5Gの技術と市場、予測 2022-2032年5G Technology, Market and Forecasts 2022-2032 この調査レポートは、最新の5Gの開発動向、主要プレイヤーの分析、市場の見通しなどを詳細に調査・分析しています。主な内容は、mmWave技術の進展、オープンRAN(無線アクセスネットワーク)の開発、主要5地域... もっと見る

出版社

IDTechEx

アイディーテックエックス 出版年月

2021年8月27日

価格

お問い合わせください

ライセンス・価格情報/注文方法はこちら 納期

お問合わせください

ページ数

442

言語

英語

※価格はデータリソースまでお問い合わせください。

サマリー

この調査レポートは、最新の5Gの開発動向、主要プレイヤーの分析、市場の見通しなどを詳細に調査・分析しています。主な内容は、mmWave技術の進展、オープンRAN(無線アクセスネットワーク)の開発、主要5地域における5Gの状況と今後のロードマップの詳細な地域別分析などです。

主な掲載内容(目次より抜粋)

Report Summary

IDTechEx has been studying 5G-related topics for many years and we have just released our latest version of the 5G market research report "5G Technology, Market and Forecasts 2022-2032". This report is built on our expertise, covering the latest 5G development trends, key player analysis, and market outlook. Key aspects in this report include mmWave technologies progress, open radio access network (Open RAN) development, and detailed regional analysis of 5G status and future roadmap in 5 key regions: U.S., China, Japan, South Korea, Europe.

5G is paving the way for a fully digitalized and connected world. Over the past two years, we have seen many new field trials and an accelerating number of commercial rollouts. Moreover, we also start to see 5G being adopted in a wide range of industries, from manufacturing to healthcare. With high throughput and ultralow latency, 5G can tap into many high-value areas including 3D robotic control, virtual reality monitoring, and remote medical control that previous technologies weren't able to address. 5G is redefining and accelerating industries such as automotive, entertainment, computing, and manufacturing, and will ultimately change the way we work and live.

Among all the spectrums included in 5G, sub-6 GHz (3.5-7 GHz) and millimeter Wave (mmWave, >24 GHz) bands are the two new ones. In the first phase of 5G commercial rollouts, sub-6 GHz band is often the telecom operator's first choice. This is because sub-6 GHz band provides higher data throughput in comparison to the lower band; at the same time, the signal attenuation is less severe compared to the mmWave band. According to IDTechEx's analysis, 56% of 5G commercial services worldwide are operating at sub-6 GHz band. Almost all those sub-6 GHz band base stations are deployed in the urban area. The figure below shows the network deployment strategy that telecom operators utilize to deploy their 5G network. We can see that higher frequency bands will be primarily deployed in highly populated areas.

Each country/region has its own spectrum released schedule. Though most of the countries released the sub-6 GHz band first, there are some exceptions. For example, the U.S. regulatory body released the mmWave spectrum first and only released its sub-6 GHz band in early 2021. This leads to different 5G rollout outlooks and deployment strategies for each country. In this report, 5G Technology, Market and Forecasts 2022-2032, we have provided a detailed regional analysis of 5G status and future roadmap in 5 key regions: U.S., China, Japan, South Korea, Europe, including governmental strategy, funding, and key national telecom operators' 5G rollout schedule and roadmap, and revenue analysis.

Many characteristic benefits such as 1 ms latency promised by 5G will require operation at mmWave. Such high frequency requires new materials and different device designs. For example, low-loss materials with small dielectric constant and small tan loss as well as advanced packaging designs are essential for mmWave devices to avoid significant transmission loss. As devices become more and more miniature and integrated due to the short wavelength of mmWave signals, the power and thermal management of such devices become even more important. In this report, we point out the unique niches for 5G materials and design and highlight the trends for technology innovations.

5G open radio access network (Open RAN) is getting more and more attention. The idea of Open RAN is to provide telecom operators an alternative way to build networks based on disaggregated RAN components with standardized interoperability, which includes using non-proprietary white-box hardware, open-source software from different vendors, and open interfaces. As of mid-2021, we've already seen a few top telecom operators deploy the Open RAN 5G networks in rural areas. Many more set out roadmaps to deploy 5G networks using Open RAN equipment in the future. How would Open RAN disrupt the 5G infrastructure market and influence the overall supply chain dynamics? Who are the players in the Open RAN field? What would be the potential Open RAN business model? Is Open RAN really cheaper than the legacy system? What are legacy system vendors' (Huawei, Ericsson, Nokia) attitudes and strategies towards Open RAN? What are the remaining challenges of Open RAN? This report discusses all these questions in detail that will help you understand the future trend of the 5G infrastructure market.

