides forecasts from 2015-2035 for electric motors segmented by the use of air, oil, or water-glycol cooling.

Oil cooling has become the dominant motor thermal management strategy. Source: IDTechEx

Power Electronics

The adoption of SiC is the largest trend in the news for EV power electronics and with good justification. This has had an impact on the construction of power electronics packages. Developments are happening for TIMs, wire bonding, die-attach, and substrate materials, largely with the goal of improving package reliability. The report provides analysis of these trends and the drivers behind adoption.

Inverter IGBT or SiC MOSFET modules are mostly cooled using water-glycol. However, both single-side and double-sided cooling options are used, each with its own benefits. There has also been an increased interest in using oil to cool power electronics to eliminate much of the water-glycol componentry within the electric drive unit, using the same oil for the motors and inverter. Whilst there has not been adoption of this approach in the current market, IDTechEx sees promise for this approach and includes a 10-year forecast for EV inverters using air, water, or oil cooling.

Evolving power electronics design presents opportunities in several material components. Source: IDTechEx

Key Aspects

Analysis of thermal management for Li-ion batteries, electric traction motors, and power electronics:

10 Year Market Forecasts & Analysis:

1, Fire protection materials forecast to 2035 by inter-cell and pack-level protection

2, Air, oil, and water cooled electric motors for cars in China, Europe, and the US for 2015-2023.

3, Air, oil, and water cooled electric motors for cars forecast to 2035.

4, Air, oil, and water cooled electric car inverters forecast to 2035.

Table of Contents

|

.png)