Summary

This report covers the market landscape and supply-chain for Precursors used in semiconductor device fabrication. It includes information about key suppliers, issues/trends in the material supply chain, estimates on supplier market share, and forecast for the material segments.

-

Provides market and technical trend information on organic and inorganic precursors, addressing CVD, ALD, and SOD applications including ILDs & low-κ dielectrics, hard masks, sidewall spacers and etch stop layers

-

Provides focused information for supply-chain managers, process integration and R&D directors, as well as business development and financial analysts

-

Covers information about key dielectric precursor suppliers, issues/trends in the material supply chain, estimates on supplier market share, and forecast for the electronics material segments

-

Includes 3 Quarterly Updates, with updates on market trends and forecasts from the analyst

ページTOPに戻る

Table of Contents

TECHCET-CMR-CVDALDSODDIELECTRICS-06232025VB

1 EXECUTIVE SUMMARY

1.1 PRECURSORS MARKET TRENDS

1.2 MARKET TRENDS IMPACTING 2025 OUTLOOK

1.3 DIELECTRIC PRECURSORS 5-YEAR REVENUE FORECAST BY SEGMENT

1.4 PRECURSOR SEGMENT TRENDS

1.5 TECHNOLOGY TRENDS

1.6 DIELECTRIC PRECURSORS PRODUCTION CAPACITY OF TOP SUPPLIERS

1.7 CURRENT QUARTER TOP-5 PRECURSOR SUPPLIERS' ACTIVITIES & REPORTED REVENUES

1.8 EHS, TRADE, AND/OR LOGISTICS ISSUES/CONCERNS

1.9 ANALYST ASSESSMENT OF METAL, HIGH-K & DIELECTRIC PRECURSORS MATERIALS

2 SCOPE, PURPOSE AND METHODOLOGY

2.1 SCOPE, PURPOSE & METHODOLOGY

2.2 OVERVIEW OF OTHER TECHCET CMR(TM) OFFERINGS

3 SEMICONDUCTOR INDUSTRY MARKET STATUS & OUTLOOK

3.1 WORLDWIDE ECONOMY AND OUTLOOK

3.2 WORLDWIDE ECONOMY AND OVERVIEW

3.2.1 WORLDWIDE ECONOMY AND SEMICONDUCTOR MARKET OVERVIEW

3.2.2 SEMICONDUCTOR INDUSTRIES TIES TO THE GLOBAL ECONOMY

3.2.3 SEMICONDUCTOR SALES GROWTH

3.2.4 TAIWAN OUTSOURCE MANUFACTURER MONTHLY SALES TRENDS

3.3 CHIPS SALES BY ELECTRONIC GOODS SEGMENT

3.3.1 FACTORS IMPACTING ELECTRONIC SYSTEMS OUTLOOK

3.3.2 PC OUTLOOK

3.3.3 SMARTPHONE OUTLOOK

3.3.4 AUTOMOTIVE INDUSTRY OUTLOOK

3.3.5 SERVERS / IT MARKET

3.4 SEMICONDUCTOR FABRICATION GROWTH & EXPANSION

3.4.1 IN THE MIDST OF HUGE INVESTMENT IN CHIP EXPANSIONS

3.4.2 PUBLIC FUNDS STIMULATING PRIVATE INVESTMENTS IN EXPANSION ACROSS THE GLOBE