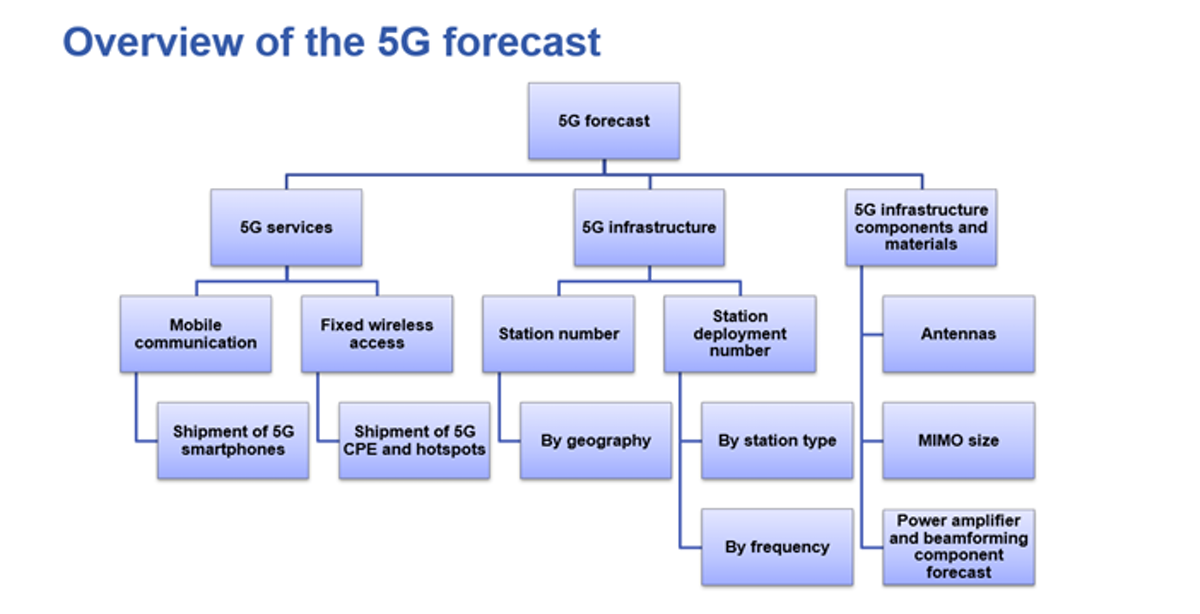

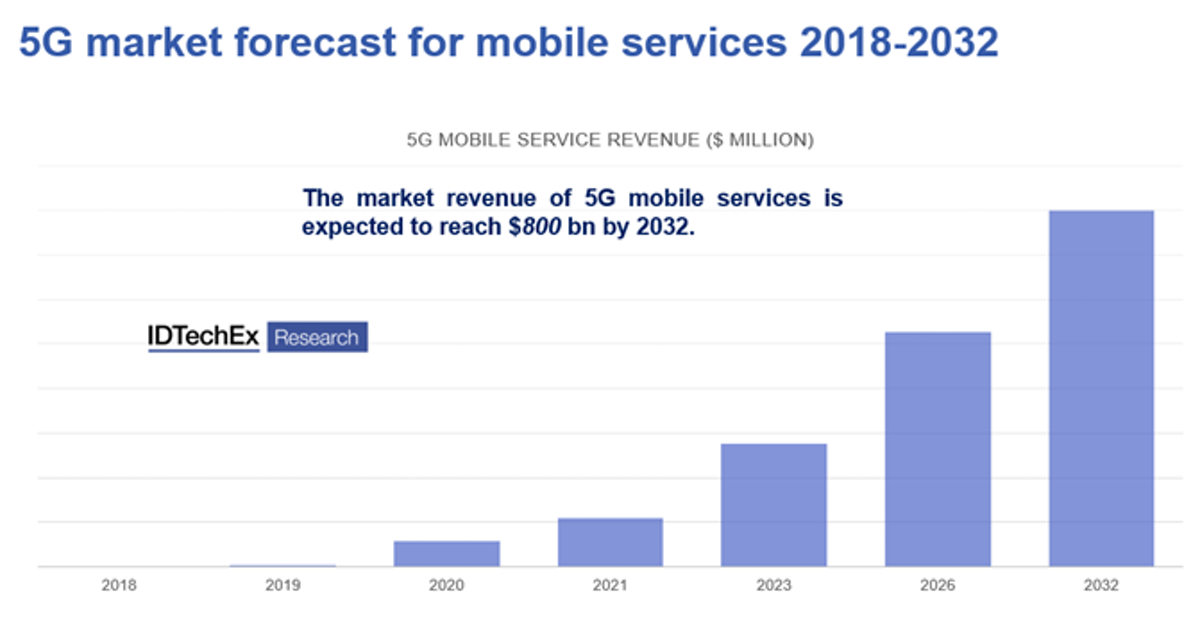

5G market is just about to take off. IDTechEx forecasts that by the end of 2032, the revenue generated by consumer mobile services will be circa $800 billion. Our forecast builds on the extensive analysis of primary and secondary data, combined with careful consideration of market drivers, constraints, and key player activities. In this report, we provide a ten-year forecast (2022 - 2032) for different segments including the 5G mobile revenue, subscriptions, and infrastructure based on five global regions (US, China, Korea & Japan, Europe, and others), 5G global mobile shipment, 5G global fixed wireless access revenue & customer promised equipment (CPE) shipment, and 5G critical components such as power amplifiers.

Below lists the key aspects in this report:

Technology trends, market player analysis, 5G roadmap of 5 key regions:

Device challenges (all sections include technology benchmarking and market player analysis):

Market Forecasts:

目次

1. EXECUTIVE SUMMARY

1.1. Current status of 5G

1.2. 5G network deployment strategy

1.3. 5G commercial/pre-commercial services by frequency (2021)

1.4. Summary of 5G status and roadmap in 5 key regions (U.S., China, Japan, South Korea, and Europe)

1.5. 5G standalone (SA) vs non-standalone (NSA) rollout update (2021)

1.6. The main technique innovations in 5G

1.7. 5G base station design trend

1.8. 5G base station types: macro cells and small cells

1.9. Competition landscape for key 5G infrastructure/system vendors

1.10. Current status of Open RAN global deployment

1.11. Open RAN disruption in the market?

1.12. Are legacy 5G system vendors embracing Open RAN?

1.13. The business model of Open RAN

1.14. 5G mmWave commercial/pre-commercial services (mid 2021)

1.15. List of telecom carriers and selected vendors for the installation of 5G mmWave base stations

1.16. Four main pain points in mmWave industry (1 - Talents)

1.17. Four main pain points in mmWave industry (2.1 - Cost)

1.18. Four main pain points in mmWave industry (2.2 - Cost)

1.19. Four main pain points in mmWave industry (3.1 - Power)

1.20. Four main pain points in mmWave industry (3.2 - Power)

1.21. Four main pain points in mmWave industry (4 - Customizability)

1.22. Five forces analysis of the 5G mmWave base station market

1.23. Overview of challenges, trends and innovations for mmWave 5G devices

1.24. Benchmark of commercialised low-loss organic laminates

1.25. Key semiconductor properties

1.26. Power amplifier technology benchmark

1.27. Benchmarking different filter technology for 5G

1.28. Five forces analysis of the 5G mmWave RF module market

1.29. Key Buying Factors (KBF) of 5G mmWave antennas. What are the changes in KBF between sub-6 GHz and mmWave antenna?

1.30. 5G mmWave phased array antenna start-ups on the rise

1.31. mmWave phased array antenna module key items and ecosystem

1.32. Landscape of key chipset players involved in the telecom/mobile industry

1.33. System on chip (SoC) for 5G handsets global market share

1.34. 5G applications overview

1.35. 5G private industrial network deployment on the rise

1.36. Detailed Comparison of Wi-Fi and Cellular based V2X communications

1.37. Value chain of chipset industry

1.38. Landscape of C-V2X supply chain

1.39. 5G market forecast for mobile services 2018-2032

1.40. 5G mid-band macro base station number forecast (2019-2032) by region (Cumulative - 1)

1.41. 5G mmWave street macro base station number forecast (2019-2032) by region (Cumulative - 1)

1.42. 5G small cells number forecast (2019-2032) (cumulative - 1)

2. INTRODUCTION TO 5G

2.1. Evolution of mobile communications

2.2. 5G commercial/pre-commercial services (Jun 2021)

2.3. 5G, next generation cellular communications network

2.4. 5G standardization roadmap

2.5. Global snapshot of allocated/targeted 5G spectrum

2.6. Two types of 5G: sub-6 GHz and mmWave

2.7. Spectrum Strategy for Foundation Network: the Role of Low Band Spectrum in 5G

2.8. 5G network deployment strategy

2.9. Low, mid-band 5G is often the operator's first choice to provide 5G national coverage

2.10. Approaches to overcome the challenges of 5G limited coverage

2.11. Frequency duplex division (FDD) vs. Time duplex division (TDD)

2.12. 5G commercial/pre-commercial services by frequency

2.13. 5G mmWave commercial/pre-commercial services (mid 2021)

2.14. 5G deployment: standalone (SA) vs non-standalone (NSA)

2.15. 5G transition from NSA mode to SA mode

2.16. Technical comparison of NSA and SA 5G

2.17. Economic comparison of NSA and SA 5G

2.18. Different deployment types in the same network

2.19. 5G standalone (SA) vs non-standalone (NSA) rollout update

2.20. The main technique innovations in 5G

2.21. 3 types of 5G services

2.22. 5G for mobile consumers market overview

2.23. 5G for industries overview

2.24. 5G investments at three stages

2.25. 5G supply chain overview

2.26. Summary: Global trends and new opportunities in 5G

3. 5G ROADMAP AND OUTLOOK: ANALYSIS OF 5 KEY REGIONS

3.1.1. 5G roadmap and outlook: analysis of 5 key regions (the U.S., China, Japan, South Korea, and Europe)

3.2. United States of America

3.2.1. U.S 5G national strategy

3.2.2. Overview of U.S. telecom operators' financial and network deployment status (mid-2021)

3.2.3. U.S. 5G spectrum update (mid-2021)

3.2.4. U.S. 5G mid band rollout roadmap

3.2.5. U.S. telecom operator: T-Mobile's revenue & expenditure

3.2.6. U.S. telecom operator: T-Mobile 5G status & strategy

3.2.7. U.S. telecom operator: AT&T - world's top telecom operator: revenue & expenditure

3.2.8. U.S. telecom operator: AT&T - 5G status & strategy

3.2.9. U.S. telecom operator: AT&T - 5G applications

3.2.10. U.S. telecom operator: Verizon - world's second telecom operator: revenue & expenditure

3.2.11. U.S. telecom operator: Verizon - 5G status & strategy

3.2.12. U.S. base stations - historical trend

3.3. China

3.3.1. China 5G environment, rollout status, and future outlook

3.3.2. China 2G - 5G Technology trend

3.3.3. China 5G spectrum at a glance

3.3.4. Is the 6 GHz band the future of 5G?

3.3.5. China 5G telecom operators performance

3.3.6. China 5G investment volume from three major operators

3.3.7. Case study: expected 5G investment for infrastructure in China

3.3.8. 5G "key performance indicator (KPI) " and roadmap in China

3.3.9. 5G private network development focus in China

3.3.10. Key 5G vertical applications identified by Chinese government

3.3.11. Demonstrations of 5G verticals by Chinese telecom operators

3.3.12. Impact of US-China trade war on 5G

3.3.13. 5G wrestle between China and the West

3.3.14. How did the 5G battle between China and the U.S. start?

3.3.15. Washington's strategy to combat China

3.3.16. How has the situation evolved?

3.3.17. Political, Economic, Socio-Cultural, and Technological analysis on the U.S. and China 5G environment

3.3.18. 5G commercial deals by 5G key system vendors (2019-Q2 2021)