3.4.3 SEMICONDUCTOR SUPPLY CHAIN ANNOUNCED EXPANSIONS IN THE US

3.4.4 EQUIPMENT SPENDING TRENDS

3.4.5 TECHNOLOGY ROADMAPS

3.5 POLICY & TRADE TRENDS AND IMPACT

3.6 SEMICONDUCTOR PRODUCTION (WAFER STARTS*) AND MATERIALS OVERVIEW

3.6.1 TECHCET WAFER STARTS FORECAST THROUGH 2029

3.6.2 TECHCET ELECTRONIC MATERIALS MARKET FORECAST THROUGH 2028

4 PRECURSOR MARKETTRENDS

4.1 PRECURSORS MARKET TRENDS

4.1.1 PRECURSOR MARKET OUTLOOK

4.1.2 2023 PRECURSOR MARKET LEADING INTO 2024

4.2 MARKET DRIVERS FROM LOGIC DEVICE GROWTH

4.2.1 LOGIC MARKET OUTLOOK

4.3 MARKET DRIVERS FROM DRAM DEVICE GROWTH

4.3.1 DRAM MARKET OUTLOOK

4.4 MARKET DRIVERS FROM 3DNAND DEVICE GROWTH

4.4.1 3DNAND MARKET OUTLOOK

4.5 MARKET STATISTICS - DIELECTRIC PRECURSORS 5-YEAR REVENUE FORECAST BY SEGMENT

4.5.1 DIELECTRIC PRECURSORS SUPPLIER MARKET SHARES

4.5.2 DIELECTRIC PRECURSOR REVENUE BY REGION

4.6 PRECURSOR PRODUCTION CAPACITY EXPANSIONS

4.6.1 INVESTMENT ANNOUNCEMENTS OVERVIEW

4.6.2 INVESTMENT ACTIVITY ADDITIONAL COMMENTS

4.7 PRICING TRENDS

4.8 TECHNOLOGY TRENDS/TECHNICAL DRIVERS - OUTLINE

4.8.1 DRAM TECHNOLOGY TRENDS

4.8.2 3DNAND TECHNOLOGY TRENDS

4.8.3 LOGIC TECHNOLOGY TRENDS

4.8.4 LOGIC TECHNOLOGY ROADMAP

4.9 DIELECTRIC PRECURSOR TECHNOLOGY TRENDS AND DEVELOPMENTS

4.9.1 DIELECTRIC PRECURSOR GENERAL TECHNOLOGY OVERVIEW

4.9.2 RECENT TRENDS ADVANCES IN DIELECTRIC ALD SIO2 AND SIN

4.9.3 RECENT TRENDS IN BIS(DIISOPROPYLAMINO)DISILANE (BDIPADS) FOR LOW TEMPERATURE ALD OF SIO2

4.9.4 PATENT FILING FOR BDIPADS

4.9.5 BDIPADS, TIER 2 SUPPLIERS

4.9.6 PATENT FILING FOR DIODOSILANE

4.9.7 PATENT FILING FOR DIODOSILANE – ASM, TOPOLOGICAL SELECTIVE DEPOSITION

4.9.8 PATENT FILING FOR DIODOSILANE – ASM, TOPOLOGICAL & MATERIAL SELECTIVE DEPOSITION 84

4.9.9 RECENT PROGRESS IN SPIN ON DIELECTRICS – INDUSTRY TREND

4.9.10 RECENT PROGRESS IN SPIN ON DIELECTRICS – DRAM

4.10 IP FILING CVD AND ALD SINCE 2001

4.11 REGIONAL CONSIDERATIONS – IP FILING IN CVD AND ALD

4.11.1 REGIONAL ASPECTS AND DRIVERS

4.12 EHS AND TRADE/LOGISTIC ISSUES

4.12.1 EHS ISSUES

4.12.2 TRADE/LOGISTICS ISSUES

4.13 ANALYST ASSESSMENT OF PRECURSOR MARKET TRENDS

5 SUPPLY-SIDE MARKET ACTIVITY

5.1 LEADING SUPPLIERS - ACTIVITIES & REPORTED REVENUES

5.1.1 CURRENT QUARTER ACTIVITY – AIR LIQUIDE Q1/2025

5.1.2 CURRENT QUARTER ACTIVITY – MERCK (EMD) Q1/2025

5.1.3 CURRENT QUARTER ACTIVITY – ADEKA Q4/2024

5.1.4 CURRENT QUARTER ACTIVITY – DUPONT Q1/2025

5.2 DIVESTITURES, M&A AND PARTNERSHIPS

5.2.1 DIVESTITURES, M&A AND PARTNERSHIPS - QNITY

5.2.2 DIVESTITURES, M&A AND PARTNERSHIPS - HONEYWELL

5.2.3 DIVESTITURES, M&A AND PARTNERSHIPS - KOREAN SUPPLIERS

5.2.4 DIVESTITURES, M&A AND PARTNERSHIPS - JSR

5.2.5 DIVESTITURES, M&A AND PARTNERSHIPS - NAGASE

5.3 PLANT CLOSURES

5.4 NEW ENTRANTS – NONE TO REPORT

5.5 SUPPLIERS OR PARTS/PRODUCT LINES THAT ARE AT RISK OF DISCONTINUATIONS - NONE

5.6 TECHCET ANALYST ASSESSMENT OF PRECURSOR SUPPLIERS

6 SUB-TIER SUPPLY CHAIN, MATERIAL

6.1 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW

6.2 SUB-TIER SUPPLY CHAIN: KEY MANUFACTURING SOURCES OF PRECURSORS

6.3 ALD/CVD EQUIPMENT M&A OF THE OEM SUB-TIER

6.4 INDUSTRIAL VS. SEMICONDUCTOR-GRADE - TIER-1 VS. SUB-TIER QUALITY

6.5 SUB-TIER SUPPLY CHAIN: SUB-TIER PRECURSOR MARKET RANKING

6.5.1 RAW MATERIALS CAPACITY EXPANSIONS

6.6 SHIFT TO LOCAL INVESTMENT IN THE SUB-TIER SUPPLY-CHAIN

6.7 SUB-TIER SUPPLY-CHAIN EHS AND LOGISTICS ISSUES

6.7.1 SUB-TIER SUPPLY-CHAIN EHS AND LOGISTICS ISSUES – LISTED MATERIAL TYPE

6.8 SUB-TIER SUPPLY-CHAIN PLANT CLOSURES – NONE TO DATE

7 SUPPLIER PROFILES

ADEKA CORPORATION

AIR LIQUIDE (MAKER, PURIFIER, SUPPLIER)

AZMAX CO., LTD

CITY CHEMICAL LLC

DNF CO., LTD

AND MORE …

ページTOPに戻る

List of Tables/Graphs

FIGURES

FIGURE 1.1: DIELECTRIC PRECURSORS REVENUE FORECAST BY SEGMENT (US $M'S)

FIGURE 1.2: WW MARKET SHARE - DIELECTRIC PRECURSORS 2024 (U$ 815 M)

FIGURE 1.3: TOP-5 PUBLIC PRECURSOR MAKERS' QUARTERLY COMBINED SALES

FIGURE 3.1: HISTORICAL AND FORECASTED GDP GROWTH (2000 – 2029)

FIGURE 3.2: GLOBAL ECONOMY AND THE ELECTRONICS SUPPLY CHAIN (2024)

FIGURE 3.3: WORLDWIDE SEMICONDUCTOR SALES ($B)

FIGURE 3.4: TECHCET'S TAIWAN SEMICONDUCTOR INDUSTRY INDEX (TTSI) MOMENTUM TRACKER

FIGURE 3.5: 2024 SEMICONDUCTOR CHIP APPLICATIONS

FIGURE 3.6: SMARTPHONE SHIPMENTS, WW ESTIMATES

FIGURE 3.7: GLOBAL LIGHT VEHICLE PRODUCTION FORECAST (IN MILLIONS OF UNITS)

FIGURE 3.8: US EV RETAIL SHARE FORECAST

FIGURE 3.9: AUTOMOTIVE SEMICONDUCTOR REVENUES HISTORY AND FORECAST (ESTIMATED, B$'S USD)

FIGURE 3.10: AI VALUE FORECAST ($B'S USD)

FIGURE 3.11: SCALE OF TODAY'S AI-CENTRIC DATA CENTERS

FIGURE 3.12: TSMC PHOENIX FAB INVESTMENT TO EXCEED US $65B

FIGURE 3.13: ESTIMATED GLOBAL FAB INVESTMENT 2024-2029 ($858.6B)