3.3.19. 5G infrastructure market share by key vendors

3.3.20. China 5G base station bid result (2021)

3.3.21. Huawei: Banned and permitted in which countries? (Updated Jun. 2021)

3.3.22. Huawei's performance in the last fiscal year (2020)

3.3.23. Huawei's strategy to survive - will it survive?

3.3.24. Ericsson's performance in the last fiscal year (2020)

3.4. Japan

3.4.1. Japan base stations - historical trend

3.4.2. Japan 5G NR spectrum at a glance

3.4.3. Japan 5G spectrum in use

3.4.4. Japan 5G environment, rollout status, and future outlook

3.4.5. NTT DOCOMO 5G rollout plan

3.4.6. NTT DOCOMO 5G solutions

3.4.7. SoftBank 5G rollout plan

3.4.8. SoftBank 5G development

3.4.9. SoftBank 5G solution case study

3.4.10. KDDI 5G rollout plan

3.4.11. KDDI 5G solution outlook

3.5. South Korea

3.5.1. South Korea 5G environment, rollout status, and future outlook

3.5.2. South Korea 5G NR spectrum at a glance

3.5.3. 5G growth in South Korea

3.5.4. Key 5G industries identified by the South Korean government

3.5.5. Key 5G B2B business in development by the South Korean telecom operators

3.6. Europe

3.6.1. 5G rollout status in EU

3.6.2. 5G spectrum released status in EU

3.6.3. 5G vertical trials in EU by segments

3.6.4. EU public funding for Digitalization

3.6.5. Financial overview of 4 key EU telecom operators

3.6.6. Deutsche Telekom: 5G commercial rollout Overview

3.6.7. Deutsche Telekom: 5G commercial rollout in Germany

3.6.8. Deutsche Telekom - Financial status

3.6.9. Deutsche Telekom - 5G strategy

3.6.10. Vodafone: 5G Overview

3.6.11. Vodafone: 5G commercial rollout status

3.6.12. Vodafone: Enterprise 5G rollout

3.6.13. Telefónica: 5G commercial rollout overview

3.6.14. Orange: 5G Overview

3.6.15. Orange deploying 5G networks for various enterprise

3.6.16. Orange: 5G status and strategy

3.6.17. Summary of 5G status and roadmap in 5 key regions (U.S., China, Japan, South Korea, and Europe)

4. OVERVIEW OF 5G INFRASTRUCTURE

4.1. From 1G to 5G: the evolution of cellular network infrastructure

4.2. Architecture of macro base stations

4.3. Key challenges for 5G macro base stations

4.4. 5G base station design trend

4.5. 5G base station types: macro cells and small cells

4.6. Drivers for Ultra Dense Network (UDN) Deployment in 5G

4.7. Challenges for ultra dense network deployment

4.8. 5G small cells will see a rapid growth

4.9. 5G infrastructure: Huawei, Ericsson, Nokia, ZTE, Samsung and others

4.10. Competition landscape for key 5G infrastructure vendors

5. 5G OPEN RAN

5.1.1. Why Open RAN becomes so important in 5G

5.1.2. Why Open RAN is getting more and more attention?

5.2. Open RAN introduction

5.2.1. 5G network architecture: virtualized and disaggregated base stations

5.2.2. Why splitting the baseband unit (BBU) is necessary in 5G

5.2.3. High and Low layer split of the 5G network

5.2.4. More functional splits to support diverse 5G use cases

5.2.5. Evolution of RAN functional split

5.2.6. Pros and Cons of RAN functional splits

5.2.7. Trade offs for Different functional splits

5.3. Open RAN technology insights

5.3.1. What is Open Radio Access Network (Open RAN)?

5.3.2. The benefits and challenges of radio access networks (RAN) decomposition and disaggregation

5.3.3. Traditional RAN vs Open RAN

5.3.4. Open interface is key - but what is it?

5.3.5. Evolution of Open RAN functional split

5.3.6. Open RAN functional split: Split 6 or Split 7.2x ?

5.3.7. Open RAN case study - the world's largest Open RAN deployment

5.3.8. Open RAN case study - 5G Open RAN + private network for logistics use cases

5.3.9. Open RAN case study: 5G emergency services networks

5.4. Open RAN market insights

5.4.1. Open RAN global deployment at a glance

5.4.2. Open RAN disruption in the market?

5.4.3. Four major challenges of Open RAN

5.4.4. Are legacy 5G system vendors embracing Open RAN?

5.4.5. Open RAN hardware commoditization risk?

5.4.6. How much does an Open RAN base station cost compared to a legacy one?

5.4.7. The business model of Open RAN

5.4.8. Open RAN hardware suppliers

5.4.9. O-RAN Alliance operators

5.4.10. Open RAN deployment schedule - Will Open RAN establish itself first in the private network or in the macro network?

5.4.11. Open RAN status update (2021)

5.4.12. Open RAN key takeaways

6. OVERVIEW OF 5G CORE AND RADIO TECHNOLOGY INNOVATIONS

6.1.1. End-to-end technology overview

6.2. 5G core network technologies

6.2.1. 5G core network technologies

6.2.2. Comparison of 4G core and 5G core

6.2.3. Service based architecture (SBA)

6.2.4. Mobile Edge Computing (MEC)

6.2.5. End-to-end Network Slicing

6.2.6. Spectrum sharing

6.2.7. Why does 5G have lower latency radio transmissions

6.2.8. 5G new radio technologies

6.3. 5G new radio technologies

6.3.1. New multiple access methods: Non-orthogonal multiple-access techniques (NOMA)

6.3.2. Advanced waveforms and channel coding

6.3.3. Comparison of Turbo, LDPC and Polar code

6.3.4. High frequency communication: mmWave

6.3.5. Massive MIMO (mMIMO)

6.3.6. Massive MIMO enables advanced beam forming

7. 5G MASSIVE MIMO ACTIVE ANTENNA

7.1. Massive MIMO requires active antennas

7.2. Trends in 5G antennas: active antennas and massive MIMO

7.3. Antenna array architectures for beamforming

7.4. Structure of massive MIMO (mMIMO) system

7.5. Advantages of Massive MIMO

7.6. Samsung and Nokia sub-6 ghz mMIMO antenna teardown

7.7. Top 5G system venders are vertically integrated with antenna capabilities

7.8. Case study: Nokia AirScale mMIMO Adaptive Antenna

7.9. Case study: Ericsson 2G - 5G Hybrid Antenna

7.10. Key challenges for massive MIMO deployment

7.11. Challenges of implementing massive MIMO in frequencies way above 6 GHz

8. 5G MMWAVE INDUSTRY ANALYSIS

8.1. List of telecom carriers and selected vendors for the installation of 5G mmWave base stations

8.2. Challenges to overcome before we see notable adoption of mmWave

8.3. Four main pain points in mmWave industry (1 - Talents)

8.4. Four main pain points in mmWave industry (2.1 - Cost)

8.5. Four main pain points in mmWave industry (2.2 - Cost)

8.6. Four main pain points in mmWave industry (3.1 - Power)

8.7. Four main pain points in mmWave industry (3.2 - Power)

8.8. Four main pain points in mmWave industry (4 - Customizability)

8.9. Five forces analysis of the 5G mmWave base station market

9. 5G MMWAVE DEVICE CHALLENGES

9.1.1. Overview of challenges, trends and innovations for mmWave 5G devices

9.2. Low-loss materials for 5G

9.2.1. Overview of the high level requirements for high frequency operation

9.2.2. Overview of the low-loss materials

9.2.3. Where low-loss materials will be used: beam forming system in base station

9.2.4. Where low-loss material will be used: substrate of mmWave antenna module for smartphone

9.2.5. Where low-loss material will be used: multiple parts inside packages

9.2.6. Low-loss materials can also be used in radome cover or molding housing

9.2.7. Five important metrics for substrate materials will impact materials selection

9.2.8. Dielectric constant: benchmarking different substrate technologies

9.2.9. Loss tangent: benchmarking different substrate technologies

9.2.10. Benchmark of commercialised low-loss organic laminates

9.2.11. More info about 5G Low Loss Materials

9.3. mmWave 5G Power amplifiers

9.3.1. The choice of the semiconductor technology for power amplifiers

9.3.2. Key semiconductor properties

9.3.3. Power vs frequency map of power amplifier technologies

9.3.4. Pros and Cons of GaN

9.3.5. GaN to win in sub-6 GHz 5G (for macro and microcell (> 5W))

9.3.6. GaN-on-Si, SiC or Diamond for RF

9.3.7. Power amplifier technology benchmark

9.3.8. Suppliers of RF GaN based power amplifiers

9.3.9. Suppliers of RF power amplifiers utilized in small cells

9.3.10. Semiconductor choices for power amplifiers in mmWave module

9.4. 5G filter technologies

9.4.1. Challenges for mmWave base stations

9.4.2. Filter requirements for mmWave base stations

9.4.3. Which filter technologies will work for mmWave 5G?

9.4.4. SAW and BAW filters are not suitable for mmWave 5G

9.4.5. Overview of transmission lines filters for 5G mmWave

9.4.6. Transmission lines filter (1): Substrate integrated waveguide filters (SIW)

9.4.7. Transmission lines filter (2.1): Single-layer transmission-line filters on PCB

9.4.8. Transmission lines filter (2.2): Single-layer transmission-line filters on ceramic

9.4.9. Transmission lines filter (2.3): Other substrate options: thin or thick film and glass

9.4.10. Transmission lines filter (3): Multilayer low temperature co-fired ceramic (LTCC) filters

9.4.11. Multilayer LTCC: production challenge

9.4.12. Examples of multilayer LTCC from key suppliers (1)

9.4.13. Examples of multilayer LTCC from key suppliers (2)

9.4.14. Benchmarking different filter technology for 5G

9.4.15. Benchmarking different transmission lines filters (1)

9.4.16. Benchmarking different transmission lines filters (2)

9.4.17. Benchmarking different transmission lines filters (3)

9.4.18. Radio frequency (RF) Front-end module

9.5. Radio frequency front end module (RF FEM)

9.5.1. Density of components in RFFE

9.5.2. RF module design architecture

9.5.3. RF FEM suppliers for LTE-advanced smartphone

9.5.4. mmWave radio frequency front end (RFFE) module suppliers

9.5.5. Qualcomm 5G NR Modem-to-Antenna module

9.5.6. Tear down of a mmWave Customer Enterprise Equipment (CPE)

9.6. RF frontend components in 5G mmWave base stations

9.6.1. Hybrid beamforming system for mmWave base stations

9.6.2. mmWave bits to mmWave radio system

9.6.3. mmWave RF beamformer (beamforming integrated circuit (BFIC))