FIGURE 3.14: ANNOUNCED PUBLIC STIMULUS AND RESPECTIVE SEMICONDUCTOR CHIP MANUFACTURING REGIONS

FIGURE 3.15: SEMICONDUCTOR SUPPLY CHAIN EXPANSIONS WITHIN THE US

FIGURE 3.16: GLOBAL TOTAL EQUIPMENT SPENDING (US$ M)

FIGURE 3.17: TSMC LOGIC ROADMAP BY NODE

FIGURE 3.18: TECHCET WAFER START FORECAST BY NODE SEGMENTS MILLIONS OF 200MM EQUIVALENTS PER YEAR

FIGURE 3.19: TECHCET WORLDWIDE ELECTRONIC MATERIALS FORECAST ($M USD)

FIGURE 4.1: LOGIC WAFER STARTS, SUB 65 NM

FIGURE 4.2: INCREASED ALD AND EPI SAM WITH MOVE TO GAA

FIGURE 4.3: LOGIC WAFER STARTS, GAA-FET NODES

FIGURE 4.4: DRAM WAFER STARTS

FIGURE 4.5: HBM STACKING CONFIGURATIONS

FIGURE 4.6: NAND WAFER STARTS

FIGURE 4.7: LAM RESEARCH'S ALTUS(R) HALO

FIGURE 4.8: DIELECTRIC PRECURSORS REVENUE FORECAST BY SEGMENT (US$ M'S)

FIGURE 4.9: WW MARKET SHARE - DIELECTRIC PRECURSORS 2024 (U$ 815 M) 62

FIGURE 4.10: DIELECTRIC PRECURSOR REVENUE BY REGION

FIGURE 4.11: ADVANCED DEVICE TECHNOLOGY DRIVE DEMAND FOR MORE ALD PRECURSORS

FIGURE 4.12: ADVANCED DEVICE TECHNOLOGY ROADMAP – HVM DRAM, INCLUDING RISK STARTS

FIGURE 4.13: ADVANCED DEVICE TECHNOLOGY ROADMAP OVERVIEW – HVM 3D NAND, INCLUDING RISK STARTS

FIGURE 4.14: ADVANCED DEVICE TECHNOLOGY ROADMAP OVERVIEW – HVM LOGIC/FOUNDRY, INCLUDING RISK STARTS

FIGURE 4.15: SEMS OF LOGIC GATE STRUCTURES 2009 TO BEYOND 2025

FIGURE 4.16: ADVANCED 3DNAND STAIRSTEPS

FIGURE 4.17: LOW TEMPERATURE GROWTH OF HIGH QUALITY SIO2 FILMS

FIGURE 4.18: PATENT FAMILIES AND APPLICATIONS FOR BDIPADS

FIGURE 4.19: BDIPADS PATENT CITATION VELOCITY

FIGURE 4.20: PATENT FAMILIES AND APPLICATIONS FOR DIS

FIGURE 4.21: DIELECTRIC SELECTIVE DEPOSITION SEQUENCE BY ASM

FIGURE 4.22: ASD OF DIELECTRIC ON METAL (DOM)

FIGURE 4.23: THE INDUSTRY TREND FOR SPIN-ON DIELECTRICS (SOD)

FIGURE 4.24: THE APPLICATION OF SOD IN VARIOUS REGIONS OF A DRAM STRUCTURES

FIGURE 4.25: PHPS (PERHYDRO-POLYSILAZANE)

FIGURE 4.26: PHPS (PERHYDRO-POLYSILAZANE)

FIGURE 4.27: CVD AND ALD PATENT FILING SINCE 2001 BY COMPANY

FIGURE 4.28: NUMBER OF CVD AND ALD PATENT FILING SINCE 2001

FIGURE 4.29: MAPPING LOCATION OF CVD AND ALD PATENT FILING SINCE 2001

FIGURE 4.30: ENVIRONMENTAL FOOTPRINT OF MOORES LAW - CO2 EMISSIONS (ENERGY CONSUMPTION RAMP OF LEADING EDGE NODES)

FIGURE 4.31: IMPACT OF EUV - ELECTRICAL ENERGY CONSUMPTION

FIGURE 4.32: INTEL AND TSMC SUSTAINABILITY GOALS

FIGURE 5.1: TOP-5 PUBLIC PRECURSOR MAKERS' QUARTERLY COMBINED SALES

FIGURE 5.2: AIR LIQUIDE CURRENT QUARTER FINANCIALS

FIGURE 5.3: MERCK CURRENT QUARTER FINANCIALS

FIGURE 5.4: ADEKA CURRENT QUARTER FINANCIALS

FIGURE 5.5: DUPONT CURRENT QUARTER FINANCIALS

FIGURE 6.1: CHIP FAB MANUFACTURING CAPACITY OF ASIA VS. US 1990-2023

FIGURE 6.2: REE REFINING PROCESS FLOW (I.E., COBALT)

TABLES

TABLE 1.1: REVENUE FORECASTS

TABLE 1.2: ESTIMATED MARKET SHARE BY SUPPLIER

TABLE 3.1: GLOBAL GDP AND SEMICONDUCTOR REVENUES

TABLE 3.2: INITIALLY ANNOUNCED* US RECIPROCAL TARIFF SCHEDULE

TABLE 3.3: WORLDWIDE PC FORECAST BY SEGMENT

TABLE 3.4: IT MARKET SPENDING FORECAST, 2025

TABLE 4.1: REVENUE FORECASTS

TABLE 4.2: ESTIMATED MARKET SHARE BY SUPPLIER – DIELECTRIC PRECURSORS

TABLE 4.3: OVERVIEW OF ANNOUNCED 2024/2025 PRECURSOR SUPPLIER INVESTMENTS