9.6.4. mmWave BFIC suppliers for 5G infrastructures

9.6.5. 5G mmWave RF modules supply chain dynamics

9.6.6. Five forces analysis of the 5G mmWave RF module market

9.7. mmWave phased array antenna module suppliers and supply chain dynamics

9.7.1. Demonstrations of 28GHz all-silicon 64 dual polarized antenna

9.7.2. Tear down of a mmWave femtocell

9.7.3. Tear down of a mmWave mobile station from Samsung

9.7.4. Tier 1 5G system vendors are vertically integrated with antenna capabilities

9.7.5. Intension of Ericsson acquired Kathrein antenna R&D department

9.7.6. 5G mmWave phased array antenna start-ups on the rise

9.7.7. mmWave phased array antenna module key items and ecosystem

9.7.8. Partnership between mmWave antenna suppliers and RF module suppliers

9.7.9. The likelihood for tier 1 system vendors to develop their own phased array antenna modules

9.7.10. Key Buying Factors (KBF) of 5G mmWave antennas: what are the changes in KBF between sub-6 GHz and mmWave antenna?

10. SI CHIPSET MARKET

10.1. Landscape of key chipset players involved in the telecom/mobile industry

10.2. System on Chip (SoC)

10.3. Value chain of chipset industry

10.4. Key chipset players involved in the telecom infrastructure

10.5. The intentions of 5G system vendors enter Si battleground

10.6. Key chipset players involve in the mobile SoC/Modem

10.7. System on chip (SoC) for 5G handsets global market share

10.8. Key chipset players involve in the key components related to wireless technology

10.9. Mobile RF frontend supply chain

11. INK-BASED EMI

Summary

この調査レポートは、最新の5Gの開発動向、主要プレイヤーの分析、市場の見通しなどを詳細に調査・分析しています。主な内容は、mmWave技術の進展、オープンRAN(無線アクセスネットワーク)の開発、主要5地域における5Gの状況と今後のロードマップの詳細な地域別分析などです。

主な掲載内容(目次より抜粋)

Report Summary

IDTechEx has been studying 5G-related topics for many years and we have just released our latest version of the 5G market research report "5G Technology, Market and Forecasts 2022-2032". This report is built on our expertise, covering the latest 5G development trends, key player analysis, and market outlook. Key aspects in this report include mmWave technologies progress, open radio access network (Open RAN) development, and detailed regional analysis of 5G status and future roadmap in 5 key regions: U.S., China, Japan, South Korea, Europe.

5G is paving the way for a fully digitalized and connected world. Over the past two years, we have seen many new field trials and an accelerating number of commercial rollouts. Moreover, we also start to see 5G being adopted in a wide range of industries, from manufacturing to healthcare. With high throughput and ultralow latency, 5G can tap into many high-value areas including 3D robotic control, virtual reality monitoring, and remote medical control that previous technologies weren't able to address. 5G is redefining and accelerating industries such as automotive, entertainment, computing, and manufacturing, and will ultimately change the way we work and live.

Among all the spectrums included in 5G, sub-6 GHz (3.5-7 GHz) and millimeter Wave (mmWave, >24 GHz) bands are the two new ones. In the first phase of 5G commercial rollouts, sub-6 GHz band is often the telecom operator's first choice. This is because sub-6 GHz band provides higher data throughput in comparison to the lower band; at the same time, the signal attenuation is less severe compared to the mmWave band. According to IDTechEx's analysis, 56% of 5G commercial services worldwide are operating at sub-6 GHz band. Almost all those sub-6 GHz band base stations are deployed in the urban area. The figure below shows the network deployment strategy that telecom operators utilize to deploy their 5G network. We can see that higher frequency bands will be primarily deployed in highly populated areas.

Each country/region has its own spectrum released schedule. Though most of the countries released the sub-6 GHz band first, there are some exceptions. For example, the U.S. regulatory body released the mmWave spectrum first and only released its sub-6 GHz band in early 2021. This leads to different 5G rollout outlooks and deployment strategies for each country. In this report, 5G Technology, Market and Forecasts 2022-2032, we have provided a detailed regional analysis of 5G status and future roadmap in 5 key regions: U.S., China, Japan, South Korea, Europe, including governmental strategy, funding, and key national telecom operators' 5G rollout schedule and roadmap, and revenue analysis.

Many characteristic benefits such as 1 ms latency promised by 5G will require operation at mmWave. Such high frequency requires new materials and different device designs. For example, low-loss materials with small dielectric constant and small tan loss as well as advanced packaging designs are essential for mmWave devices to avoid significant transmission loss. As devices become more and more miniature and integrated due to the short wavelength of mmWave signals, the power and thermal management of such devices become even more important. In this report, we point out the unique niches for 5G materials and design and highlight the trends for technology innovations.

5G open radio access network (Open RAN) is getting more and more attention. The idea of Open RAN is to provide telecom operators an alternative way to build networks based on disaggregated RAN components with standardized interoperability, which includes using non-proprietary white-box hardware, open-source software from different vendors, and open interfaces. As of mid-2021, we've already seen a few top telecom operators deploy the Open RAN 5G networks in rural areas. Many more set out roadmaps to deploy 5G networks using Open RAN equipment in the future. How would Open RAN disrupt the 5G infrastructure market and influence the overall supply chain dynamics? Who are the players in the Open RAN field? What would be the potential Open RAN business model? Is Open RAN really cheaper than the legacy system? What are legacy system vendors' (Huawei, Ericsson, Nokia) attitudes and strategies towards Open RAN? What are the remaining challenges of Open RAN? This report discusses all these questions in detail that will help you understand the future trend of the 5G infrastructure market.

5G market is just about to take off. IDTechEx forecasts that by the end of 2032, the revenue generated by consumer mobile services will be circa $800 billion. Our forecast builds on the extensive analysis of primary and secondary data, combined with careful consideration of market drivers, constraints, and key player activities. In this report, we provide a ten-year forecast (2022 - 2032) for different segments including the 5G mobile revenue, subscriptions, and infrastructure based on five global regions (US, China, Korea & Japan, Europe, and others), 5G global mobile shipment, 5G global fixed wireless access revenue & customer promised equipment (CPE) shipment, and 5G critical components such as power amplifiers.