TABLE 4.4: DIELECTRIC FILMS AND PROCESS APPLICATIONS

TABLE 4.5: BDIPADS SUPPLIERS TIER 2, OVERVIEW

TABLE 4.6: DESCRIPTIONS OF PRECURSOR MARKET DYNAMICS BY REGION

TABLE 4.7: ESG REPORTING BY INDUSTRY LEADERS IN SEMICONDUCTOR MANUFACTURING

TABLE 6.1: SUB-TIER PRECURSOR DEMAND SEMICONDUCTOR VS. ELECTRONIC VS. INDUSTRIAL

TABLE 6.2: 2024 EXCLUSIVE SUB-TIER PRECURSOR SUPPLIERS RANKING OF THE TOP 3

Press Release

Oct 1, 2025 | Press Release

ALD/CVD Materials Market Bright Outlook

San Diego, CA,

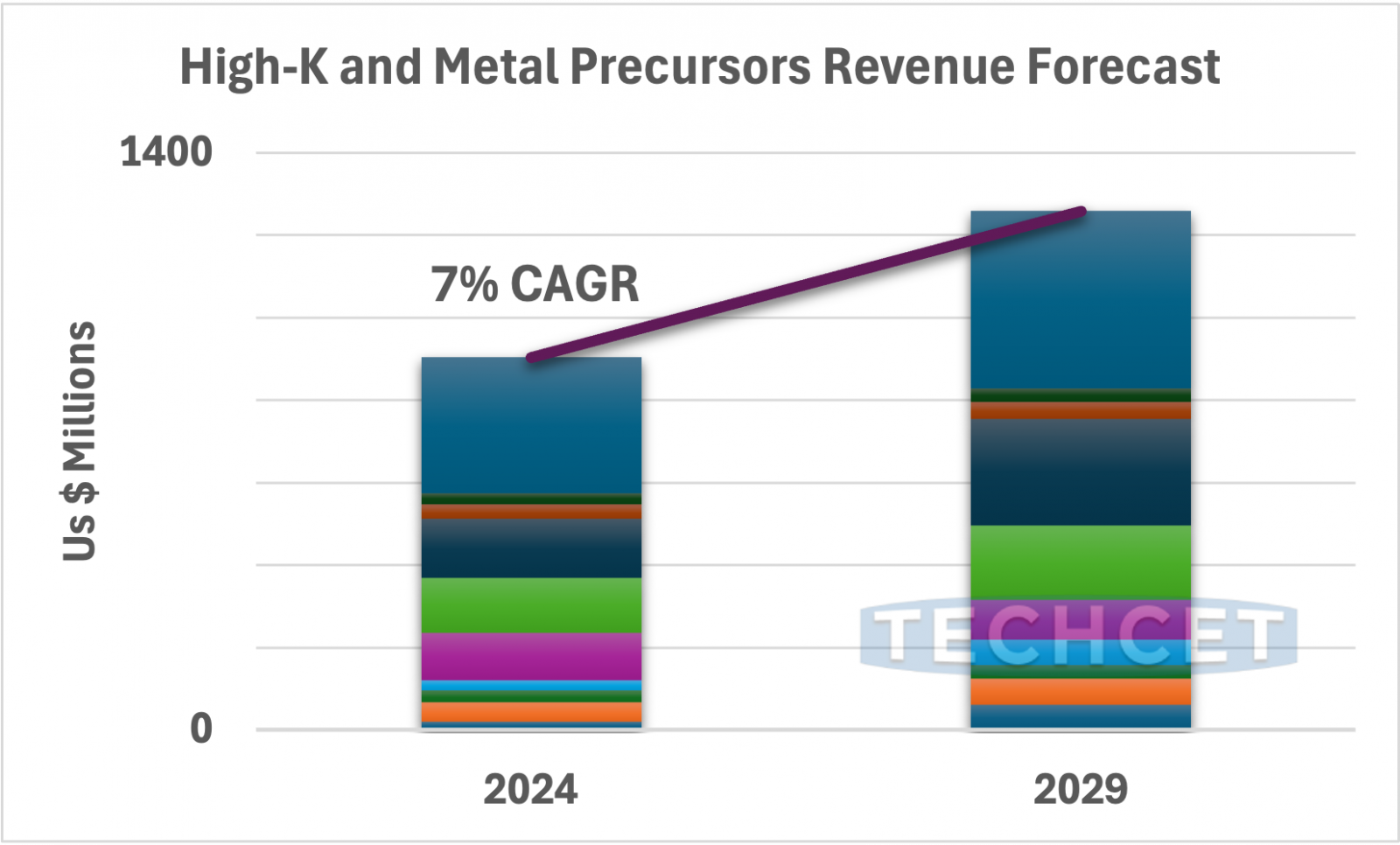

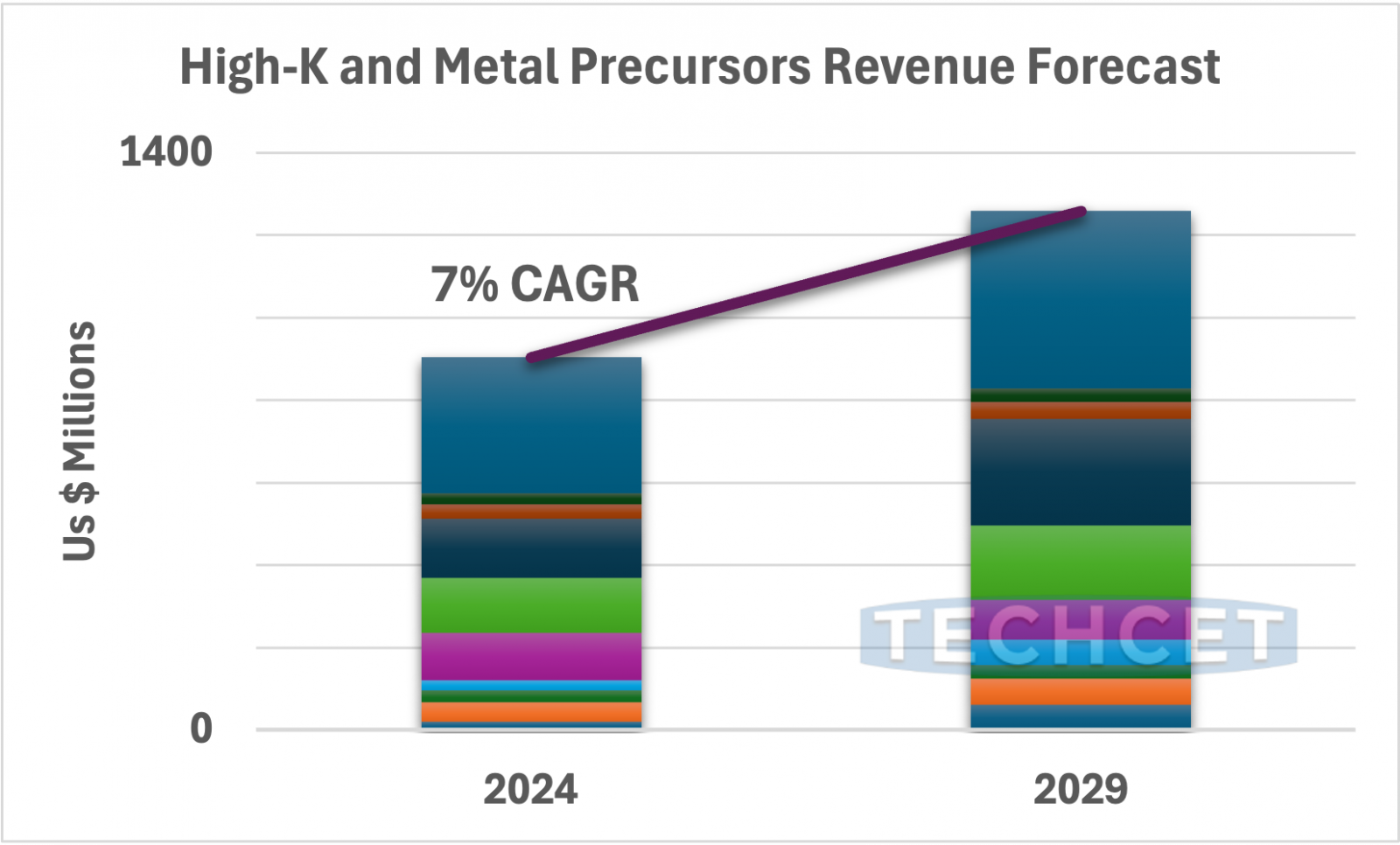

TECHCET, the electronic materials advisory firm providing semiconductor materials supply chain information, reported strong momentum in the ALD/CVD dielectric and metallization precursors. Revenues for dielectric precursors rebounded in 2024 with an 18% increase, while metallization precursors are expected to post 11% YoY growth from 2025 to 2026. Looking longer term, 2024–2029 CAGRs are forecast at 9% for dielectrics and 7% for metals, according to TECHCET’s 2025-2026 Critical Materials Report(TM) on ALD/CVD Precursors.

Hight K and Metal Precursors Revenue Forecast 2024-2029

*Each color represents a different material segment

The market is being propelled by increased demand for Low-K and high aspect ratio (AR) dielectrics to enable scaling in advanced logic and memory, with the DIPAS/BDEAS segment expected to lead dielectric growth. At the same time, alternative metals such as molybdenum (Mo) are gaining traction for backside power delivery and 3D NAND structures, alongside rising use of Zr, Hf, Co, and W. New opportunities are also emerging for Mo and Ru in advanced metallization, with Tier 1 suppliers and OEMs already reporting Mo ramping for leading-edge logic and 3D NAND metal gates. Together, these trends highlight the growing importance of dielectric and metal precursors in enabling next-generation device performance and semiconductor scaling.