Below lists the key aspects in this report:

Technology trends, market player analysis, 5G roadmap of 5 key regions:

Device challenges (all sections include technology benchmarking and market player analysis):

Market Forecasts:

Table of Contents

1. EXECUTIVE SUMMARY

1.1. Current status of 5G

1.2. 5G network deployment strategy

1.3. 5G commercial/pre-commercial services by frequency (2021)

1.4. Summary of 5G status and roadmap in 5 key regions (U.S., China, Japan, South Korea, and Europe)

1.5. 5G standalone (SA) vs non-standalone (NSA) rollout update (2021)

1.6. The main technique innovations in 5G

1.7. 5G base station design trend

1.8. 5G base station types: macro cells and small cells

1.9. Competition landscape for key 5G infrastructure/system vendors

1.10. Current status of Open RAN global deployment

1.11. Open RAN disruption in the market?

1.12. Are legacy 5G system vendors embracing Open RAN?

1.13. The business model of Open RAN

1.14. 5G mmWave commercial/pre-commercial services (mid 2021)

1.15. List of telecom carriers and selected vendors for the installation of 5G mmWave base stations

1.16. Four main pain points in mmWave industry (1 - Talents)

1.17. Four main pain points in mmWave industry (2.1 - Cost)

1.18. Four main pain points in mmWave industry (2.2 - Cost)

1.19. Four main pain points in mmWave industry (3.1 - Power)

1.20. Four main pain points in mmWave industry (3.2 - Power)

1.21. Four main pain points in mmWave industry (4 - Customizability)

1.22. Five forces analysis of the 5G mmWave base station market

1.23. Overview of challenges, trends and innovations for mmWave 5G devices

1.24. Benchmark of commercialised low-loss organic laminates

1.25. Key semiconductor properties

1.26. Power amplifier technology benchmark

1.27. Benchmarking different filter technology for 5G

1.28. Five forces analysis of the 5G mmWave RF module market

1.29. Key Buying Factors (KBF) of 5G mmWave antennas. What are the changes in KBF between sub-6 GHz and mmWave antenna?

1.30. 5G mmWave phased array antenna start-ups on the rise

1.31. mmWave phased array antenna module key items and ecosystem

1.32. Landscape of key chipset players involved in the telecom/mobile industry

1.33. System on chip (SoC) for 5G handsets global market share

1.34. 5G applications overview

1.35. 5G private industrial network deployment on the rise

1.36. Detailed Comparison of Wi-Fi and Cellular based V2X communications

1.37. Value chain of chipset industry

1.38. Landscape of C-V2X supply chain

1.39. 5G market forecast for mobile services 2018-2032

1.40. 5G mid-band macro base station number forecast (2019-2032) by region (Cumulative - 1)

1.41. 5G mmWave street macro base station number forecast (2019-2032) by region (Cumulative - 1)

1.42. 5G small cells number forecast (2019-2032) (cumulative - 1)

2. INTRODUCTION TO 5G

2.1. Evolution of mobile communications

2.2. 5G commercial/pre-commercial services (Jun 2021)

2.3. 5G, next generation cellular communications network

2.4. 5G standardization roadmap

2.5. Global snapshot of allocated/targeted 5G spectrum

2.6. Two types of 5G: sub-6 GHz and mmWave

2.7. Spectrum Strategy for Foundation Network: the Role of Low Band Spectrum in 5G

2.8. 5G network deployment strategy

2.9. Low, mid-band 5G is often the operator's first choice to provide 5G national coverage

2.10. Approaches to overcome the challenges of 5G limited coverage

2.11. Frequency duplex division (FDD) vs. Time duplex division (TDD)

2.12. 5G commercial/pre-commercial services by frequency

2.13. 5G mmWave commercial/pre-commercial services (mid 2021)

2.14. 5G deployment: standalone (SA) vs non-standalone (NSA)

2.15. 5G transition from NSA mode to SA mode

2.16. Technical comparison of NSA and SA 5G

2.17. Economic comparison of NSA and SA 5G

2.18. Different deployment types in the same network

2.19. 5G standalone (SA) vs non-standalone (NSA) rollout update

2.20. The main technique innovations in 5G

2.21. 3 types of 5G services

2.22. 5G for mobile consumers market overview

2.23. 5G for industries overview

2.24. 5G investments at three stages

2.25. 5G supply chain overview

2.26. Summary: Global trends and new opportunities in 5G

3. 5G ROADMAP AND OUTLOOK: ANALYSIS OF 5 KEY REGIONS

3.1.1. 5G roadmap and outlook: analysis of 5 key regions (the U.S., China, Japan, South Korea, and Europe)

3.2. United States of America

3.2.1. U.S 5G national strategy

3.2.2. Overview of U.S. telecom operators' financial and network deployment status (mid-2021)

3.2.3. U.S. 5G spectrum update (mid-2021)

3.2.4. U.S. 5G mid band rollout roadmap

3.2.5. U.S. telecom operator: T-Mobile's revenue & expenditure

3.2.6. U.S. telecom operator: T-Mobile 5G status & strategy

3.2.7. U.S. telecom operator: AT&T - world's top telecom operator: revenue & expenditure

3.2.8. U.S. telecom operator: AT&T - 5G status & strategy

3.2.9. U.S. telecom operator: AT&T - 5G applications

3.2.10. U.S. telecom operator: Verizon - world's second telecom operator: revenue & expenditure

3.2.11. U.S. telecom operator: Verizon - 5G status & strategy

3.2.12. U.S. base stations - historical trend

3.3. China

3.3.1. China 5G environment, rollout status, and future outlook

3.3.2. China 2G - 5G Technology trend

3.3.3. China 5G spectrum at a glance

3.3.4. Is the 6 GHz band the future of 5G?

3.3.5. China 5G telecom operators performance

3.3.6. China 5G investment volume from three major operators

3.3.7. Case study: expected 5G investment for infrastructure in China

3.3.8. 5G "key performance indicator (KPI) " and roadmap in China

3.3.9. 5G private network development focus in China

3.3.10. Key 5G vertical applications identified by Chinese government

3.3.11. Demonstrations of 5G verticals by Chinese telecom operators

3.3.12. Impact of US-China trade war on 5G

3.3.13. 5G wrestle between China and the West

3.3.14. How did the 5G battle between China and the U.S. start?

3.3.15. Washington's strategy to combat China

3.3.16. How has the situation evolved?

3.3.17. Political, Economic, Socio-Cultural, and Technological analysis on the U.S. and China 5G environment

3.3.18. 5G commercial deals by 5G key system vendors (2019-Q2 2021)

3.3.19. 5G infrastructure market share by key vendors

3.3.20. China 5G base station bid result (2021)

3.3.21. Huawei: Banned and permitted in which countries? (Updated Jun. 2021)

3.3.22. Huawei's performance in the last fiscal year (2020)

3.3.23. Huawei's strategy to survive - will it survive?

3.3.24. Ericsson's performance in the last fiscal year (2020)

3.4. Japan

3.4.1. Japan base stations - historical trend

3.4.2. Japan 5G NR spectrum at a glance

3.4.3. Japan 5G spectrum in use

3.4.4. Japan 5G environment, rollout status, and future outlook

3.4.5. NTT DOCOMO 5G rollout plan

3.4.6. NTT DOCOMO 5G solutions

3.4.7. SoftBank 5G rollout plan

3.4.8. SoftBank 5G development

3.4.9. SoftBank 5G solution case study

3.4.10. KDDI 5G rollout plan

3.4.11. KDDI 5G solution outlook

3.5. South Korea

3.5.1. South Korea 5G environment, rollout status, and future outlook

3.5.2. South Korea 5G NR spectrum at a glance

3.5.3. 5G growth in South Korea

3.5.4. Key 5G industries identified by the South Korean government

3.5.5. Key 5G B2B business in development by the South Korean telecom operators

3.6. Europe

3.6.1. 5G rollout status in EU

3.6.2. 5G spectrum released status in EU

3.6.3. 5G vertical trials in EU by segments

3.6.4. EU public funding for Digitalization

3.6.5. Financial overview of 4 key EU telecom operators

3.6.6. Deutsche Telekom: 5G commercial rollout Overview

3.6.7. Deutsche Telekom: 5G commercial rollout in Germany

3.6.8. Deutsche Telekom - Financial status

3.6.9. Deutsche Telekom - 5G strategy

3.6.10. Vodafone: 5G Overview

3.6.11. Vodafone: 5G commercial rollout status

3.6.12. Vodafone: Enterprise 5G rollout

3.6.13. Telefónica: 5G commercial rollout overview

3.6.14. Orange: 5G Overview

3.6.15. Orange deploying 5G networks for various enterprise

3.6.16. Orange: 5G status and strategy

3.6.17. Summary of 5G status and roadmap in 5 key regions (U.S., China, Japan, South Korea, and Europe)

4. OVERVIEW OF 5G INFRASTRUCTURE

4.1. From 1G to 5G: the evolution of cellular network infrastructure

4.2. Architecture of macro base stations

4.3. Key challenges for 5G macro base stations

4.4. 5G base station design trend

4.5. 5G base station types: macro cells and small cells

4.6. Drivers for Ultra Dense Network (UDN) Deployment in 5G

4.7. Challenges for ultra dense network deployment

4.8. 5G small cells will see a rapid growth

4.9. 5G infrastructure: Huawei, Ericsson, Nokia, ZTE, Samsung and others

4.10. Competition landscape for key 5G infrastructure vendors

5. 5G OPEN RAN

5.1.1. Why Open RAN becomes so important in 5G

5.1.2. Why Open RAN is getting more and more attention?

5.2. Open RAN introduction

5.2.1. 5G network architecture: virtualized and disaggregated base stations

5.2.2. Why splitting the baseband unit (BBU) is necessary in 5G

5.2.3. High and Low layer split of the 5G network

5.2.4. More functional splits to support diverse 5G use cases

5.2.5. Evolution of RAN functional split

5.2.6. Pros and Cons of RAN functional splits

5.2.7. Trade offs for Different functional splits

5.3. Open RAN technology insights

5.3.1. What is Open Radio Access Network (Open RAN)?

5.3.2. The benefits and challenges of radio access networks (RAN) decomposition and disaggregation

5.3.3. Traditional RAN vs Open RAN

5.3.4. Open interface is key - but what is it?

5.3.5. Evolution of Open RAN functional split

5.3.6. Open RAN functional split: Split 6 or Split 7.2x ?

5.3.7. Open RAN case study - the world's largest Open RAN deployment

5.3.8. Open RAN case study - 5G Open RAN + private network for logistics use cases

5.3.9. Open RAN case study: 5G emergency services networks

5.4. Open RAN market insights

5.4.1. Open RAN global deployment at a glance

5.4.2. Open RAN disruption in the market?

5.4.3. Four major challenges of Open RAN

5.4.4. Are legacy 5G system vendors embracing Open RAN?

5.4.5. Open RAN hardware commoditization risk?

5.4.6. How much does an Open RAN base station cost compared to a legacy one?

5.4.7. The business model of Open RAN

5.4.8. Open RAN hardware suppliers

5.4.9. O-RAN Alliance operators

5.4.10. Open RAN deployment schedule - Will Open RAN establish itself first in the private network or in the macro network?

5.4.11. Open RAN status update (2021)

5.4.12. Open RAN key takeaways

6. OVERVIEW OF 5G CORE AND RADIO TECHNOLOGY INNOVATIONS

6.1.1. End-to-end technology overview

6.2. 5G core network technologies

6.2.1. 5G core network technologies

6.2.2. Comparison of 4G core and 5G core

6.2.3. Service based architecture (SBA)

6.2.4. Mobile Edge Computing (MEC)

6.2.5. End-to-end Network Slicing

6.2.6. Spectrum sharing

6.2.7. Why does 5G have lower latency radio transmissions

6.2.8. 5G new radio technologies

6.3. 5G new radio technologies

6.3.1. New multiple access methods: Non-orthogonal multiple-access techniques (NOMA)

6.3.2. Advanced waveforms and channel coding

6.3.3. Comparison of Turbo, LDPC and Polar code

6.3.4. High frequency communication: mmWave

6.3.5. Massive MIMO (mMIMO)

6.3.6. Massive MIMO enables advanced beam forming

7. 5G MASSIVE MIMO ACTIVE ANTENNA

7.1. Massive MIMO requires active antennas

7.2. Trends in 5G antennas: active antennas and massive MIMO

7.3. Antenna array architectures for beamforming

7.4. Structure of massive MIMO (mMIMO) system

7.5. Advantages of Massive MIMO

7.6. Samsung and Nokia sub-6 ghz mMIMO antenna teardown

7.7. Top 5G system venders are vertically integrated with antenna capabilities

7.8. Case study: Nokia AirScale mMIMO Adaptive Antenna

7.9. Case study: Ericsson 2G - 5G Hybrid Antenna

7.10. Key challenges for massive MIMO deployment

7.11. Challenges of implementing massive MIMO in frequencies way above 6 GHz

8. 5G MMWAVE INDUSTRY ANALYSIS

8.1. List of telecom carriers and selected vendors for the installation of 5G mmWave base stations

8.2. Challenges to overcome before we see notable adoption of mmWave

8.3. Four main pain points in mmWave industry (1 - Talents)

8.4. Four main pain points in mmWave industry (2.1 - Cost)

8.5. Four main pain points in mmWave industry (2.2 - Cost)

8.6. Four main pain points in mmWave industry (3.1 - Power)

8.7. Four main pain points in mmWave industry (3.2 - Power)

8.8. Four main pain points in mmWave industry (4 - Customizability)

8.9. Five forces analysis of the 5G mmWave base station market

9. 5G MMWAVE DEVICE CHALLENGES

9.1.1. Overview of challenges, trends and innovations for mmWave 5G devices

9.2. Low-loss materials for 5G

9.2.1. Overview of the high level requirements for high frequency operation

9.2.2. Overview of the low-loss materials

9.2.3. Where low-loss materials will be used: beam forming system in base station

9.2.4. Where low-loss material will be used: substrate of mmWave antenna module for smartphone

9.2.5. Where low-loss material will be used: multiple parts inside packages

9.2.6. Low-loss materials can also be used in radome cover or molding housing

9.2.7. Five important metrics for substrate materials will impact materials selection

9.2.8. Dielectric constant: benchmarking different substrate technologies

9.2.9. Loss tangent: benchmarking different substrate technologies

9.2.10. Benchmark of commercialised low-loss organic laminates

9.2.11. More info about 5G Low Loss Materials

9.3. mmWave 5G Power amplifiers

9.3.1. The choice of the semiconductor technology for power amplifiers

9.3.2. Key semiconductor properties

9.3.3. Power vs frequency map of power amplifier technologies

9.3.4. Pros and Cons of GaN

9.3.5. GaN to win in sub-6 GHz 5G (for macro and microcell (> 5W))

9.3.6. GaN-on-Si, SiC or Diamond for RF

9.3.7. Power amplifier technology benchmark

9.3.8. Suppliers of RF GaN based power amplifiers

9.3.9. Suppliers of RF power amplifiers utilized in small cells

9.3.10. Semiconductor choices for power amplifiers in mmWave module

9.4. 5G filter technologies

9.4.1. Challenges for mmWave base stations

9.4.2. Filter requirements for mmWave base stations

9.4.3. Which filter technologies will work for mmWave 5G?

9.4.4. SAW and BAW filters are not suitable for mmWave 5G

9.4.5. Overview of transmission lines filters for 5G mmWave

9.4.6. Transmission lines filter (1): Substrate integrated waveguide filters (SIW)

9.4.7. Transmission lines filter (2.1): Single-layer transmission-line filters on PCB

9.4.8. Transmission lines filter (2.2): Single-layer transmission-line filters on ceramic

9.4.9. Transmission lines filter (2.3): Other substrate options: thin or thick film and glass

9.4.10. Transmission lines filter (3): Multilayer low temperature co-fired ceramic (LTCC) filters

9.4.11. Multilayer LTCC: production challenge

9.4.12. Examples of multilayer LTCC from key suppliers (1)

9.4.13. Examples of multilayer LTCC from key suppliers (2)

9.4.14. Benchmarking different filter technology for 5G

9.4.15. Benchmarking different transmission lines filters (1)

9.4.16. Benchmarking different transmission lines filters (2)

9.4.17. Benchmarking different transmission lines filters (3)

9.4.18. Radio frequency (RF) Front-end module

9.5. Radio frequency front end module (RF FEM)

9.5.1. Density of components in RFFE

9.5.2. RF module design architecture

9.5.3. RF FEM suppliers for LTE-advanced smartphone

9.5.4. mmWave radio frequency front end (RFFE) module suppliers

9.5.5. Qualcomm 5G NR Modem-to-Antenna module

9.5.6. Tear down of a mmWave Customer Enterprise Equipment (CPE)

9.6. RF frontend components in 5G mmWave base stations

9.6.1. Hybrid beamforming system for mmWave base stations

9.6.2. mmWave bits to mmWave radio system

9.6.3. mmWave RF beamformer (beamforming integrated circuit (BFIC))

9.6.4. mmWave BFIC suppliers for 5G infrastructures

9.6.5. 5G mmWave RF modules supply chain dynamics

9.6.6. Five forces analysis of the 5G mmWave RF module market

9.7. mmWave phased array antenna module suppliers and supply chain dynamics

9.7.1. Demonstrations of 28GHz all-silicon 64 dual polarized antenna

9.7.2. Tear down of a mmWave femtocell

9.7.3. Tear down of a mmWave mobile station from Samsung

9.7.4. Tier 1 5G system vendors are vertically integrated with antenna capabilities

9.7.5. Intension of Ericsson acquired Kathrein antenna R&D department

9.7.6. 5G mmWave phased array antenna start-ups on the rise

9.7.7. mmWave phased array antenna module key items and ecosystem

9.7.8. Partnership between mmWave antenna suppliers and RF module suppliers

9.7.9. The likelihood for tier 1 system vendors to develop their own phased array antenna modules

9.7.10. Key Buying Factors (KBF) of 5G mmWave antennas: what are the changes in KBF between sub-6 GHz and mmWave antenna?

10. SI CHIPSET MARKET

10.1. Landscape of key chipset players involved in the telecom/mobile industry

10.2. System on Chip (SoC)

10.3. Value chain of chipset industry

10.4. Key chipset players involved in the telecom infrastructure

10.5. The intentions of 5G system vendors enter Si battleground

10.6. Key chipset players involve in the mobile SoC/Modem

10.7. System on chip (SoC) for 5G handsets global market share

10.8. Key chipset players involve in the key components related to wireless technology

10.9. Mobile RF frontend supply chain

11. INK-BASED EMI

ご注文は、お電話またはWEBから承ります。お見積もりの作成もお気軽にご相談ください。本レポートと同分野(金融)の最新刊レポートIDTechEx社の 5G, 6G, RFID, IoT分野 での最新刊レポート

よくあるご質問IDTechEx社はどのような調査会社ですか?IDTechExはセンサ技術や3D印刷、電気自動車などの先端技術・材料市場を対象に広範かつ詳細な調査を行っています。データリソースはIDTechExの調査レポートおよび委託調査(個別調査)を取り扱う日... もっと見る 調査レポートの納品までの日数はどの程度ですか?在庫のあるものは速納となりますが、平均的には 3-4日と見て下さい。

注文の手続きはどのようになっていますか?1)お客様からの御問い合わせをいただきます。

お支払方法の方法はどのようになっていますか?納品と同時にデータリソース社よりお客様へ請求書(必要に応じて納品書も)を発送いたします。

データリソース社はどのような会社ですか?当社は、世界各国の主要調査会社・レポート出版社と提携し、世界各国の市場調査レポートや技術動向レポートなどを日本国内の企業・公官庁及び教育研究機関に提供しております。

|

|

.png)